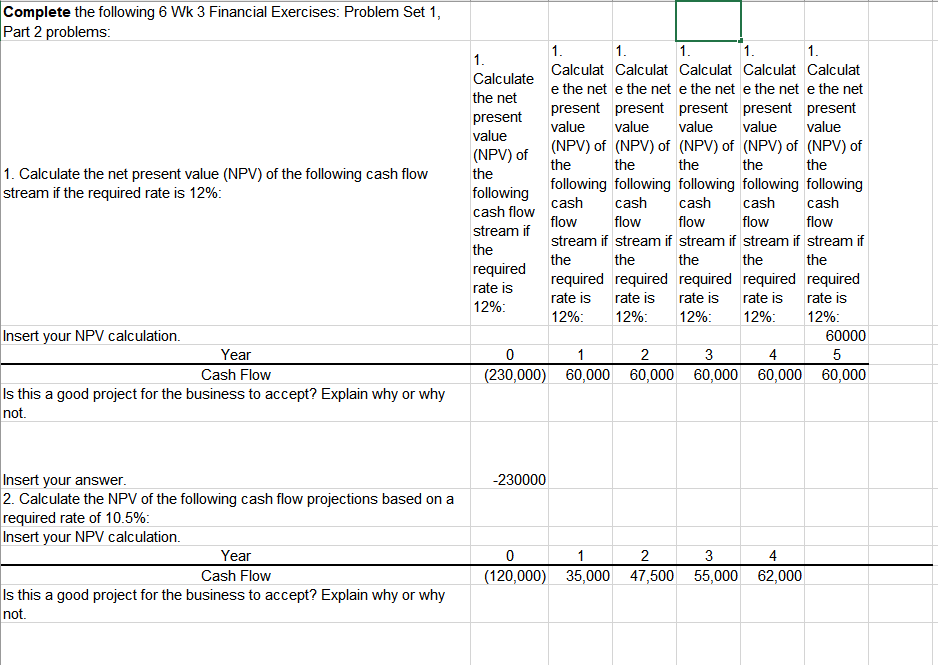

Question: Complete the following 6 Wk 3 Financial Exercises: Problem Set 1, Part 2 problems the the the 1. Calculate the net present value (NPV) of

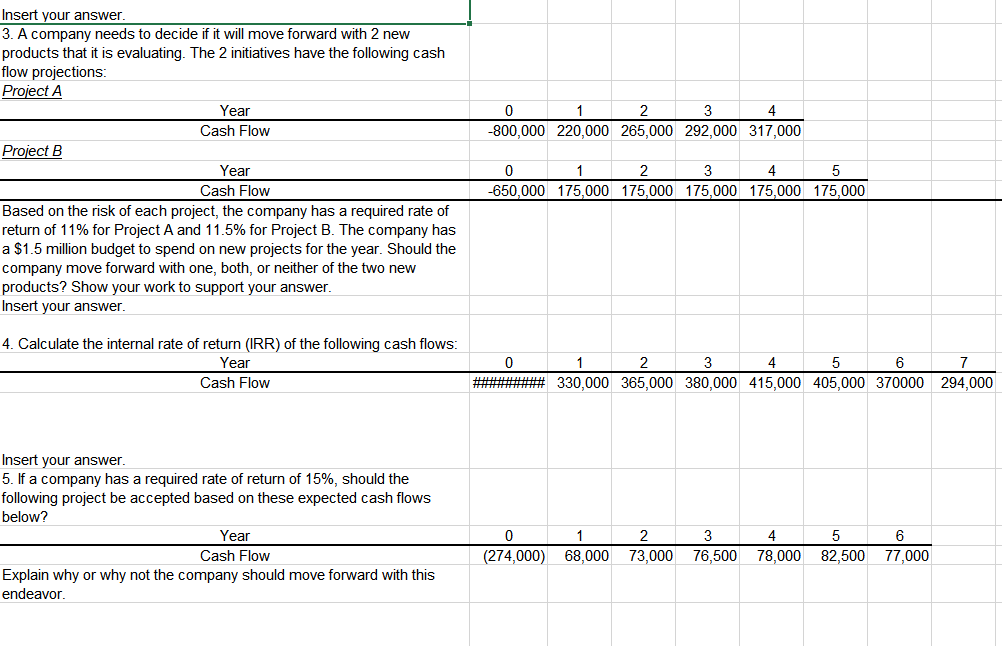

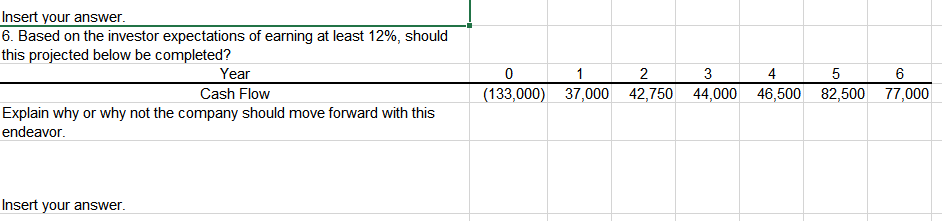

Complete the following 6 Wk 3 Financial Exercises: Problem Set 1, Part 2 problems the the the 1. Calculate the net present value (NPV) of the following cash flow stream if the required rate is 12%: 1. 1. 1. 1. 1. 1. Calculate Calculat Calculat Calculat Calculat Calculat e the net e the net e the net e the net e the net the net present present present present present present value value value value value value (NPV) of (NPV) of (NPV) of (NPV) of (NPV) of (NPV) of the the the following following following following following following cash cash cash cash cash flow cash flow flow flow stream if flow flow stream if stream if stream if stream if stream if the the the the the the required required required required required required rate is rate is rate is rate is rate is 12%: rate is 12%: 12%: 12%: 12%: 12%: 60000 0 1 2 3 4 5 (230,000) 60,000 60,000 60,000 60,000 60,000 Insert your NPV calculation. Year Cash Flow Is this a good project for the business to accept? Explain why or why not. -230000 Insert your answer. 2. Calculate the NPV of the following cash flow projections based on a required rate of 10.5%: Insert your NPV calculation. Year Cash Flow Is this a good project for the business to accept? Explain why or why not 0 1 2 3 4 (120,000) 35,000 47,500 55,000 62,000 1 4 0 2 3 -800,000 220,000 265,000 292,000 317,000 Insert your answer. 3. A company needs to decide if it will move forward with 2 new products that it is evaluating. The 2 initiatives have the following cash flow projections: Project A Year Cash Flow Project B Year Cash Flow Based on the risk of each project, the company has a required rate of return of 11% for Project A and 11.5% for Project B. The company has a $1.5 million budget to spend on new projects for the year. Should the company move forward with one, both, or neither of the two new products? Show your work to support your answer. Insert your answer. 0 1 2 3 4 5 -650,000 175,000 175,000 175,000 175,000 175,000 4. Calculate the internal rate of return (IRR) of the following cash flows: Year Cash Flow 0 1 2 3 4 5 6 #***** 330,000 365,000 380,000 415,000 405,000 370000 7 294,000 Insert your answer. 5. If a company has a required rate of return of 15%, should the following project be accepted based on these expected cash flows below? Year Cash Flow Explain why or why not the company should move forward with this endeavor. 0 1 2 3 4 5 (274,000) 68,000 73,000 76,500 78,000 82,500 6 77,000 Insert your answer. 6. Based on the investor expectations of earning at least 12%, should this projected below be completed? Year Cash Flow Explain why or why not the company should move forward with this endeavor. 0 (133,000) 1 2 3 4 5 6 37,000 42,750 44,000 46,500 82,500 77,000 Insert your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts