Question: Complete table. Show work please. TABLE 10.1 Payroll Component Regular pay Retirement Contribution Formula (Hours worked *Hourly wage) (Vlookup function)*Regular Pay Comments Vlookup is based

Complete table. Show work please.

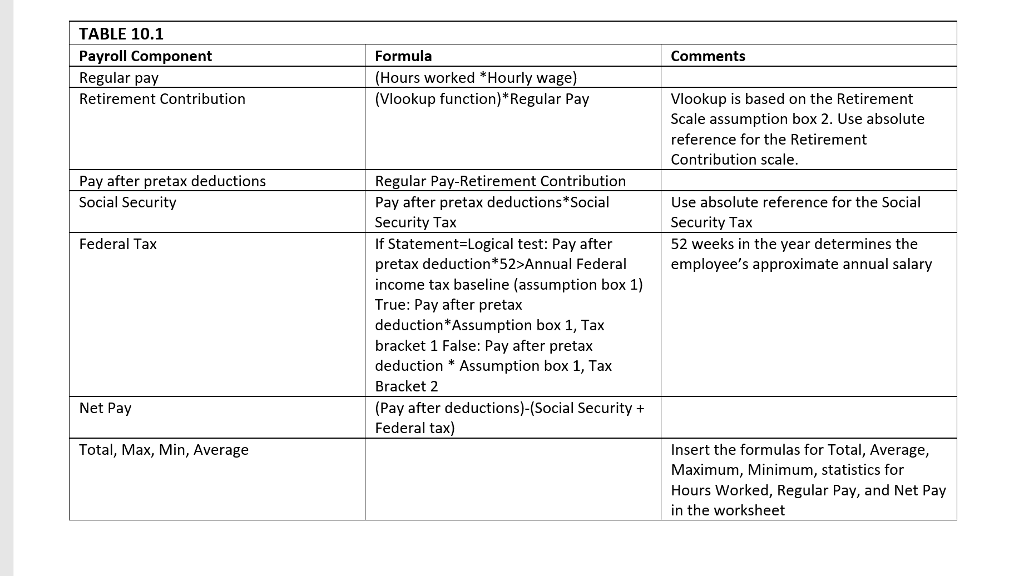

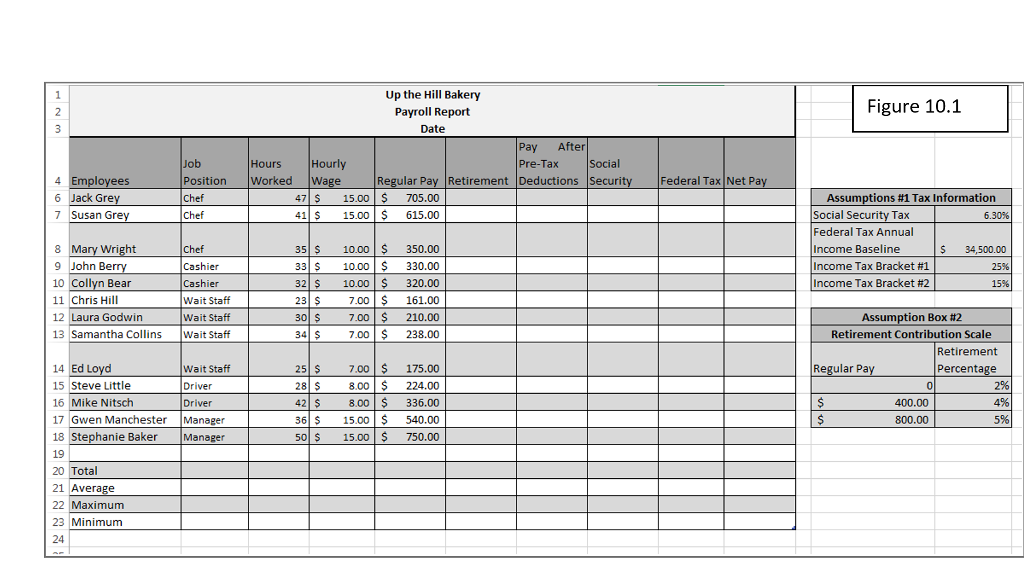

TABLE 10.1 Payroll Component Regular pay Retirement Contribution Formula (Hours worked *Hourly wage) (Vlookup function)*Regular Pay Comments Vlookup is based on the Retirement Scale assumption box 2. Use absolute reference for the Retirement Contribution scale Regular Pay-Retirement Contribution Pay after pretax deductions*Social Security Tax If Statement-Logical test: Pay after pretax deduction 52>Annual Federal income tax baseline (assumption box 1) True: Pay after pretax deduction Assumption box 1, Tax bracket 1 False: Pay after pretax deduction * Assumption box 1, Tax Bracket2 (Pay after deductions)-(Social Security + Federal tax) Pay after pretax deductions Use absolute reference for the Social Security Tax 52 weeks in the year determines the employee's approximate annual salary Social Security Federal Tax Net Pay Insert the formulas for Total, Average, Maximum, Minimum, statistics for Hours Worked, Regular Pay, and Net Pay in the worksheet Total, Max, Min, Average TABLE 10.1 Payroll Component Regular pay Retirement Contribution Formula (Hours worked *Hourly wage) (Vlookup function)*Regular Pay Comments Vlookup is based on the Retirement Scale assumption box 2. Use absolute reference for the Retirement Contribution scale Regular Pay-Retirement Contribution Pay after pretax deductions*Social Security Tax If Statement-Logical test: Pay after pretax deduction 52>Annual Federal income tax baseline (assumption box 1) True: Pay after pretax deduction Assumption box 1, Tax bracket 1 False: Pay after pretax deduction * Assumption box 1, Tax Bracket2 (Pay after deductions)-(Social Security + Federal tax) Pay after pretax deductions Use absolute reference for the Social Security Tax 52 weeks in the year determines the employee's approximate annual salary Social Security Federal Tax Net Pay Insert the formulas for Total, Average, Maximum, Minimum, statistics for Hours Worked, Regular Pay, and Net Pay in the worksheet Total, Max, Min, Average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts