Question: Complete a depreciation schedule for the straight-line method. (Do not round interm Complete a depreciation schedule for the units-of-production method. (Do not answers to the

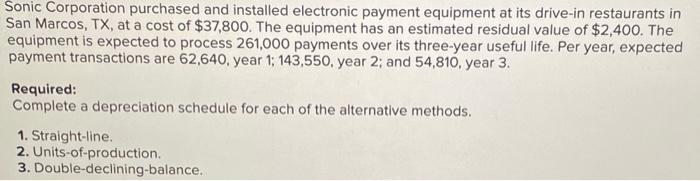

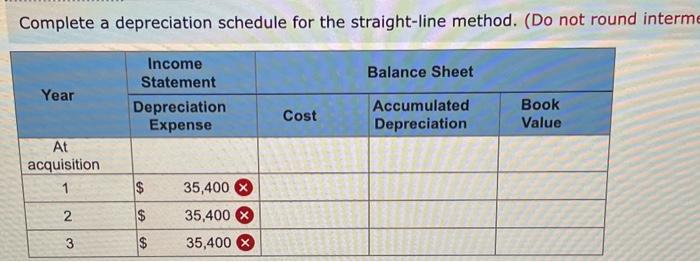

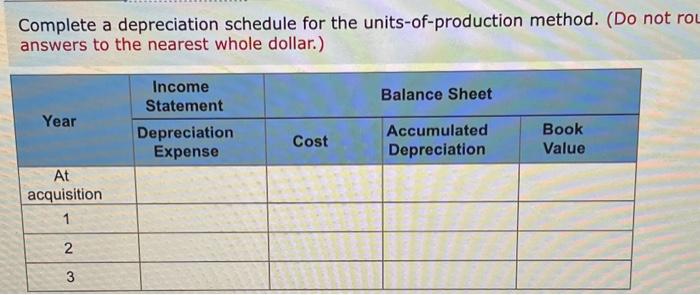

Complete a depreciation schedule for the straight-line method. (Do not round interm Complete a depreciation schedule for the units-of-production method. (Do not answers to the nearest whole dollar.) Sonic Corporation purchased and installed electronic payment equipment at its drive-in restaurants in San Marcos, TX, at a cost of $37,800. The equipment has an estimated residual value of $2,400. The equipment is expected to process 261,000 payments over its three-year useful life. Per year, expected payment transactions are 62,640 , year 1;143,550, year 2 ; and 54,810 , year 3. Required: Complete a depreciation schedule for each of the alternative methods. 1. Straight-line. 2. Units-of-production. 3. Double-declining-balance. Complete a depreciation schedule for the double-declining-balance method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts