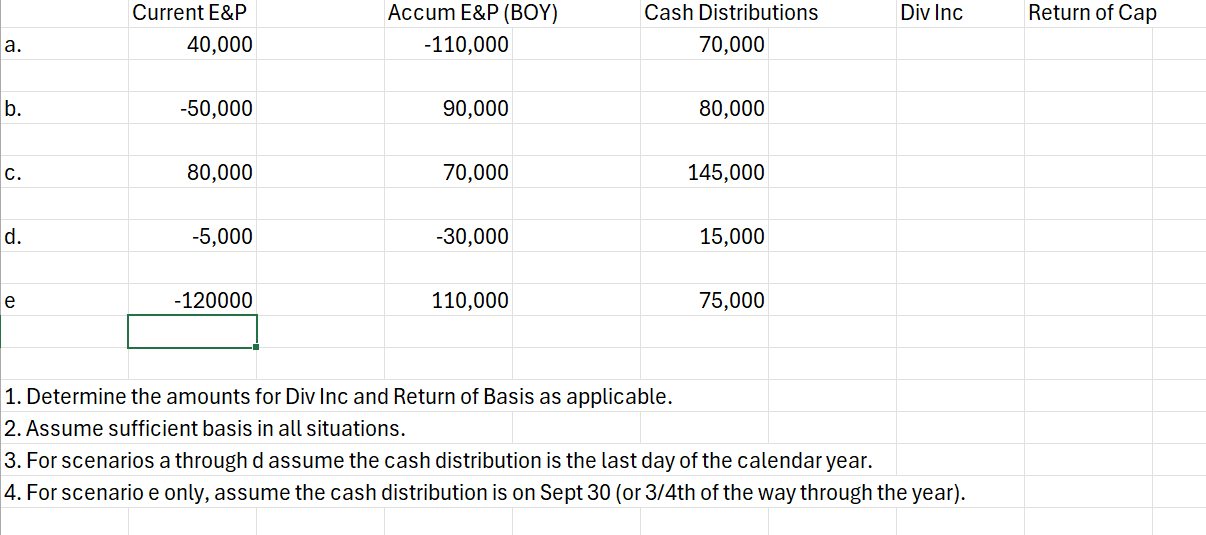

Question: Complete the following schedule (see excel) for each case. Unless otherwise indicated, assume that the shareholders have ample basis in the stock investment. There are

- Complete the following schedule (see excel) for each case. Unless otherwise indicated, assume that the shareholders have ample basis in the stock investment. There are 10 specific answers.

2. Crow Corporation (a calendar year, accrual basis taxpayer) had the following transactions in 2024, its second year of operation:

Taxable income (after considering all of the below items) $405,000

Federal income tax liability paid net of credits 92,500

Tax-exempt interest income 8,000

Meals expense in total (use 50% disallowance rule) 4,000

Premiums paid on key employee life insurance 9,500

Excess of capital losses over capital gains 13,000

MACRS deduction 26,000

Straight-line depreciation using ADS lives 16,000

Net Operating Loss from prior year used this year. 28,000.

Compute Crow's current E & P.

3. Rhonda owns 50% of the stock of Peach Corporation. She and the other 50% shareholder, Rachel, have decided that additional contributions of capital are needed if Peach is to remain successful in its competitive industry. The two shareholders have agreed that Rhonda will contribute assets having a value of $70,000 (adjusted basis of $12,000) in exchange for additional shares of stock. After the transaction, Rhonda will hold 70% of Peach Corporation and Rachel's interest will fall to 30%.

a. What gain is realized on the transaction?

b. How much of the gain will be recognized?

4. Adam transfers property with an adjusted basis of $30,000 and a fair market value of $90,000 to Swift Corporation for 100% of the stock. The property is subject to a liability of $55,000, which Swift assumes.

a. What Internal Revenue Code Section over-rides the general non-recognition rule of IRC 351?

b. What is the basis of the Swift stock to Adam?

c. What is the basis of the property to Swift Corporation?

5. Orange Corporation has a wholly owned subsidiary, Green Corporation. Upon liquidation of Green pursuant to 332, Orange receives Green's only asset, a parcel of land worth $400,000. Green Corporation had a basis of $320,000 in the land.

a. What are the tax consequences of this land transfer to Green Corporation?

b. What are the tax consequences to Orange Corporation?

6. X Corporation makes a cash tender to the shareholders of Y Corporation for 100% of the shares of Y Corporation.

a. Will Y Corporation recognize a gain if Y Corporation shareholders' sell their shares for cash?

b. Will X Corporation take a carryover basis in Y Corporation's assets, or will X Corporation be able to step-up the tax basis in assets to reflect the FMV of Y Corporation?

c. Based on a. will X Corporation record a deferred tax asset for the addition, a deferred tax liability, or simply inherit Y Corporation's preacquisition numbers for tax basis?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts