Question: Complete the decision tree table by calculating the net present values (NPVS) and joint probabilities, as well as products of joint probabilities and NPVS

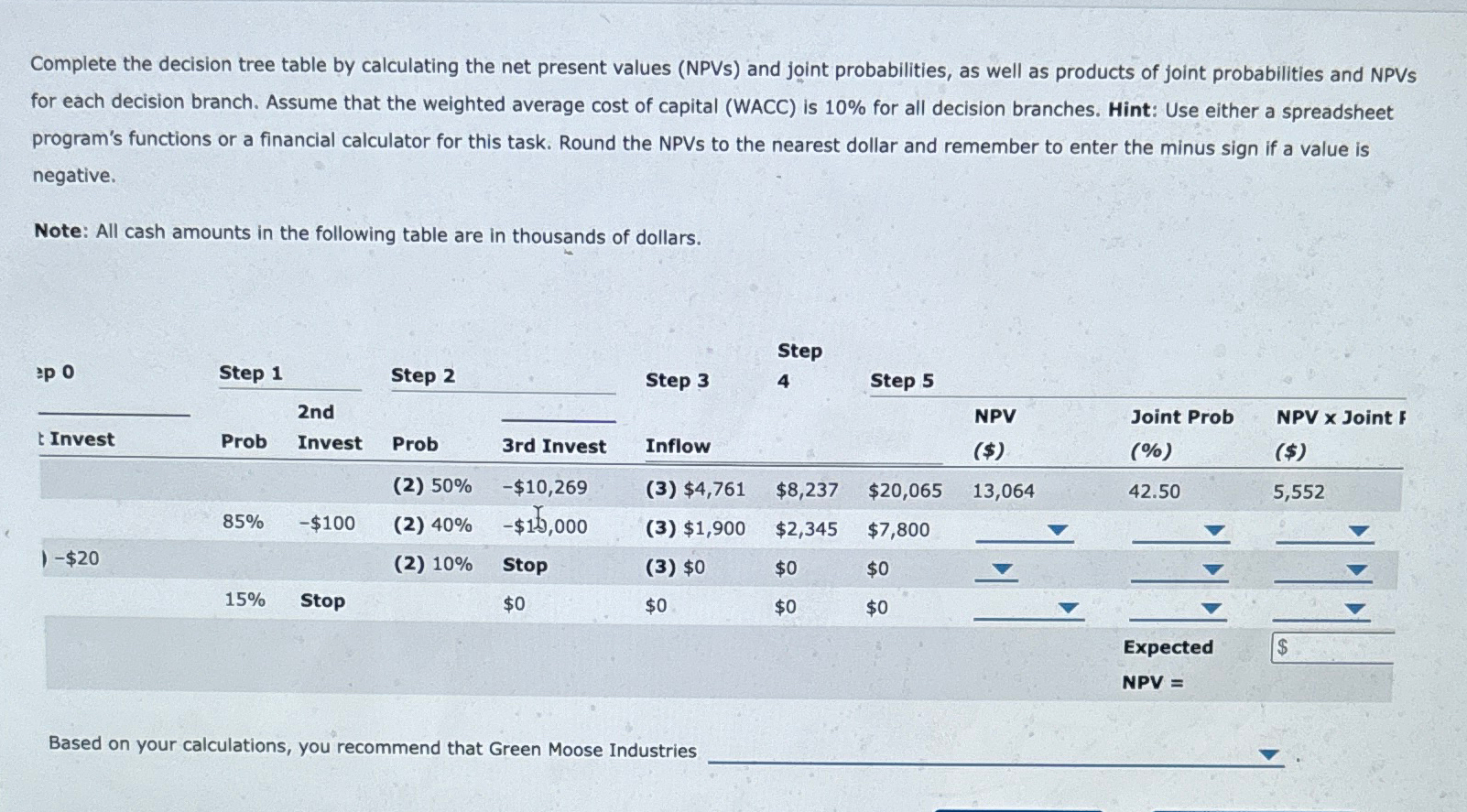

Complete the decision tree table by calculating the net present values (NPVS) and joint probabilities, as well as products of joint probabilities and NPVS for each decision branch. Assume that the weighted average cost of capital (WACC) is 10% for all decision branches. Hint: Use either a spreadsheet program's functions or a financial calculator for this task. Round the NPVS to the nearest dollar and remember to enter the minus sign if a value is negative. Note: All cash amounts in the following table are in thousands of dollars. ep 0 Step 1 Step 2 Step 3 Step 4 Step 5 2nd NPV t Invest Prob Invest Prob 3rd Invest Inflow ($) Joint Prob (%) NPV x Joint F ($) (2) 50% -$10,269 (3) $4,761 $8,237 $20,065 13,064 42.50 5,552 85% -$100 (2) 40% -$15,000 (3) $1,900 $2,345 $7,800 -$20 (2) 10% Stop (3) $0 $0 $0 15% Stop $0 $0 $0 $0 Based on your calculations, you recommend that Green Moose Industries Expected NPV =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts