Question: Compounding frequency and time value Personal Finance Problem You plan to invest $1,900 in an individual retirement arrangement (IRA) today at a nominal annual rate

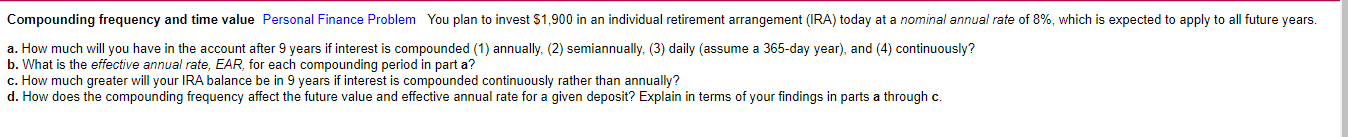

Compounding frequency and time value Personal Finance Problem You plan to invest $1,900 in an individual retirement arrangement (IRA) today at a nominal annual rate of 8%, which is expected to apply to all future years. a. How much will you have in the account after 9 years if interest is compounded (1) annually, (2) semiannually, (3) daily (assume a 365-day year), and (4) continuously? b. What is the effective annual rate, EAR, for each compounding period in part a? c. How much greater will your IRA balance be in 9 years if interest is compounded continuously rather than annually? d. How does the compounding frequency affect the future value and effective annual rate for a given deposit? Explain in terms of your findings in parts a through c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts