Question: Comprehensive Problem 1 1 - 6 8 ( LO 1 1 - 1 , LO 1 1 - 2 , LO 1 1 - 3

Comprehensive Problem LO LO LO LO LO LO Static

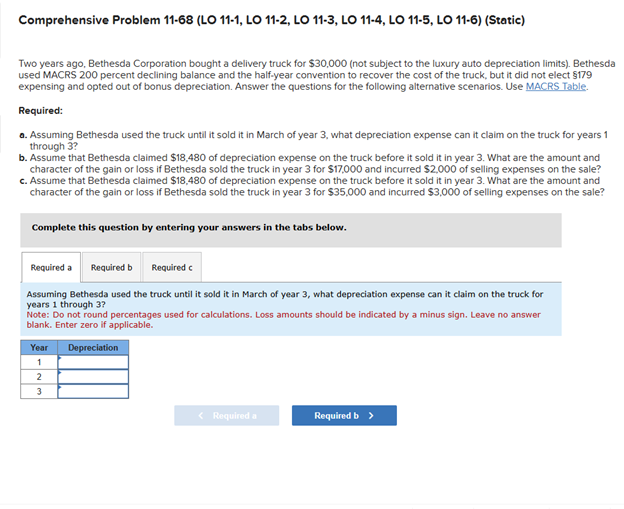

Two years ago, Bethesda Corporation bought a delivery truck for $ not subject to the luxury auto depreciation limits Bethesda used MACRS percent declining balance and the halfyear convention to recover the cost of the truck, but it did not elect $ expensing and opted out of bonus depreciation. Answer the questions for the following alternative scenarios. Use MACRS Table.

Required:

a Assuming Bethesda used the truck until it sold it in March of year what depreciation expense can it claim on the truck for years through

b Assume that Bethesda claimed $ of depreciation expense on the truck before it sold it in year What are the amount and character of the gain or loss if Bethesda sold the truck in year for $ and incurred $ of selling expenses on the sale?

c Assume that Bethesda claimed $ of depreciation expense on the truck before it sold it in year What are the amount and character of the gain or loss if Bethesda sold the truck in year for $ and incurred $ of selling expenses on the sale?

Complete this question by entering your answers in the tabs below.

Assuming Bethesda used the truck until it sold it in March of year what depreciation expense can it claim on the truck for years through

Note: Do not round percentages used for calculations. Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock