Question: Completely answer the following question: Using the following information please calculate the weighted average cost of capital (WACC) using retained earnings. Also identify the breakpoint

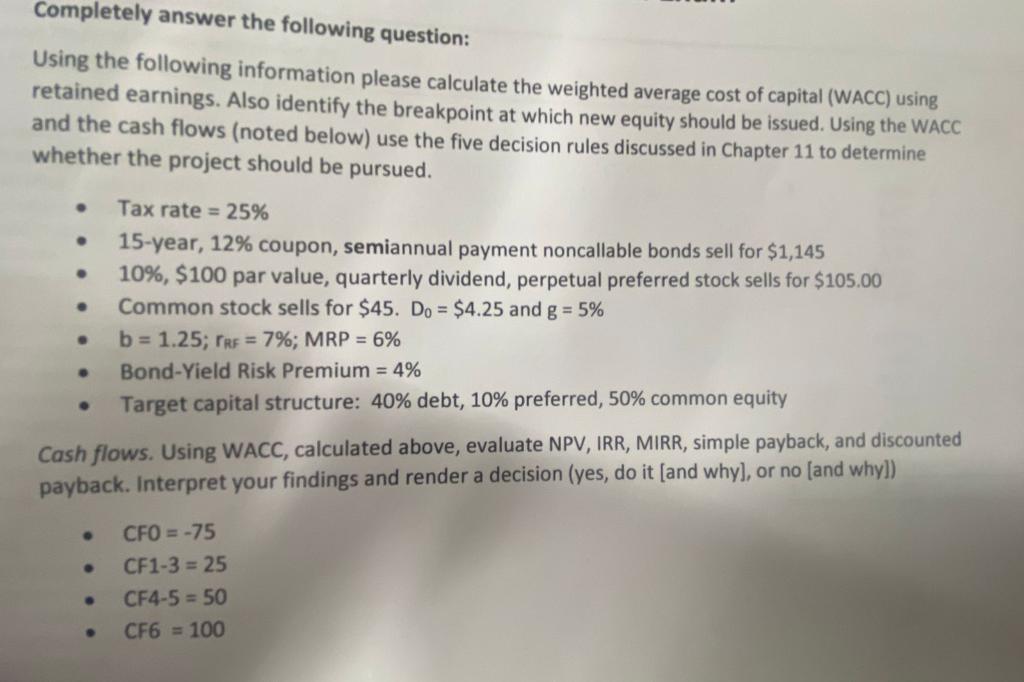

Completely answer the following question: Using the following information please calculate the weighted average cost of capital (WACC) using retained earnings. Also identify the breakpoint at which new equity should be issued. Using the WACC and the cash flows (noted below) use the five decision rules discussed in Chapter 11 to determine whether the project should be pursued. Tax rate = 25% 15-year, 12% coupon, semiannual payment noncallable bonds sell for $1,145 10%, $100 par value, quarterly dividend, perpetual preferred stock sells for $105.00 Common stock sells for $45. Do = $4.25 and g = 5% b = 1.25; TRF = 7%; MRP = 6% Bond-Yield Risk Premium = 4% Target capital structure: 40% debt, 10% preferred, 50% common equity Cash flows. Using WACC, calculated above, evaluate NPV, IRR, MIRR, simple payback, and discounted payback. Interpret your findings and render a decision (yes, do it [and why], or no [and why]) CFO = -75 CF1-3 = 25 CF4-5 = 50 CF6 = 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts