Question: Complete the ratio calculations for 2021 using the income statement and balance sheet C w N 2020 44,452 24,969 19,483 10 . B 1 H

Complete the ratio calculations for 2021 using the income statement and balance sheet

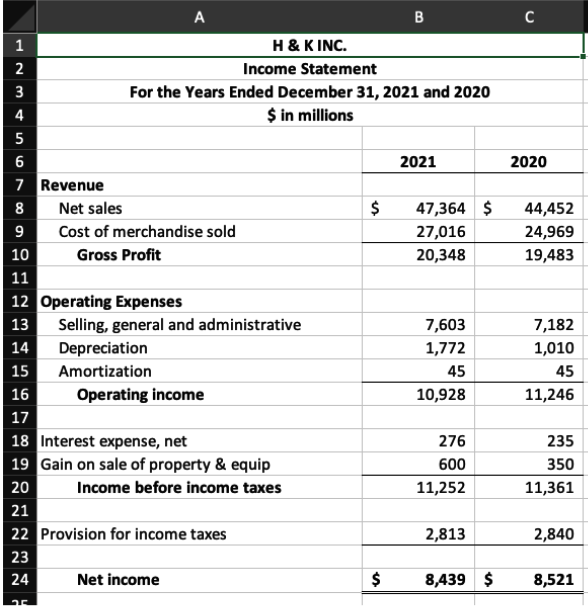

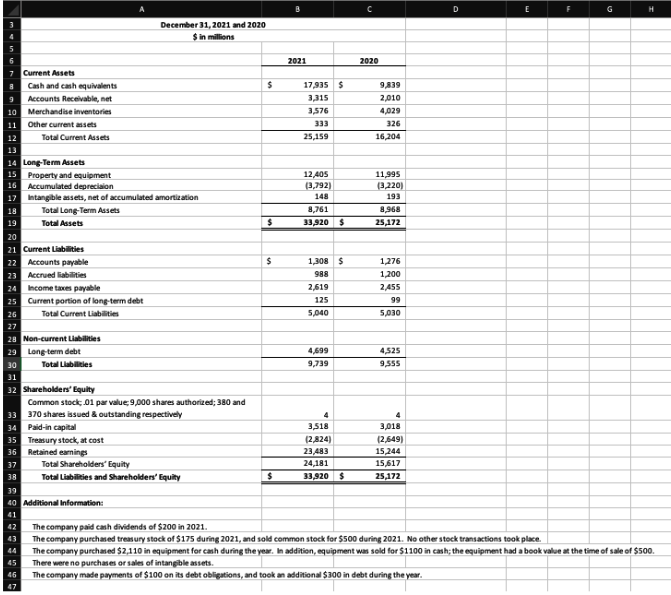

C w N 2020 44,452 24,969 19,483 10 . B 1 H & KINC. 2 Income Statement 3 For the Years Ended December 31, 2021 and 2020 4 $ in millions 5 6 2021 7 Revenue 8 Net sales $ 47,364 $ 9 Cost of merchandise sold 27,016 Gross Profit 20,348 11 12 Operating Expenses 13 Selling, general and administrative 7,603 14 Depreciation 1,772 Amortization 45 16 Operating income 10,928 17 18 Interest expense, net 276 19 Gain on sale of property & equip 600 20 Income before income taxes 11,252 21 22 Provision for income taxes 2,813 23 24 Net income 8,439 $ 7,182 1,010 15 45 11,246 235 350 11,361 2,840 $ 8,521 D E H December 31, 2021 and 2020 $ in millions 988 2021 2020 Current Assets Cash and cash equivalents $ 17,935 5 9839 Accounts Receivable, net 3.315 2,010 10 Merchandise inventories 3,576 4,029 11 Other current assets 333 326 12 Total Current Assets 25,159 16,204 13 14 Long-Term Assets 15 Property and equipment 12,405 11,995 16 Accumulated depreciaion (3,792) (3.220) 17 Intangible assets, net of accumulated amortization 148 193 18 Total Long-Term Assets 8,761 8,968 19 Total Assets $ 33,920 $ 25,172 20 21 Current Liabilities 22 Accounts payable $ 1,308 $ 1276 23 Accrued liabilities 1,200 24 Income taxes payable 2,619 2.455 25 Current portion of long-term debt 125 99 26 Total Current Liabilities 5.040 5.030 27 20 Non-current abilities 29 Long-term debt 4,699 4.525 30 Total Liabilities 9,739 9.555 31 32 Shareholders' Equity Common stock 01 par value:9,000 shares authorized; 380 and 33 370 shares issued & outstanding respectively 34 Paid-in capital 3,518 3,018 35 Treasurystock, at cost 12.824) 12.649) 36 Retained earnings 23,483 15 244 37 Total Shareholders' Equity 24,181 15,617 38 Total Liabilities and Shareholders' Equity $ 33,920 $ 25,172 39 40 Additional Information: 41 42 The company paid cash dividends of $200 in 2021 43 The company purchased treasury stock of $175 during 2021, and sold common stock for $500 during 2021. No other stock transactions took place. 44 The company purchased $2,110 in equipment for cash during the year. In addition, equipment was sold for $1100 in cash; the equipment had a book value at the time of sale of $500. 45 There were no purchases or sales of intangible assets. 46 The company made payments of $100 on its debt obligations, and took an additional $300 in debt during the year. 47 Inventory turnover = Days sales in Inventory- 14 15 16 17 18 19 20 21 22 23 24 25 Total Asset Turnover = Debt to Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts