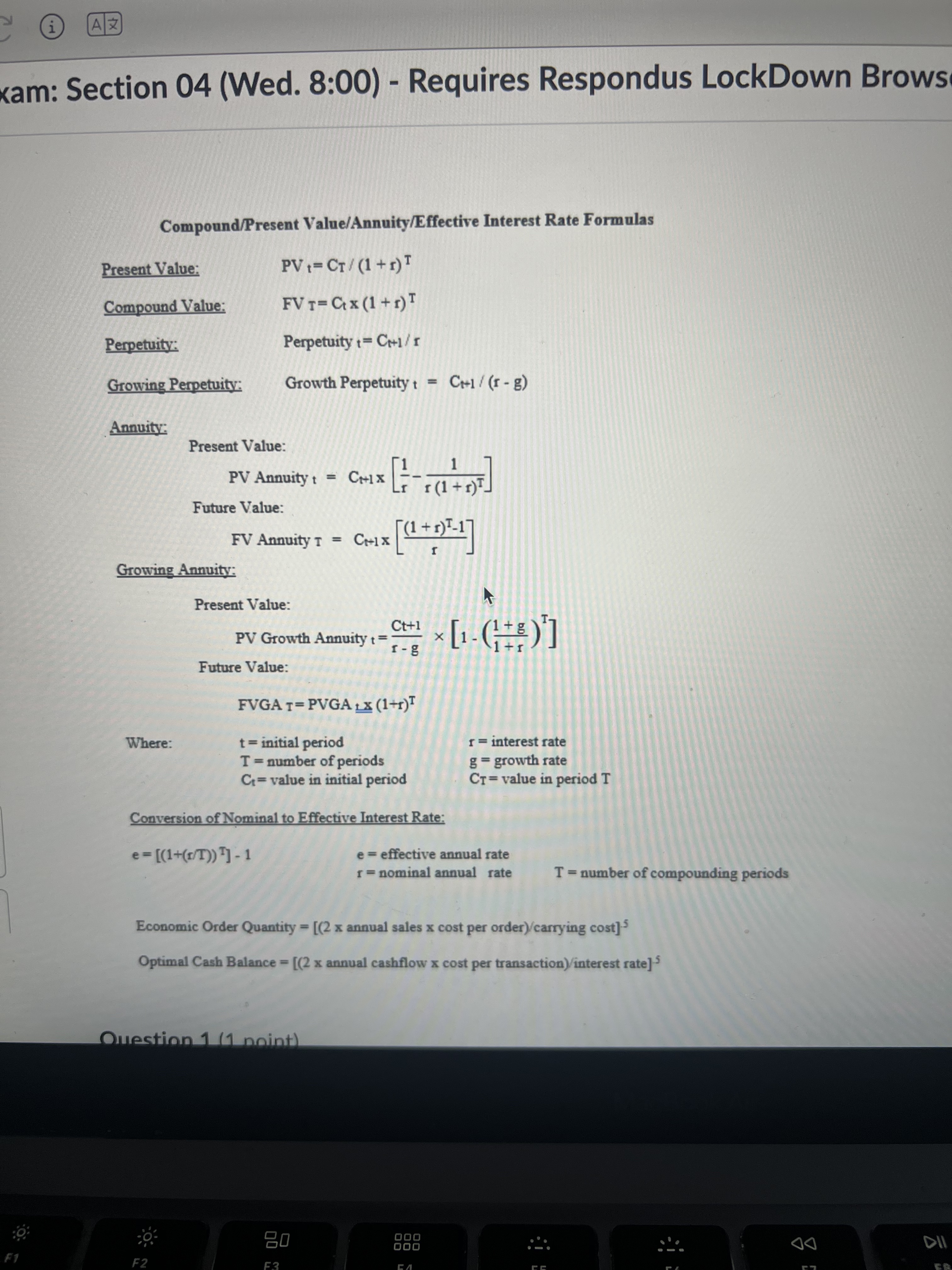

Question: Compound / Present Value / Annuity / Effective Interest Rate Formulas Present Value: Compound Value: Perpetuity: Growing Perpetuity: P V t = C T (

CompoundPresent ValueAnnuityEffective Interest Rate Formulas

Present Value:

Compound Value:

Perpetuity:

Growing Perpetuity:

Perpetuity

Growth Perpetuity

Annuity:

Present Value:

Annuity

Future Value:

Annuity

Growing Annuity:

Present Value:

Growth Annuity

Future Value:

Where:

initial period

interest rate

number of periods

growth rate

value in initial period

value in period T

Conversion of Nominal to Effective Interest Rate:

effective annual rate

nominal annual rate

number of compounding periods

Economic Order Quantity arrying cost

Optimal Cash Balance annual cashflow cost per transaction

Question How much can be accumulated for retirement if is deposited annually, beginning one year from today and the account earns percent interest compounded annually for years

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock