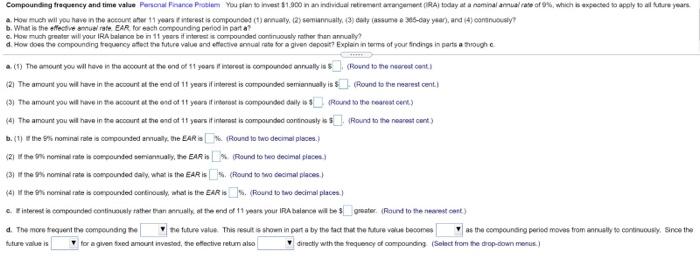

Question: Compounding frequency and time value Personal France Problem you plan to invest $1.000 n an individual retirement arrangement (IRA today at a nominalna rate of

Compounding frequency and time value Personal France Problem you plan to invest $1.000 n an individual retirement arrangement (IRA today at a nominalna rate of 0%, which is expected to apply to a fare years a. How much wil you have in the account 11 years interest is compounded annually. (2) semiannually. 9 day assume 5-day year, and (4) continuously c. How much greater will your IRA balance ben 11 years if interest is compounded continuously rather than annually! d. How does the compounding frequency affect the future value and effective annual rate for a given deposit? Explan in terms of your findings in parts arouhe a () The amount you will have the account at the end of 11 years ir interest is compounder annually in (Round to menorest cont) (2) The amount you will have in the account at the end of 11 years if interest is compounded somiermusly is $(Round as the mainst cent.) (3) The amount you will have in the account at the end of 15 years of interest to compounded awy Rount to the rest cent) (141 The amount you wit have in the account at the end of 11 years it interest le compounded continously o 5. Round to the nearest cont> B. () the 8% nominai rates compounded may the EARL Round io to decimal places. (21f the nominal rato la compounded comintually, the SARIS Pound to be decimal place 3) the nominal rate is compounded caly what is the EARISS. (found to a decimal places (4) the nominal rate is compounded continously, that is the EAR 5 (Round to ho decimal places . Einterest is compounded continuously tatte annually at the end of 11 years your IRA baron will be greater (Round to the cont) d. The more frequent the compounding the the future value. This results shown in part a by the fact that the future value becomes as the compounding period moves from annusty to continuously. Since the future values for a given fed amount invested, the effective retum also directly with the frequency of compounding Select from the drop-down menus) Compounding frequency and time value Personal France Problem you plan to invest $1.000 n an individual retirement arrangement (IRA today at a nominalna rate of 0%, which is expected to apply to a fare years a. How much wil you have in the account 11 years interest is compounded annually. (2) semiannually. 9 day assume 5-day year, and (4) continuously c. How much greater will your IRA balance ben 11 years if interest is compounded continuously rather than annually! d. How does the compounding frequency affect the future value and effective annual rate for a given deposit? Explan in terms of your findings in parts arouhe a () The amount you will have the account at the end of 11 years ir interest is compounder annually in (Round to menorest cont) (2) The amount you will have in the account at the end of 11 years if interest is compounded somiermusly is $(Round as the mainst cent.) (3) The amount you will have in the account at the end of 15 years of interest to compounded awy Rount to the rest cent) (141 The amount you wit have in the account at the end of 11 years it interest le compounded continously o 5. Round to the nearest cont> B. () the 8% nominai rates compounded may the EARL Round io to decimal places. (21f the nominal rato la compounded comintually, the SARIS Pound to be decimal place 3) the nominal rate is compounded caly what is the EARISS. (found to a decimal places (4) the nominal rate is compounded continously, that is the EAR 5 (Round to ho decimal places . Einterest is compounded continuously tatte annually at the end of 11 years your IRA baron will be greater (Round to the cont) d. The more frequent the compounding the the future value. This results shown in part a by the fact that the future value becomes as the compounding period moves from annusty to continuously. Since the future values for a given fed amount invested, the effective retum also directly with the frequency of compounding Select from the drop-down menus)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts