Question: NO Excel PLEASE. Step by step solution please Bachmerica Industries produces its own electric power. The plant's power capacity exceeds its own requirements. Bachmerica has

NO Excel PLEASE. Step by step solution please

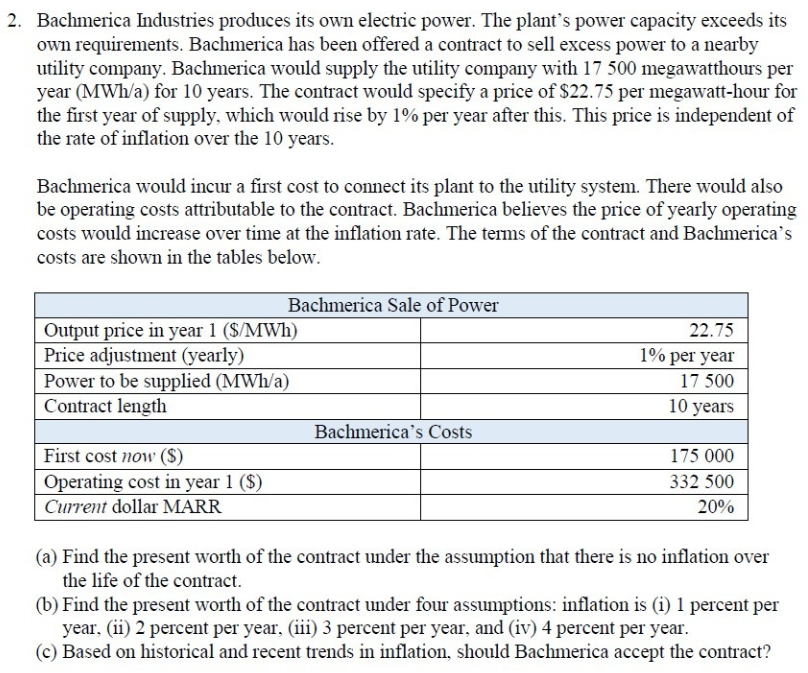

Bachmerica Industries produces its own electric power. The plant's power capacity exceeds its own requirements. Bachmerica has been offered a contract to sell excess power to a nearby utility company. Bachmerica would supply the utility company with 17500 megawatthours per year (MWh/a) for 10 years. The contract would specify a price of $22.75 per megawatt-hour for the first year of supply, which would rise by 1% per year after this. This price is independent of the rate of inflation over the 10 years. Bachmerica would incur a first cost to connect its plant to the utility system. There would also be operating costs attributable to the contract. Bachmerica believes the price of yearly operating costs would increase over time at the inflation rate. The terms of the contract and Bachmerica's costs are shown in the tables below. (a) Find the present worth of the contract under the assumption that there is no inflation over the life of the contract. (b) Find the present worth of the contract under four assumptions: inflation is (i) 1 percent per year, (ii) 2 percent per year, (iii) 3 percent per year, and (iv) 4 percent per year. (c) Based on historical and recent trends in inflation, should Bachmerica accept the contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts