Question: Complete the table on both sides Qs 1-3; Answer all questions in this assessment 4-10 (towards your chosen funding type). Ensure to note all relevant

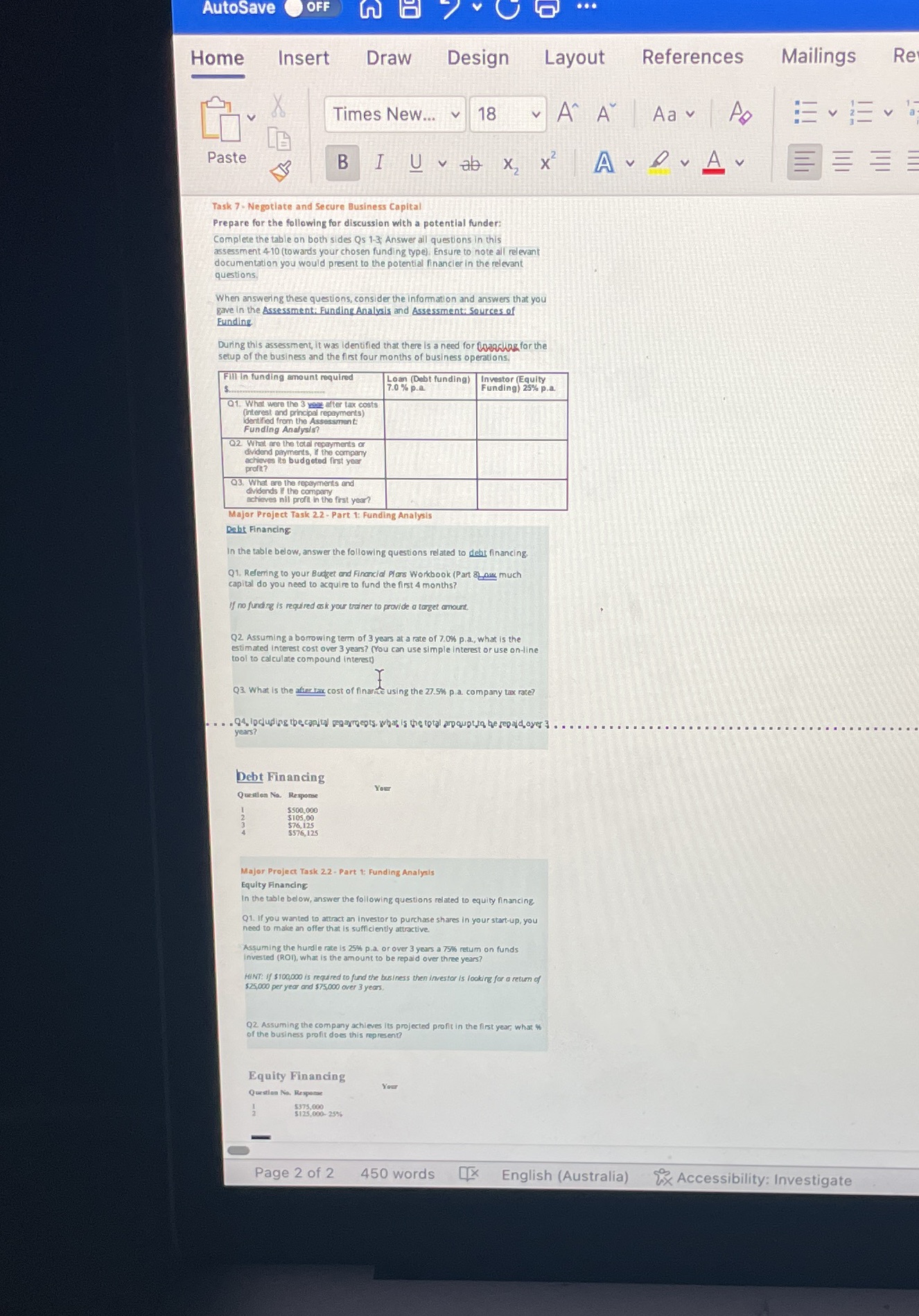

Complete the table on both sides Qs 1-3; Answer all questions in this assessment 4-10 (towards your chosen funding type). Ensure to note all relevant documentation you would present to the potential financier in the relevant questions.When answering these questions, consider the information and answers that you gave in the Assessment: Funding Analysis and Assessment: Sources of Funding.

AutoSave OFF Home Insert Draw Design Layout References Mailings Re Times New... 18 A A Aa Ap LA Paste B I U vab x x ADVA v E Task 7 - Negotiate and Secure Business Capital Prepare for the following for discussion with a potential funder: Complete the table on both sides Qs 1-3; Answer all questions in this assessment 4-10 (towards your chosen funding type). Ensure to note all relevant documentation you would present to the potential financier in the relevant questions. When answering these questions, consider the Information and answers that you gave in the Assessment: Funding Analysis and Assessment: Sources of Funding During this assessment, it was identified that there is a need for financing for the setup of the business and the first four months of business operations. Fill in funding amount required Lom (Debt funding) |Investor (Equity Funding) 25% p.a wore the 3 chase after tax costs identified from the Assessments Funding Analysis? sta repayments ar dividend payments, If the company achieves its budgeted first year profit? Q3. What are the repayments and achieves nil profit in the first year? Major Project Task 2.2 - Part 1: Funding Analysis Debt Financing In the table below, answer the following questions related to debt financing Q1. Referring to your Budget and Financial Plans Workbook (Part So much capital do you need to acquire to fund the first 4 months? no funding is required ask your trainer to provide a target amount. Q2. Assuming a borrowing term of 3 years at a rate of 7.0% p.a., what is the estimated Interest cost over 3 years? (You can use simple interest or use on-line tool to calculate compound interest) Q3. What Is the after tax cost of finarice using the 27.5% p.a. company tax rate? . . . 94. loduping the capital repayrents. what is the total ampqupto be repaid.over ] . . . .. years? Debt Financing Your Quenton No. Response 3 376 125 $576.125 Major Project Task 2.2 - Part 1: Funding Analysis Equity Financing In the table below, answer the following questions related to equity financing. Q1. If you wanted to attract an investor to purchase shares in your start-up, you clently attractive. Assuming the hurdle rate is 25% p.a. or over 3 years a 75% return on funds Invested (ROI), what is the amount to be repaid over three ye HINT: If $100,000 is required to fund the business then Investor is looking for a return of $25,000 per year and $75,000 over 3 years, Q2. Assuming the company achieves Its projected profit in the first year, what of the business profit does this represent? Equity Financing Your Question No. Response $375,000 $125,000-25% Page 2 of 2 450 words X English (Australia) %% Accessibility: Investigate