Question: Complete: T1 General Form -pages 2 and 3 Schedule 1 Ontario Tax Form ON428 Ontario Credits ON 479 T1 General - page 4 Tax Rates

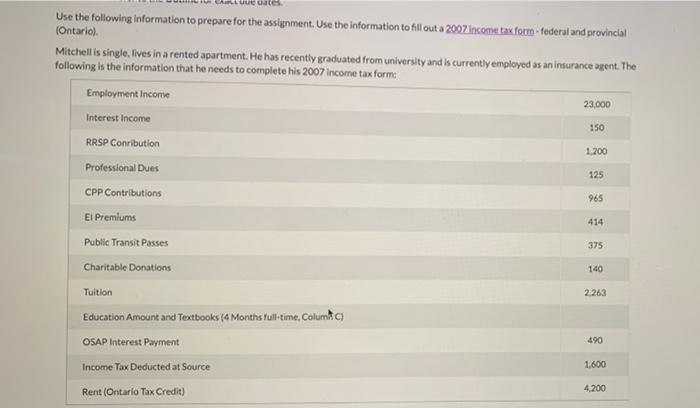

THE CARLLUue Dat Use the following information to prepare for the assignment. Use the information to fill out a 2007 income tax form-federal and provincial (Ontario). Mitchell is single, lives in a rented apartment. He has recently graduated from university and is currently employed as an insurance agent. The following is the information that he needs to complete his 2007 income tax form: Employment Income 23,000 Interest Income 150 RRSP Conribution 1,200 Professional Dues 125 CPP Contributions 965 El Premiums 414 Public Transit Passes 375 Charitable Donations 140 Tuition 2.263 Education Amount and Textbooks (4 Months full-time, Colum C 490 OSAP Interest Payment 1,600 Income Tax Deducted at Source 4,200 Rent (Ontario Tax Credit) THE CARLLUue Dat Use the following information to prepare for the assignment. Use the information to fill out a 2007 income tax form-federal and provincial (Ontario). Mitchell is single, lives in a rented apartment. He has recently graduated from university and is currently employed as an insurance agent. The following is the information that he needs to complete his 2007 income tax form: Employment Income 23,000 Interest Income 150 RRSP Conribution 1,200 Professional Dues 125 CPP Contributions 965 El Premiums 414 Public Transit Passes 375 Charitable Donations 140 Tuition 2.263 Education Amount and Textbooks (4 Months full-time, Colum C 490 OSAP Interest Payment 1,600 Income Tax Deducted at Source 4,200 Rent (Ontario Tax Credit)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts