Question: COMPLETE SCHEDULE M-1 Question #3 To the left is the profit and loss statement for Oak Hill Limited Partners. Oak Hill LP is involved with

COMPLETE SCHEDULE M-1

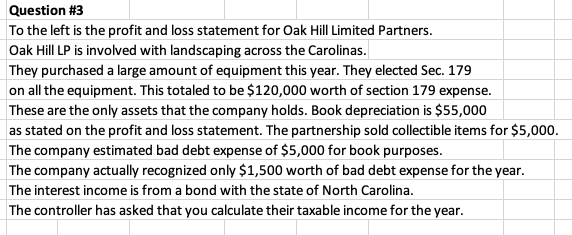

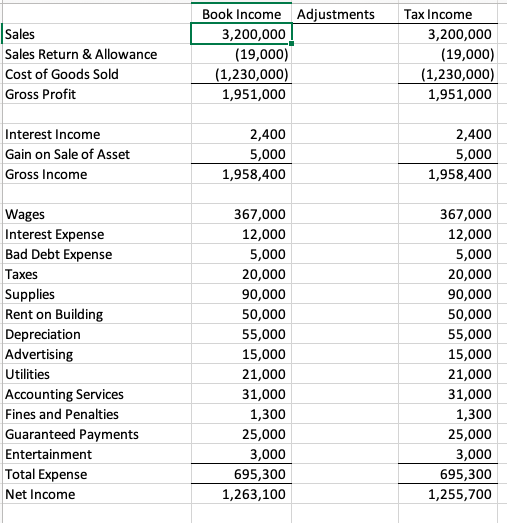

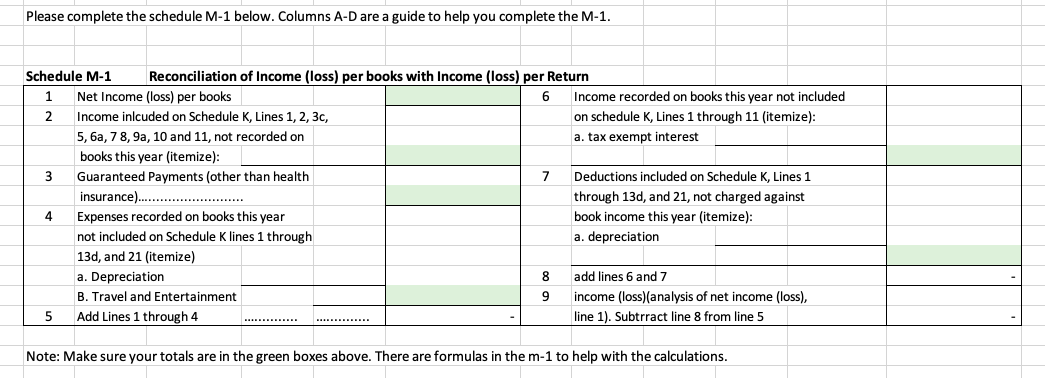

Question \#3 To the left is the profit and loss statement for Oak Hill Limited Partners. Oak Hill LP is involved with landscaping across the Carolinas. They purchased a large amount of equipment this year. They elected Sec. 179 on all the equipment. This totaled to be $120,000 worth of section 179 expense. These are the only assets that the company holds. Book depreciation is $55,000 as stated on the profit and loss statement. The partnership sold collectible items for $5,000. The company estimated bad debt expense of $5,000 for book purposes. The company actually recognized only $1,500 worth of bad debt expense for the year. The interest income is from a bond with the state of North Carolina. The controller has asked that you calculate their taxable income for the year. Sales Sales Return \& Allowance Cost of Goods Sold Gross Profit \begin{tabular}{|r|r|r|} \hline Book Income & Adjustments & \multicolumn{1}{|c|}{ Tax Income } \\ \hline 3,200,000 & & 3,200,000 \\ \hline(19,000) & (19,000) \\ \hline(1,230,000) & 1,230,000) \\ \hline 1,951,000 & & 1,951,000 \\ \hline \end{tabular} 2,4005,0001,958,400 2,4005,0001,958,400 Wages 367,000 Interest Expense Bad Debt Expense Taxes Supplies Rent on Building Depreciation Advertising Utilities Accounting Services Fines and Penalties Guaranteed Payments Entertainment Total Expense Net Income 3,000695,3001,263,100 3,000695,3001,255,700 Please complete the schedule M1 below. Columns AD are a guide to help you complete the M1. Schedule M-1 Reconciliation of Income (loss) per books with Income (loss) per Return Note: Make sure your totals are in the green boxes above. There are formulas in the m1 to help with the calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts