Question: Complete this problem please. Theyre all on one question. Check My Work (1 remaining) 2. 3. 4. 5. 6. Determinants of Market Interest Rate The

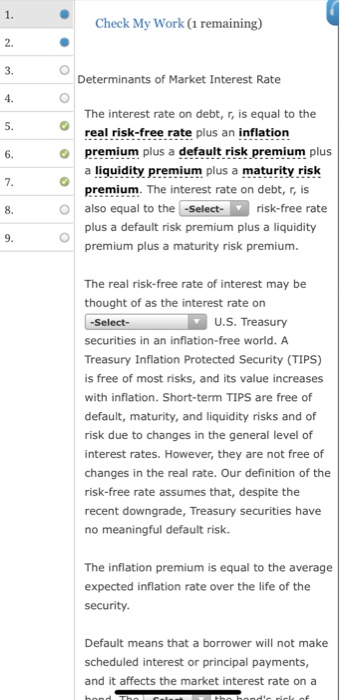

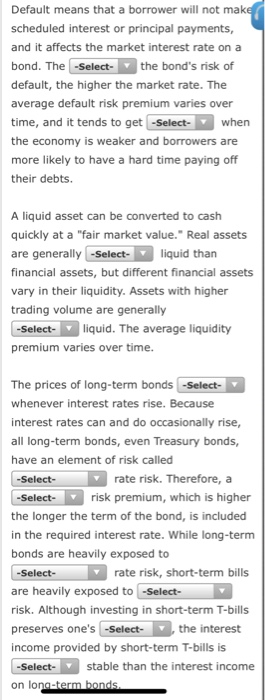

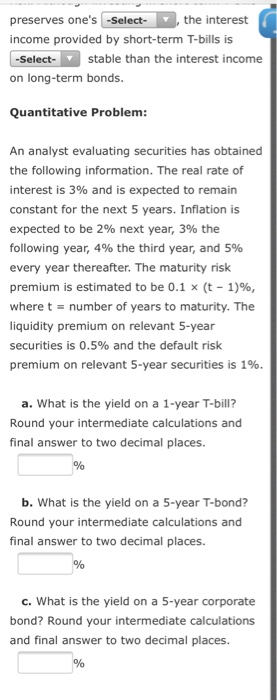

Check My Work (1 remaining) 2. 3. 4. 5. 6. Determinants of Market Interest Rate The interest rate on debt, r, is equal to the real risk-free rate plus an inflation o premium plus a default risk premium plus a liquidity premium plus a maturity risk premium. The interest rate on debt, r, is also equal to the -Select-risk-free rate plus a default risk premium plus a liquidity premium plus a maturity risk premium. 8. The real risk-free rate of interest may be thought of as the interest rate on U.S. Treasury -Select- securities in an inflation-free world. A Treasury Inflation Protected Security (TIPS) is free of most risks, and its value increases with inflation. Short-term TIPS are free of default, maturity, and liquidity risks and of risk due to changes in the general level of interest rates. However, they are not free of changes in the real rate. Our definition of the risk-free rate assumes that, despite the recent downgrade, Treasury securities have no meaningful default risk. The inflation premium is equal to the average expected inflation rate over the life of the security Default means that a borrower will not make scheduled interest or principal payments, and it affects the market interest rate on a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts