Question: Complete Part A & B A During 2020, Mora Corporation completed the following transactions: Jan. 1 Traded in old office equipment with book value of

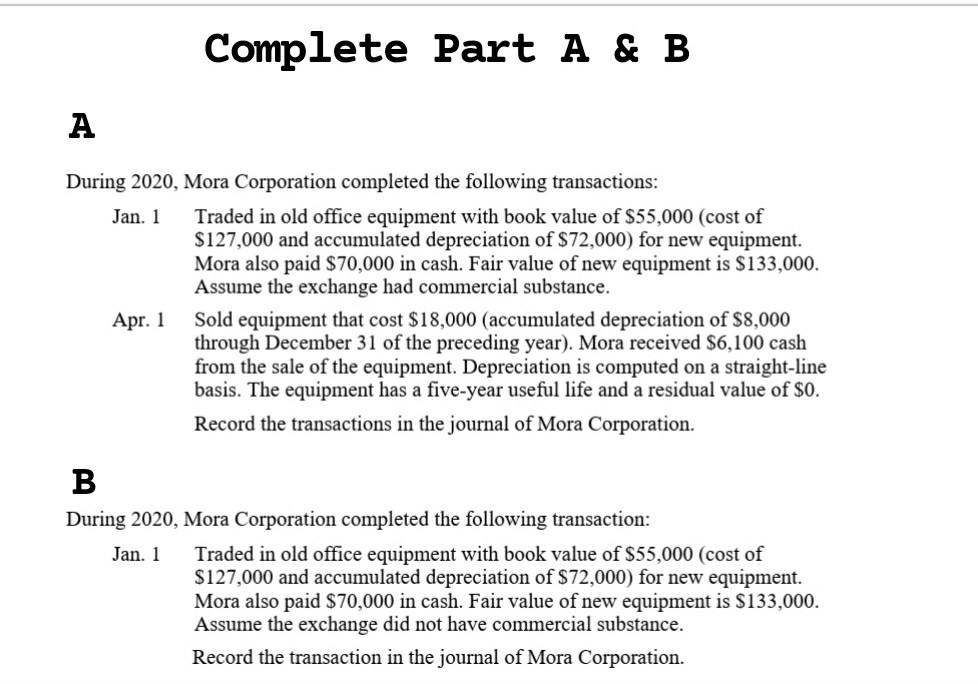

Complete Part A & B A During 2020, Mora Corporation completed the following transactions: Jan. 1 Traded in old office equipment with book value of $55,000 (cost of $127,000 and accumulated depreciation of $72,000) for new equipment. Mora also paid $70,000 in cash. Fair value of new equipment is $133,000. Assume the exchange had commercial substance. Sold equipment that cost $18,000 (accumulated depreciation of $8,000 through December 31 of the preceding year). Mora received $6,100 cash from the sale of the equipment. Depreciation is computed on a straight-line basis. The equipment has a five-year useful life and a residual value of $0. Record the transactions in the journal of Mora Corporation. Apr. 1 B During 2020, Mora Corporation completed the following transaction: Jan. 1 Traded in old office equipment with book value of $55,000 (cost of $127,000 and accumulated depreciation of $72,000) for new equipment. Mora also paid $70,000 in cash. Fair value of new equipment is $133,000. Assume the exchange did not have commercial substance. Record the transaction in the journal of Mora Corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts