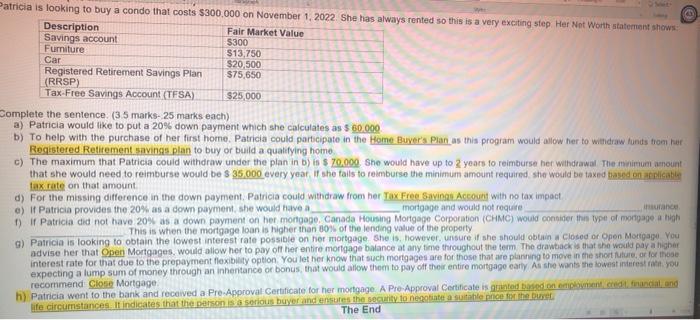

Question: complete answers please correct the highlights if any are wrong omplete the sentence. ( 3.5 marks- 25 marks each) a) Patricia would like to put

omplete the sentence. ( 3.5 marks- 25 marks each) a) Patricia would like to put a 20% down payment which she caiculates as 560.000. b) To help with the purchase of her first home. Patricia could participate in the Heme Buvers Plan as this program would allow her to withidraw funds tromi her Registered Retitement savings plan to buy or build a qualitying home. c) The maximum that Patricia could withdraw under the plan in b) is $70.000. She would have up to 2 years to reimburse her withdrawal The minimum anount that she would need to reimburse would be $35,000 every year, If she tails to reimburse the minimum amount required. she would be taxed tased on arrilicatile tax rate on that amount. d) For the missing ditference in the down payment. Patricia could withdraw from her Tax Free Savinge Account with no tax imnant. e) If Patricia provides the 20% as a down paymem, she would have a morigage and would not require f) If Patricia did not have 20% as a down payment on her mongoge. Canada Housing Mortgage Corporation (CHMC) would contiger lisis type of morfigane a high This is when the mortgage loan is higher then bows of the lending value of the property advise her that open Mortgages, would allow her to pay off her entire mortgage balance at any time throughout the tem The drawbicks that sho would pay a highat interest rate for that due to the prepayment flexibity option. You let her know that such morigages are for those that are planning to move in the shori uture, of lac those expecting a lump sum of money through an inheritance or bonus, that would allow them to pay off their entire motgage eariy As sho wants tie bwest interest rietil you recommend close Mortgage: The End

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts