Question: Complete excel spreadsheet for the following questions. If possible include any formulas entered to find out the sum of the requested adjusted totals. Instructions and

Complete excel spreadsheet for the following questions. If possible include any formulas entered to find out the sum of the requested adjusted totals. Instructions and information provided in screen shots.

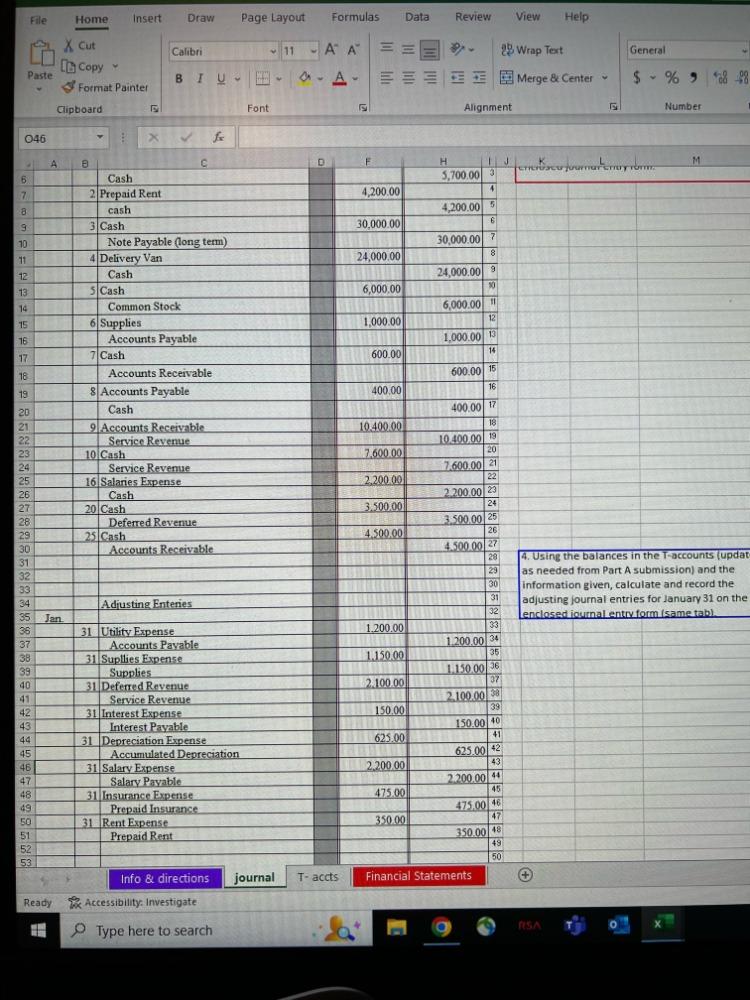

(missing from below screen shot) Jan 1st entry is Prepaid Insurance (debit) 5,700.00

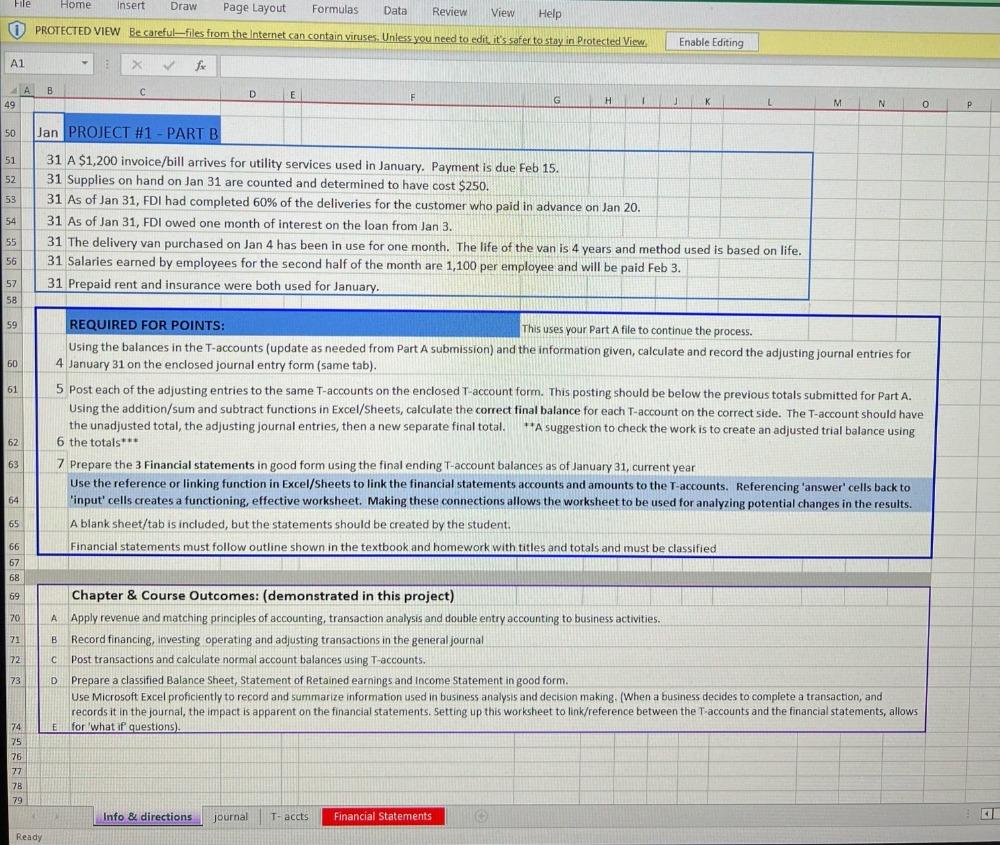

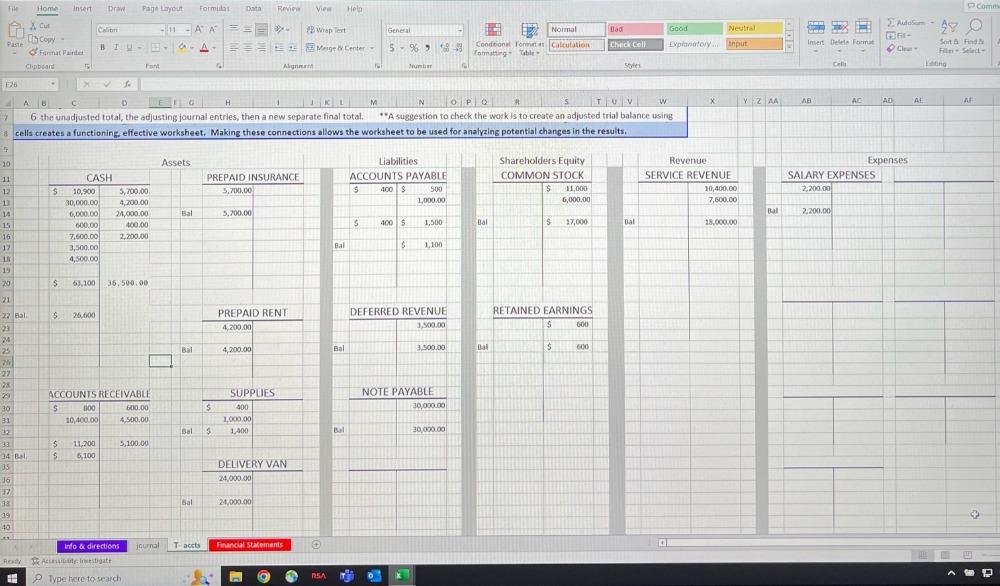

REQUIRED FOR POINTS: Using the balances in the T-accounts (update as needed from Part A submission) and the information part A file to continue the process. Using the balances in the T-accounts (update as needed from Part A submission) and the information given, calculate and record the adjusting journal entries for 4 January 31 on the enclosed journal entry form (same tab). 5 Post each of the adjusting entries to the same T-accounts on the enclosed T-account form. This posting should be below the previous totals submitted for Part A. Using the addition/sum and subtract functions in Excel/Sheets, calculate the correct final balance for each T-account on the correct side. The T-account should have the unadjusted total, the adjusting journal entries, then a new separate final total. "*A suggestion to check the work is to create an adjusted trial balance using 6 the totals*. 7 Prepare the 3 Financial statements in good form using the final ending T-account balances as of January 31 , current year Use the reference or linking function in Excel/sheets to link the financial statements accounts and amounts to the T-accounts. Referencing 'answer' cells back to 'input' cells creates a functioning, effective worksheet. Making these connections allows the worksheet to be used for analyzing potential changes in the results. A blank sheet/tab is included, but the statements should be created by the student. Financial statements must follow outline shown in the textbook and homework with titles and totals and must be classified Chapter \& Course Outcomes: (demonstrated in this project) A Apply revenue and matching principles of accounting, transaction analysis and double entry accounting to business activities. B Record financing, investing operating and adjusting transactions in the general journal c Post transactions and calculate normal account balances using T-accounts. D Prepare a classified Balance Sheet, statement of Retained earnings and income statement in good form. Use Microsoft Excel proficiently to record and summarize information used in business analysis and decision making. (When a business decides to complete a transaction, and records it in the journal, the impact is apparent on the financial statements. Setting up this worksheet to link/reference between the T-accounts and the financial statements, allows E. for 'what if questions). Ready 4. Using the balances in the T-accounts (updat as needed from Part A submission) and the information given, calculate and record the adjusting journal entries for January 31 on the enclosed ioumal entry form (same tab) REQUIRED FOR POINTS: Using the balances in the T-accounts (update as needed from Part A submission) and the information part A file to continue the process. Using the balances in the T-accounts (update as needed from Part A submission) and the information given, calculate and record the adjusting journal entries for 4 January 31 on the enclosed journal entry form (same tab). 5 Post each of the adjusting entries to the same T-accounts on the enclosed T-account form. This posting should be below the previous totals submitted for Part A. Using the addition/sum and subtract functions in Excel/Sheets, calculate the correct final balance for each T-account on the correct side. The T-account should have the unadjusted total, the adjusting journal entries, then a new separate final total. "*A suggestion to check the work is to create an adjusted trial balance using 6 the totals*. 7 Prepare the 3 Financial statements in good form using the final ending T-account balances as of January 31 , current year Use the reference or linking function in Excel/sheets to link the financial statements accounts and amounts to the T-accounts. Referencing 'answer' cells back to 'input' cells creates a functioning, effective worksheet. Making these connections allows the worksheet to be used for analyzing potential changes in the results. A blank sheet/tab is included, but the statements should be created by the student. Financial statements must follow outline shown in the textbook and homework with titles and totals and must be classified Chapter \& Course Outcomes: (demonstrated in this project) A Apply revenue and matching principles of accounting, transaction analysis and double entry accounting to business activities. B Record financing, investing operating and adjusting transactions in the general journal c Post transactions and calculate normal account balances using T-accounts. D Prepare a classified Balance Sheet, statement of Retained earnings and income statement in good form. Use Microsoft Excel proficiently to record and summarize information used in business analysis and decision making. (When a business decides to complete a transaction, and records it in the journal, the impact is apparent on the financial statements. Setting up this worksheet to link/reference between the T-accounts and the financial statements, allows E. for 'what if questions). Ready 4. Using the balances in the T-accounts (updat as needed from Part A submission) and the information given, calculate and record the adjusting journal entries for January 31 on the enclosed ioumal entry form (same tab)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts