Question: complete this one as well A borrower has secured a 30 year, $150,000 loan at 7% with monthly payments. Fifteen years later, an investor wants

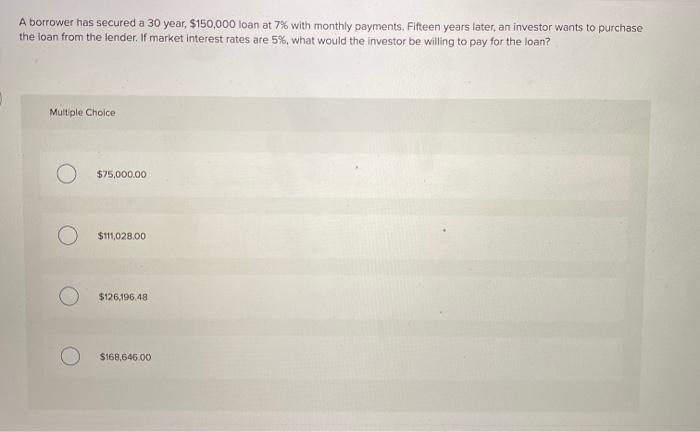

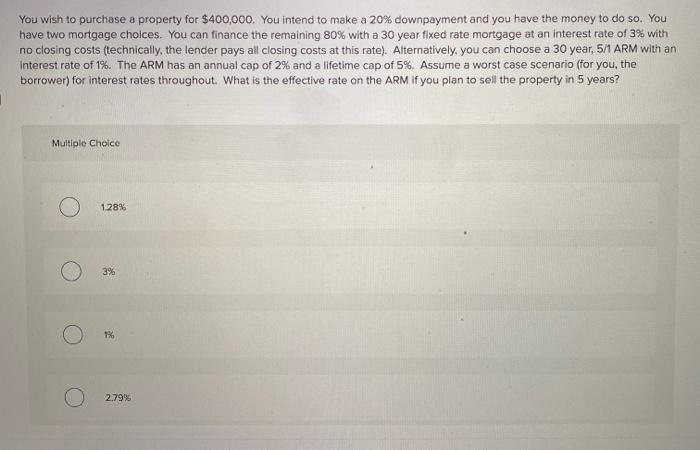

A borrower has secured a 30 year, $150,000 loan at 7% with monthly payments. Fifteen years later, an investor wants to purchase the loan from the lender. If market interest rates are 5%, what would the investor be willing to pay for the loan? Multiple Choice $75,000.00 $111,028,00 $126,196.48 $168,646.00 You wish to purchase a property for $400,000. You intend to make a 20% downpayment and you have the money to do so. You have two mortgage choices. You can finance the remaining 80% with a 30 year fixed rate mortgage at an interest rate of 3% with no closing costs (technically, the lender pays all closing costs at this rate). Alternatively, you can choose a 30 year, 5/1 ARM with an Interest rate of 1%. The ARM has an annual cap of 2% and a lifetime cap of 5%. Assume a worst case scenario (for you, the borrower) for interest rates throughout. What is the effective rate on the ARM if you plan to sell the property in 5 years? Multiple Choice 1.28% 3% 1% 2.79%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts