Question: Comprehensive Problem 1 1 - 6 8 ( LO 1 1 - 1 , LO 1 1 - 2 , LO 1 1 - 3

Comprehensive Problem LO LO LO LO LO LO Static

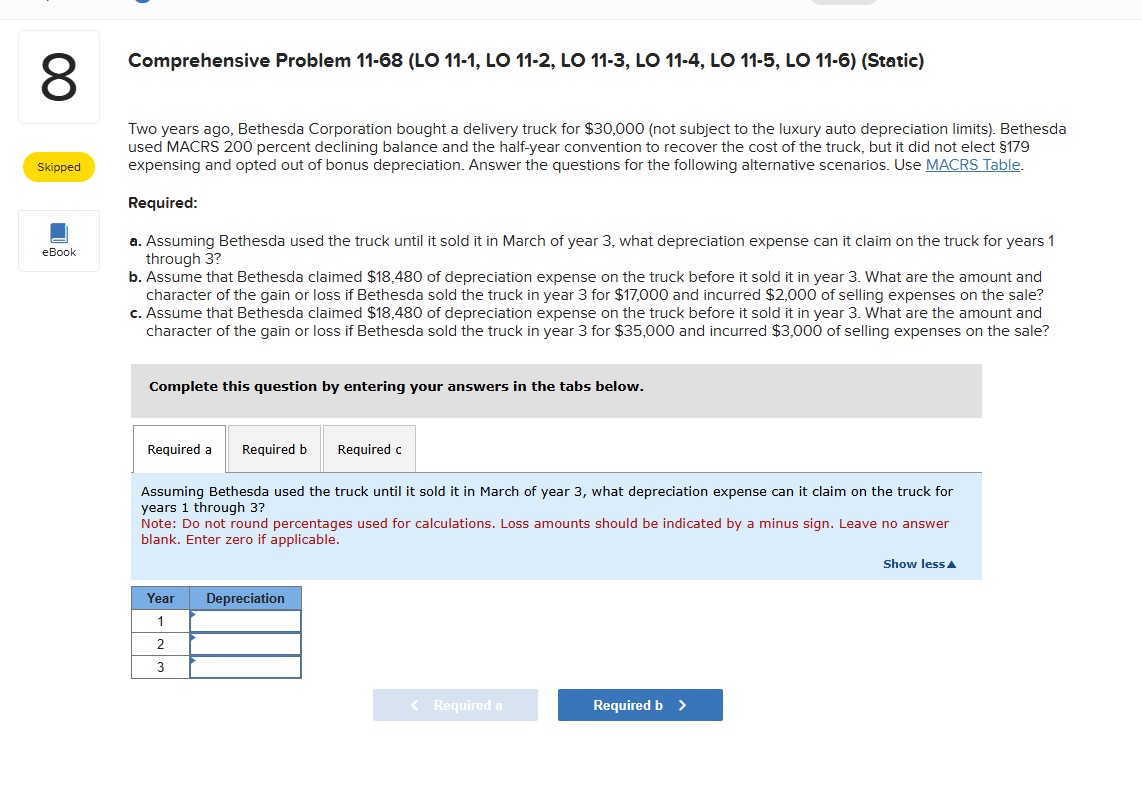

Two years ago, Bethesda Corporation bought a delivery truck for $ not subject to the luxury auto depreciation limits Bethesda used MACRS percent declining balance and the halfyear convention to recover the cost of the truck, but it did not elect $ expensing and opted out of bonus depreciation. Answer the questions for the following alternative scenarios. Use MACRS Table.

Required:

a Assuming Bethesda used the truck until it sold it in March of year what depreciation expense can it claim on the truck for years through

b Assume that Bethesda claimed $ of depreciation expense on the truck before it sold it in year What are the amount and character of the gain or loss if Bethesda sold the truck in year for $ and incurred $ of selling expenses on the sale?

c Assume that Bethesda claimed $ of depreciation expense on the truck before it sold it in year What are the amount and character of the gain or loss if Bethesda sold the truck in year for $ and incurred $ of selling expenses on the sale?

Complete this question by entering your answers in the tabs below.

Required a

Assuming Bethesda used the truck until it sold it in March of year what depreciation expense can it claim on the truck for years through

Note: Do not round percentages used for calculations. Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.

Show less

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock