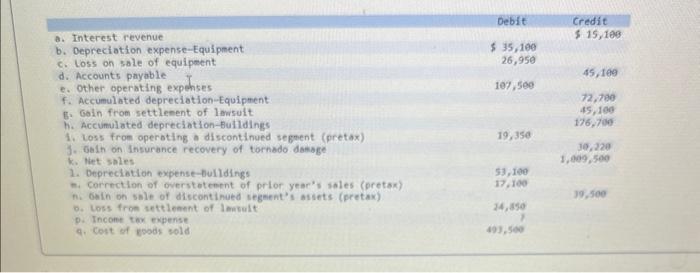

Question: Complete the table given below a. Interest revenue b. Depreciation expense-Equipment c. Loss on sale of equipment d. Accounts payable e. Other operating expenses f.

Complete the table given below

a. Interest revenue b. Depreciation expense-Equipment c. Loss on sale of equipment d. Accounts payable e. Other operating expenses f. Accumulated depreciation Equipment g. Gain from settlement of lawsuit h. Accumulated depreciation-Buildings 1. Loss from operating a discontinued segment (pretax) 3. Gain on insurance recovery of tornado damage k. Net sales 1. Depreciation expense-buildings . Correction of overstatement of prior year's sales (pretax) n. Gain on sale of discontinued segment's assets (pretax) o. Loss from settlement of lawsuit p. Income tax expense 9. Cost of goods sold Debit $ 35,100 26,950 107,500 19,350 53,100 17,100 24,850 493,500 Credit $ 15,100 45,100 72,700 45,100 176,700 30,220 1,009,500 39,500

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

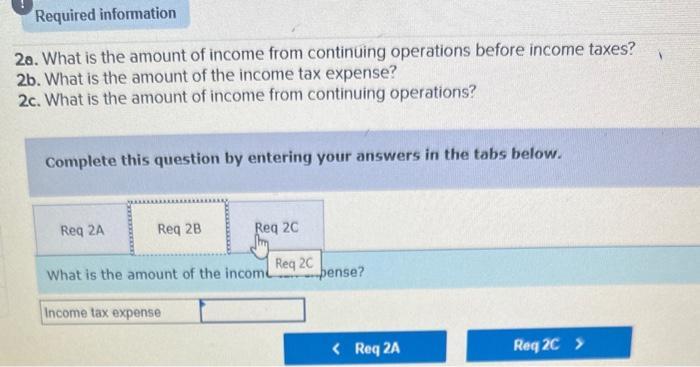

Step 1 Calculate Income from Continuing Operations Before Income Taxes I... View full answer

Get step-by-step solutions from verified subject matter experts