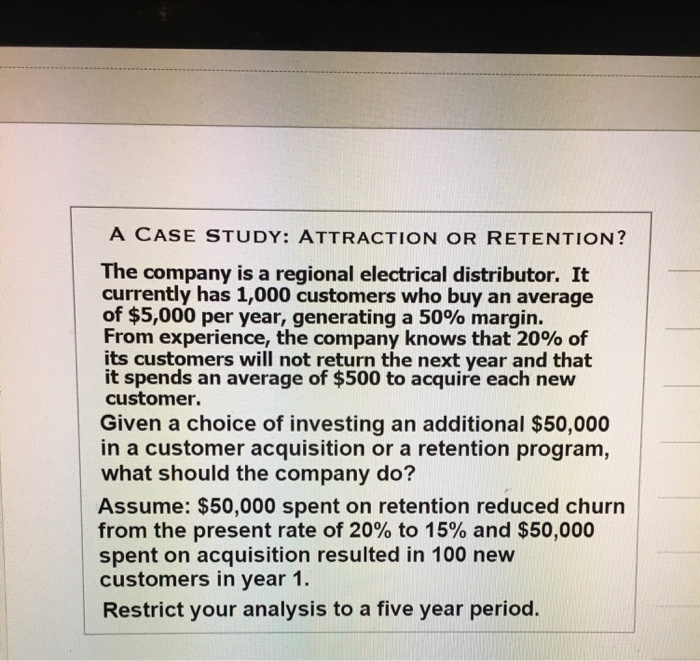

Question: Complete the Five Year Payout chart after reading the case study prompt A CASE STUDY: ATTRACTION OR RETENTION? The company is a regional electrical distributor.

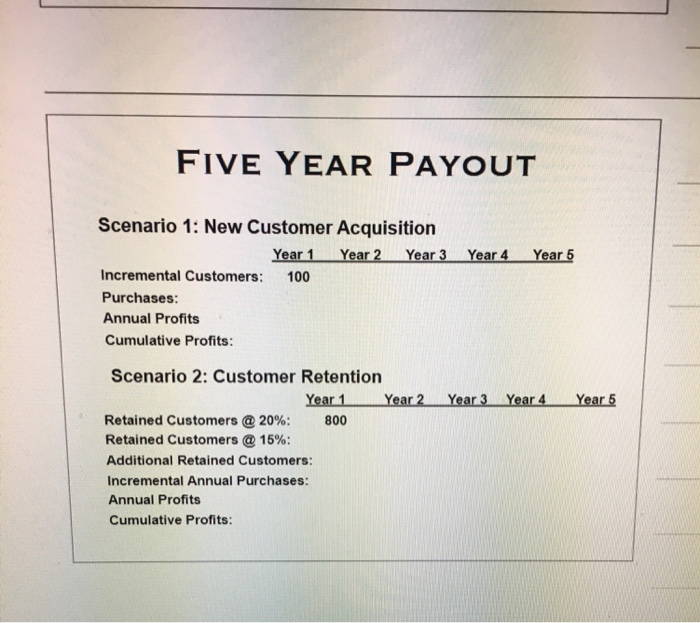

A CASE STUDY: ATTRACTION OR RETENTION? The company is a regional electrical distributor. It currently has 1,000 customers who buy an average of $5,000 per year, generating a 50% margin. From experience, the company knows that 20% of its customers will not return the next year and that it spends an average of $500 to acquire each new customer. Given a choice of investing an additional $50,000 in a customer acquisition or a retention program what should the company do? Assume: $50,000 spent on retention reduced churn from the present rate of 20% to 15% and $50,000 spent on acquisition resulted in 100 new customers in year 1 Restrict your analysis to a five year period. FIVE YEAR PAYOUT Scenario 1: New Customer Acquisition Year 1 Year 2Year 3Year 4Year 5 Incremental Customers:100 Purchases: Annual Profits Cumulative Profits: Scenario 2: Customer Retention Year 1Year 2 Year 3 Year4 Year 5 Retained Customers @ 20%; Retained Customers @ 15%; Additional Retained Customers: Incremental Annual Purchases: Annual Profits Cumulative Profits: 800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts