Question: Complete Schedule E in the Final Exam module using the following data. Place your Schedule E in the drop box. In January, 2017, the Smiths

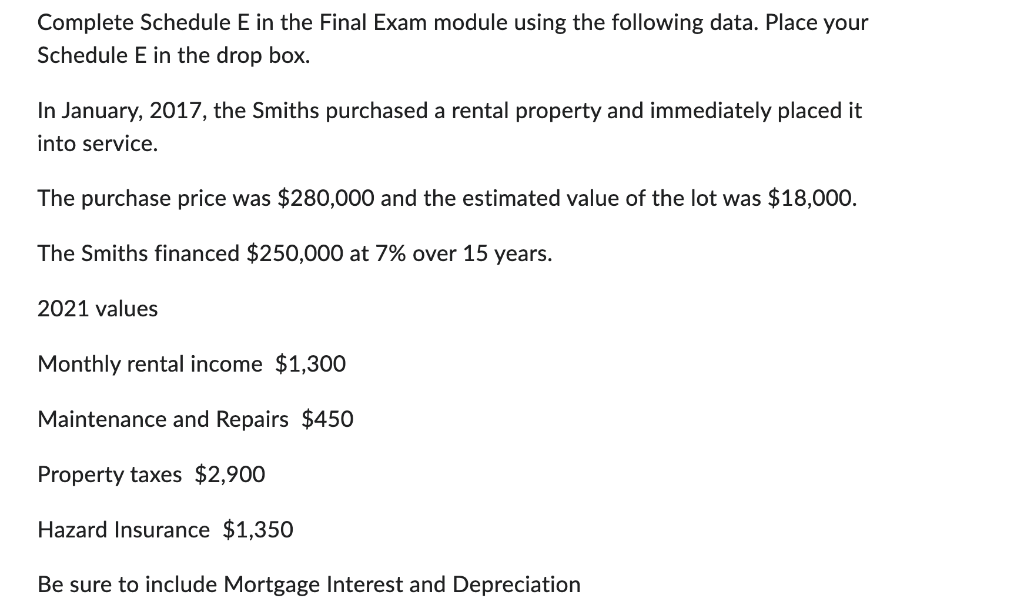

Complete Schedule E in the Final Exam module using the following data. Place your Schedule E in the drop box. In January, 2017, the Smiths purchased a rental property and immediately placed it into service. The purchase price was $280,000 and the estimated value of the lot was $18,000. The Smiths financed $250,000 at 7% over 15 years. 2021 values Monthly rental income $1,300 Maintenance and Repairs $450 Property taxes $2,900 Hazard Insurance $1,350 Be sure to include Mortgage Interest and Depreciation Complete Schedule E in the Final Exam module using the following data. Place your Schedule E in the drop box. In January, 2017, the Smiths purchased a rental property and immediately placed it into service. The purchase price was $280,000 and the estimated value of the lot was $18,000. The Smiths financed $250,000 at 7% over 15 years. 2021 values Monthly rental income $1,300 Maintenance and Repairs $450 Property taxes $2,900 Hazard Insurance $1,350 Be sure to include Mortgage Interest and Depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts