Question: Complete the problems using excel formula. Show all work (display all the variables used in your formulas, and/or detail all steps used in determining

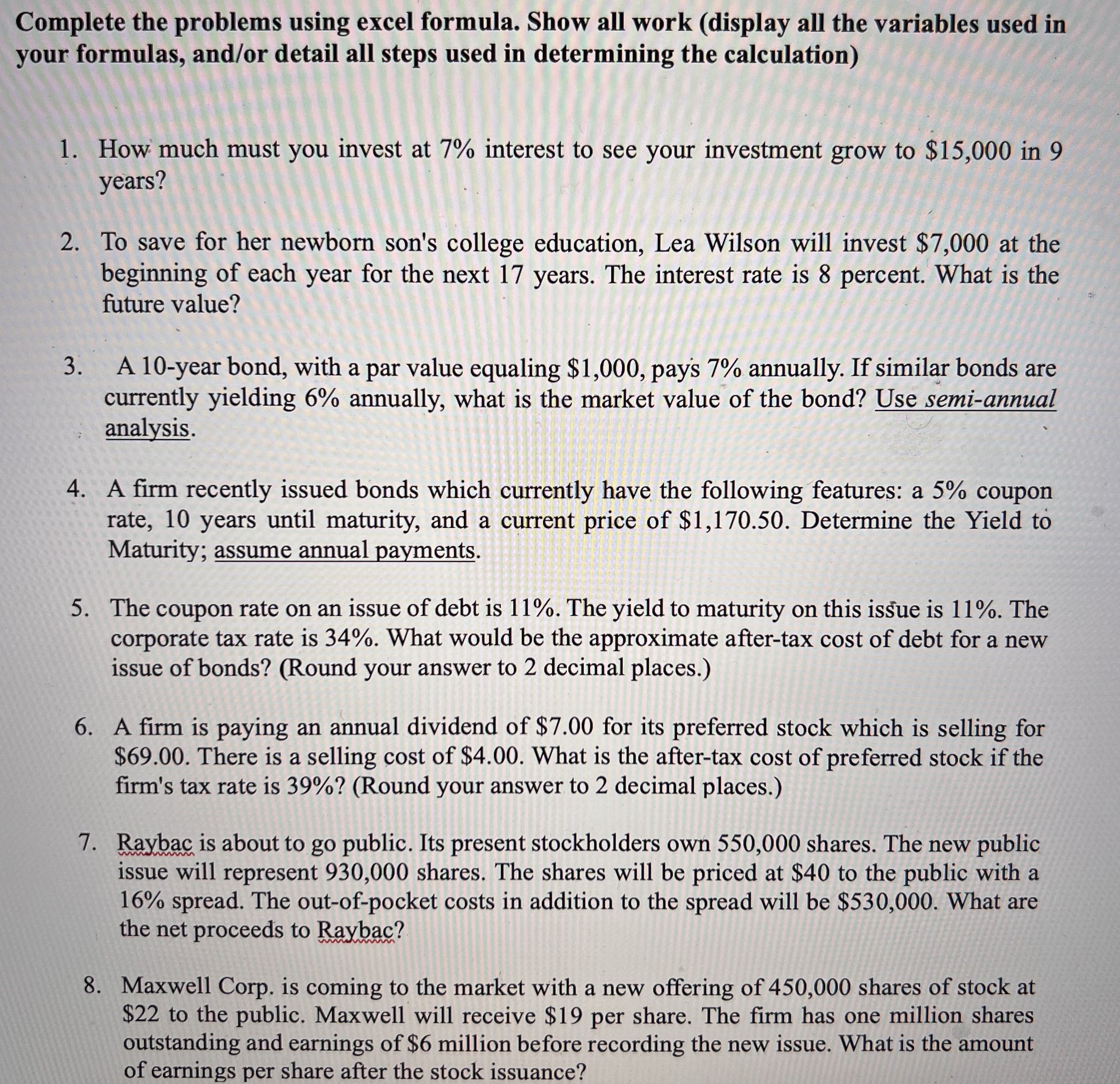

Complete the problems using excel formula. Show all work (display all the variables used in your formulas, and/or detail all steps used in determining the calculation) 1. How much must you invest at 7% interest to see your investment grow to $15,000 in 9 years? 2. To save for her newborn son's college education, Lea Wilson will invest $7,000 at the beginning of each year for the next 17 years. The interest rate is 8 percent. What is the future value? 3. A 10-year bond, with a par value equaling $1,000, pays 7% annually. If similar bonds are currently yielding 6% annually, what is the market value of the bond? Use semi-annual analysis. 4. A firm recently issued bonds which currently have the following features: a 5% coupon rate, 10 years until maturity, and a current price of $1,170.50. Determine the Yield to Maturity; assume annual payments. 5. The coupon rate on an issue of debt is 11%. The yield to maturity on this issue is 11%. The corporate tax rate is 34%. What would be the approximate after-tax cost of debt for a new issue of bonds? (Round your answer to 2 decimal places.) 6. A firm is paying an annual dividend of $7.00 for its preferred stock which is selling for $69.00. There is a selling cost of $4.00. What is the after-tax cost of preferred stock if the firm's tax rate is 39%? (Round your answer to 2 decimal places.) 7. Raybac is about to go public. Its present stockholders own 550,000 shares. The new public issue will represent 930,000 shares. The shares will be priced at $40 to the public with a 16% spread. The out-of-pocket costs in addition to the spread will be $530,000. What are the net proceeds to Raybac? 8. Maxwell Corp. is coming to the market with a new offering of 450,000 shares of stock at $22 to the public. Maxwell will receive $19 per share. The firm has one million shares outstanding and earnings of $6 million before recording the new issue. What is the amount of earnings per share after the stock issuance? Cr

Step by Step Solution

3.41 Rating (145 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Here are the solutions to the problems using Excel formulas All work is shown 1 How much ... View full answer

Get step-by-step solutions from verified subject matter experts