Question: complete part D t a The bond will pay in for in the marke? What ther a n an overment has once again decided to

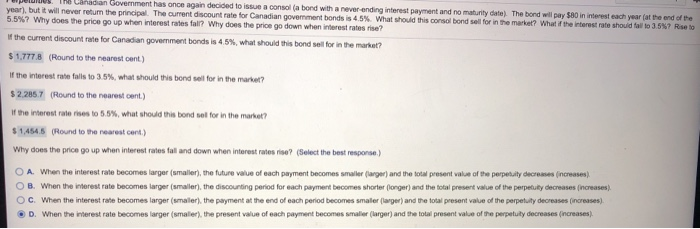

t a The bond will pay in for in the marke? What ther a n an overment has once again decided to consola bond with a never ending interest payment and no year, but it will never return the principal. The current discount for Canadian government bonds is 4 What should this consolbord 5.5%? Why does the price go up when interest Why does the price go down when interest rates rise the current discount rate for Canadian government bonds is what should this bond sell for in the market? e ch year should the end of the 3 Reto $ 1.7778 Round to the nearest cent) If the rest rate falls to 3.5%, what should this bond sell for in the market? $2.2857 Round to the nearest cont.) If the interest rates to 5.5%, what should this bond sel for in the market? $ 1,4545 Round to the nearest cent) Why does the price go up when interest rates all and down when interest rates ? (Select the best response) O A When the interest rate becomes larger smaller the tre value of each payment becomes m orger) and the present value of the perpetuity decreases increases) OB. When the interest rate becomes larger (smaller), the discouring period for each payment becomes shorter (onger) and the total present value of the perpetuty decreases increases) OC. When the interest rate becomes larger smaller the payment at the end of each period becomes male arger and the total present of the perpetuty decreases increases) D. When the rest rate becomes arger smaller the present of each payment becomes mal e r and the present of the perpetuty decreases increases)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts