Question: Complete Problem 7-54 Multiple-Product Analysis, Changes in Sales Mix, Sales to Earn Target Operating Income at the end of the chapter in your textbook, using

Complete Problem 7-54 Multiple-Product Analysis, Changes in Sales Mix, Sales to Earn Target Operating Income at the end of the chapter in your textbook, using the following template:

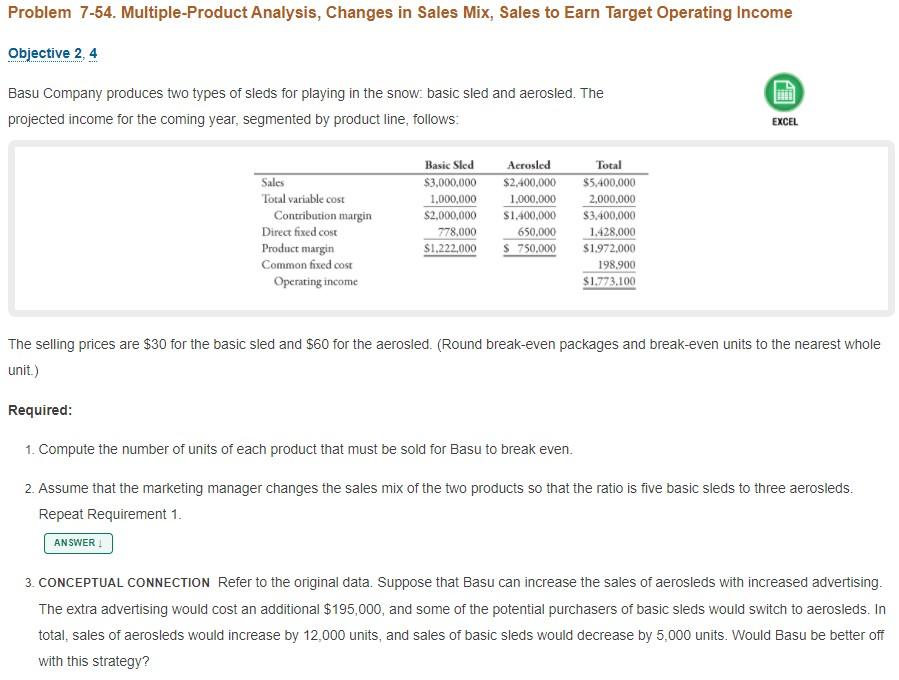

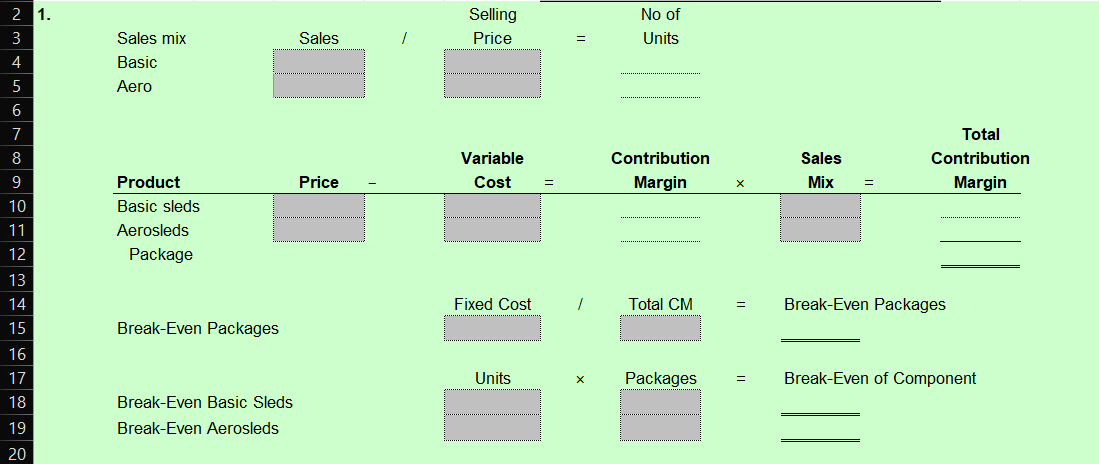

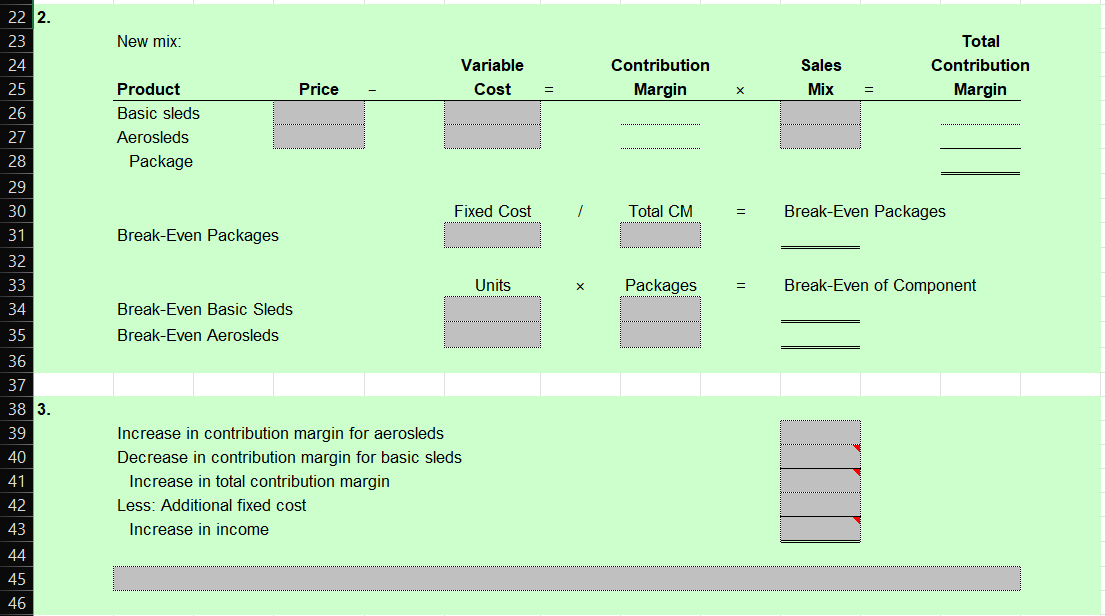

Problem 7-54. Multiple-Product Analysis, Changes in Sales Mix, Sales to Earn Target Operating Income Objective 2,4 Basu Company produces two types of sleds for playing in the snow. basic sled and aerosled. The projected income for the coming year, segmented by product line, follows: EXCEL Sales Total variable cost Contribution margin Direct fixed cost Product margin Common fixed cost Operating income Basic Sled $3.000.000 1,000,000 $2,000,000 778.000 $1.222,000 Acrosled $2,400,000 1,000,000 $1,400,000 650,000 $ 750,000 Total $5.400.000 2,000,000 $3.400.000 1.428.000 $1.972.000 198.900 $1.773.100 The selling prices are $30 for the basic sled and $60 for the aerosled. (Round break-even packages and break-even units to the nearest whole unit.) Required: 1. Compute the number of units of each product that must be sold for Basu to break even. 2. Assume that the marketing manager changes the sales mix of the two products so that the ratio is five basic sleds to three aerosleds. Repeat Requirement 1. ANSWER 3. CONCEPTUAL CONNECTION Refer to the original data. Suppose that Basu can increase the sales of aerosleds with increased advertising. The extra advertising would cost an additional $195,000, and some of the potential purchasers of basic sleds would switch to aerosleds. In total, sales of aerosleds would increase by 12,000 units, and sales of basic sleds would decrease by 5,000 units. Would Basu be better off with this strategy? Selling No of Units Sales / Price Sales mix Basic Aero Variable Cost Contribution Margin Sales Mix Total Contribution Margin Price = 2 1. 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Product Basic sleds Aerosleds Package Fixed Cost Total CM Break-Even Packages Break-Even Packages Units Packages Break-Even of Component Break-Even Basic Sleds Break-Even Aerosleds 19 20 22 2. New mix: Variable Cost Contribution Margin Sales Mix Total Contribution Margin Price Product Basic sleds Aerosleds Package Fixed Cost Total CM Break-Even Packages Break-Even Packages Units Packages = Break-Even of Component 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 3. 39 40 41 42 43 44 45 46 Break-Even Basic Sleds Break-Even Aerosleds Increase in contribution margin for aerosleds Decrease in contribution margin for basic sleds Increase in total contribution margin Less: Additional fixed cost Increase in income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts