Question: Complete Roberta's Schedule A for 2019. SCHEDULE A (Form 1040 or 1040-SR) (Rev. January 2020) Department of the Treasury Internal Revenue Service (99) Itemized Deductions

Complete Roberta's Schedule A for 2019.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

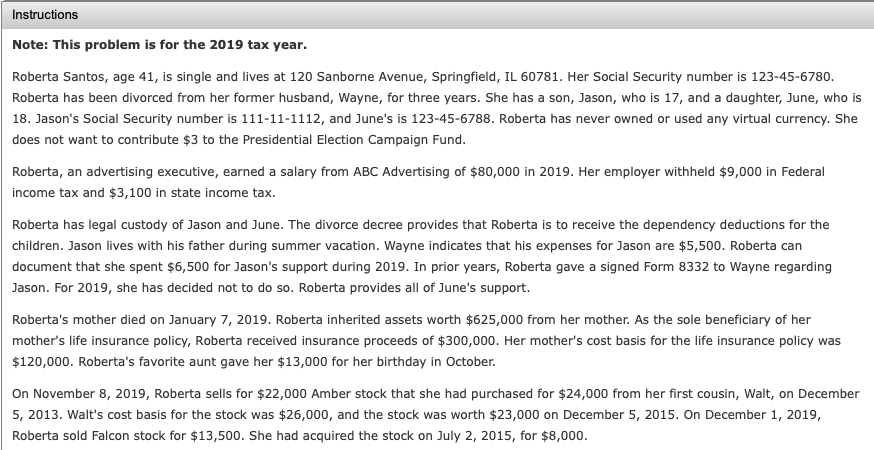

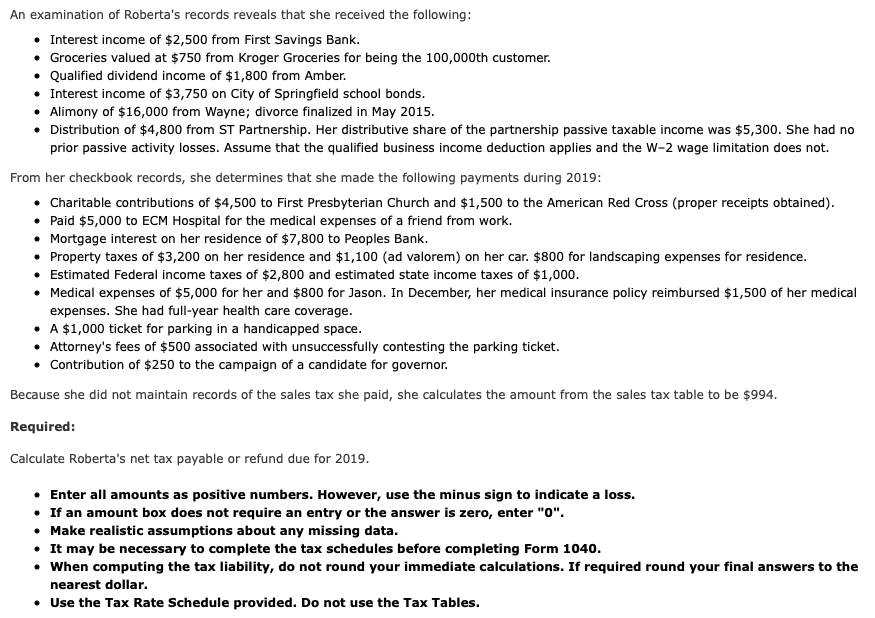

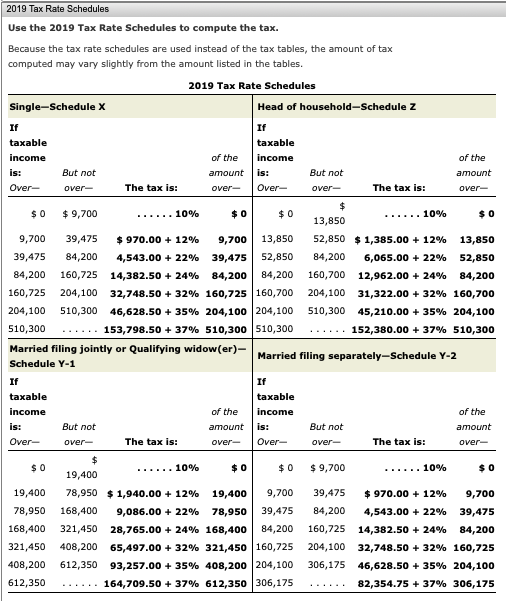

Instructions Note: This problem is for the 2019 tax year. Roberta Santos, age 41, is single and lives at 120 Sanborne Avenue, Springfield, IL 60781. Her Social Security number is 123-45-6780. Roberta has been divorced from her former husband, Wayne, for three years. She has a son, Jason, who is 17, and a daughter, June, who is 18. Jason's Social Security number is 111-11-1112, and June's is 123-45-6788. Roberta has never owned or used any virtual currency. She does not want to contribute $3 to the Presidential Election Campaign Fund. Roberta, an advertising executive, earned a salary from ABC Advertising of $80,000 in 2019. Her employer withheld $9,000 in Federal income tax and $3,100 in state income tax. Roberta has legal custody of Jason and June. The divorce decree provides that Roberta is to receive the dependency deductions for the children. Jason lives with his father during summer vacation. Wayne indicates that his expenses for Jason are $5,500. Roberta can document that she spent $6,500 for Jason's support during 2019. In prior years, Roberta gave a signed Form 8332 to Wayne regarding Jason. For 2019, she has decided not to do so. Roberta provides all of June's support. Roberta's mother died on January 7, 2019. Roberta inherited assets worth $625,000 from her mother. As the sole beneficiary of her mother's life insurance policy, Roberta received insurance proceeds of $300,000. Her mother's cost basis for the life insurance policy was $120,000. Roberta's favorite aunt gave her $13,000 for her birthday in October. On November 8, 2019, Roberta sells for $22,000 Amber stock that she had purchased for $24,000 from her first cousin, Walt, on December 5, 2013. Walt's cost basis for the stock was $26,000, and the stock was worth $23,000 on December 5, 2015. On December 1, 2019, Roberta sold Falcon stock for $13,500. She had acquired the stock on July 2, 2015, for $8,000. An examination of Roberta's records reveals that she received the following: Interest income of $2,500 from First Savings Bank. Groceries valued at $750 from Kroger Groceries for being the 100,000th customer. Qualified dividend income of $1,800 from Amber. Interest income of $3,750 on City of Springfield school bonds. Alimony of $16,000 from Wayne; divorce finalized in May 2015. Distribution of $4,800 from ST Partnership. Her distributive share of the partnership passive taxable income was $5,300. She had no prior passive activity losses. Assume that the qualified business income deduction applies and the W-2 wage limitation does not. From her checkbook records, she determines that she made the following payments during 2019: Charitable contributions of $4,500 to First Presbyterian Church and $1,500 to the American Red Cross (proper receipts obtained). Paid $5,000 to ECM Hospital for the medical expenses of a friend from work. Mortgage interest on her residence of $7,800 to Peoples Bank. Property taxes of $3,200 on her residence and $1,100 (ad valorem) on her car. $800 for landscaping expenses for residence. Estimated Federal income taxes of $2,800 and estimated state income taxes of $1,000. Medical expenses of $5,000 for her and $800 for Jason. In December, her medical insurance policy reimbursed $1,500 of her medical expenses. She had full-year health care coverage. A $1,000 ticket for parking in a handicapped space. Attorney's fees of $500 associated with unsuccessfully contesting the parking ticket. Contribution of $250 to the campaign of a candidate for governor. Because she did not maintain records of the sales tax she paid, she calculates the amount from the sales tax table to be $994. Required: Calculate Roberta's net tax payable or refund due for 2019. Enter all amounts as positive numbers. However, use the minus sign to indicate a loss. If an amount box does not require an entry or the answer is zero, enter "O". Make realistic assumptions about any missing data. It may be necessary to complete the tax schedules before completing Form 1040. When computing the tax liability, do not round your immediate calculations. If required round your final answers to the nearest dollar. Use the Tax Rate Schedule provided. Do not use the Tax Tables. 2019 Tax Rate Schedules Use the 2019 Tax Rate Schedules to compute the tax. Because the tax rate schedules are used instead of the tax tables, the amount of tax computed may vary slightly from the amount listed in the tables. 2019 Tax Rate Schedules Single-Schedule X Head of household-Schedule z If If taxable taxable income of the income of the is: But not amount is: But not amount Over over- The tax is: over Over over- The tax is: over $ $0 $ 9,700 ...... 10% $0 $0 ...... 10% $0 13,850 9,700 39,475 $ 970.00 + 12% 9,700 13,850 52,850 $ 1,385.00 + 12% 13,850 39,475 84,200 4,543.00 + 22% 39,47552,850 84,200 6,065.00 + 22% 52,850 84,200 160,725 14,382.50 + 24% 84,200 84,200 160,700 12,962.00 + 24% 84,200 160,725 204,100 32,748.50 + 32% 160,725 160,700 204,100 31,322.00 + 32% 160,700 204,100 510,300 46,628.50 + 35% 204,100 204,100 510,300 45,210.00 + 35% 204,100 510,300 153,798.50 + 37% 510,300 510,300 152,380.00 + 37% 510,300 Married filing jointly or Qualifying widow(er)- Schedule Y-1 Married filing separately-Schedule Y-2 If If taxable taxable income of the income of the is: But not amount is: But not amount Over over The tax is: over Over over- The tax is: over- $ $0 ...... 10% $ 0 19,400 $ 0 $ 9,700 $0 10% 19,400 78,950 168,400 321,450 408,200 612,350 78,950 $ 1,940.00 + 12% 19,400 9,700 168,400 9,086.00 + 22% 78,950 39,475 321,450 28,765.00 + 24% 168,400 84,200 408,200 65,497.00 + 32% 321,450 160,725 612,350 93,257.00 + 35% 408,200 204,100 164,709.50 + 37% 612,350 306,175 39,475 $ 970.00 + 12% 9,700 84,200 4,543.00 + 22% 39,475 160,725 14,382.50 + 24% 84,200 204,100 32,748.50 + 32% 160,725 306,175 46,628.50 + 35% 204,100 82,354.75 + 37% 306,175 Instructions Note: This problem is for the 2019 tax year. Roberta Santos, age 41, is single and lives at 120 Sanborne Avenue, Springfield, IL 60781. Her Social Security number is 123-45-6780. Roberta has been divorced from her former husband, Wayne, for three years. She has a son, Jason, who is 17, and a daughter, June, who is 18. Jason's Social Security number is 111-11-1112, and June's is 123-45-6788. Roberta has never owned or used any virtual currency. She does not want to contribute $3 to the Presidential Election Campaign Fund. Roberta, an advertising executive, earned a salary from ABC Advertising of $80,000 in 2019. Her employer withheld $9,000 in Federal income tax and $3,100 in state income tax. Roberta has legal custody of Jason and June. The divorce decree provides that Roberta is to receive the dependency deductions for the children. Jason lives with his father during summer vacation. Wayne indicates that his expenses for Jason are $5,500. Roberta can document that she spent $6,500 for Jason's support during 2019. In prior years, Roberta gave a signed Form 8332 to Wayne regarding Jason. For 2019, she has decided not to do so. Roberta provides all of June's support. Roberta's mother died on January 7, 2019. Roberta inherited assets worth $625,000 from her mother. As the sole beneficiary of her mother's life insurance policy, Roberta received insurance proceeds of $300,000. Her mother's cost basis for the life insurance policy was $120,000. Roberta's favorite aunt gave her $13,000 for her birthday in October. On November 8, 2019, Roberta sells for $22,000 Amber stock that she had purchased for $24,000 from her first cousin, Walt, on December 5, 2013. Walt's cost basis for the stock was $26,000, and the stock was worth $23,000 on December 5, 2015. On December 1, 2019, Roberta sold Falcon stock for $13,500. She had acquired the stock on July 2, 2015, for $8,000. An examination of Roberta's records reveals that she received the following: Interest income of $2,500 from First Savings Bank. Groceries valued at $750 from Kroger Groceries for being the 100,000th customer. Qualified dividend income of $1,800 from Amber. Interest income of $3,750 on City of Springfield school bonds. Alimony of $16,000 from Wayne; divorce finalized in May 2015. Distribution of $4,800 from ST Partnership. Her distributive share of the partnership passive taxable income was $5,300. She had no prior passive activity losses. Assume that the qualified business income deduction applies and the W-2 wage limitation does not. From her checkbook records, she determines that she made the following payments during 2019: Charitable contributions of $4,500 to First Presbyterian Church and $1,500 to the American Red Cross (proper receipts obtained). Paid $5,000 to ECM Hospital for the medical expenses of a friend from work. Mortgage interest on her residence of $7,800 to Peoples Bank. Property taxes of $3,200 on her residence and $1,100 (ad valorem) on her car. $800 for landscaping expenses for residence. Estimated Federal income taxes of $2,800 and estimated state income taxes of $1,000. Medical expenses of $5,000 for her and $800 for Jason. In December, her medical insurance policy reimbursed $1,500 of her medical expenses. She had full-year health care coverage. A $1,000 ticket for parking in a handicapped space. Attorney's fees of $500 associated with unsuccessfully contesting the parking ticket. Contribution of $250 to the campaign of a candidate for governor. Because she did not maintain records of the sales tax she paid, she calculates the amount from the sales tax table to be $994. Required: Calculate Roberta's net tax payable or refund due for 2019. Enter all amounts as positive numbers. However, use the minus sign to indicate a loss. If an amount box does not require an entry or the answer is zero, enter "O". Make realistic assumptions about any missing data. It may be necessary to complete the tax schedules before completing Form 1040. When computing the tax liability, do not round your immediate calculations. If required round your final answers to the nearest dollar. Use the Tax Rate Schedule provided. Do not use the Tax Tables. 2019 Tax Rate Schedules Use the 2019 Tax Rate Schedules to compute the tax. Because the tax rate schedules are used instead of the tax tables, the amount of tax computed may vary slightly from the amount listed in the tables. 2019 Tax Rate Schedules Single-Schedule X Head of household-Schedule z If If taxable taxable income of the income of the is: But not amount is: But not amount Over over- The tax is: over Over over- The tax is: over $ $0 $ 9,700 ...... 10% $0 $0 ...... 10% $0 13,850 9,700 39,475 $ 970.00 + 12% 9,700 13,850 52,850 $ 1,385.00 + 12% 13,850 39,475 84,200 4,543.00 + 22% 39,47552,850 84,200 6,065.00 + 22% 52,850 84,200 160,725 14,382.50 + 24% 84,200 84,200 160,700 12,962.00 + 24% 84,200 160,725 204,100 32,748.50 + 32% 160,725 160,700 204,100 31,322.00 + 32% 160,700 204,100 510,300 46,628.50 + 35% 204,100 204,100 510,300 45,210.00 + 35% 204,100 510,300 153,798.50 + 37% 510,300 510,300 152,380.00 + 37% 510,300 Married filing jointly or Qualifying widow(er)- Schedule Y-1 Married filing separately-Schedule Y-2 If If taxable taxable income of the income of the is: But not amount is: But not amount Over over The tax is: over Over over- The tax is: over- $ $0 ...... 10% $ 0 19,400 $ 0 $ 9,700 $0 10% 19,400 78,950 168,400 321,450 408,200 612,350 78,950 $ 1,940.00 + 12% 19,400 9,700 168,400 9,086.00 + 22% 78,950 39,475 321,450 28,765.00 + 24% 168,400 84,200 408,200 65,497.00 + 32% 321,450 160,725 612,350 93,257.00 + 35% 408,200 204,100 164,709.50 + 37% 612,350 306,175 39,475 $ 970.00 + 12% 9,700 84,200 4,543.00 + 22% 39,475 160,725 14,382.50 + 24% 84,200 204,100 32,748.50 + 32% 160,725 306,175 46,628.50 + 35% 204,100 82,354.75 + 37% 306,175

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts