Question: Comprehensive Problem 2 Part 4 and 6: Note: You must complete parts 1, 2 and 3 before attempting to complete part 4 and part 6.

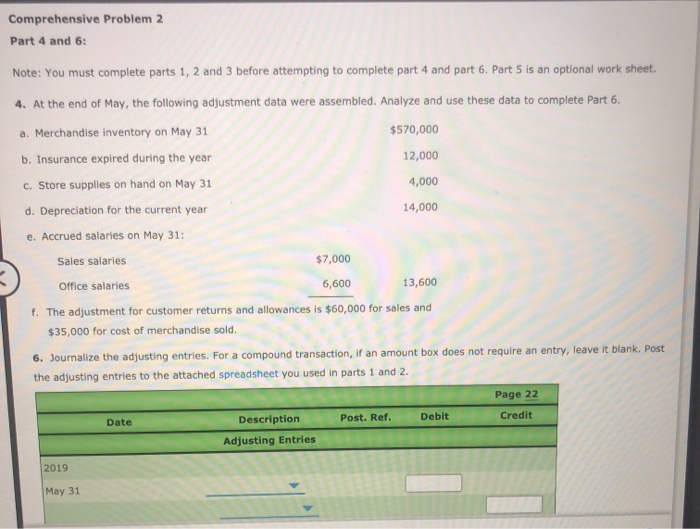

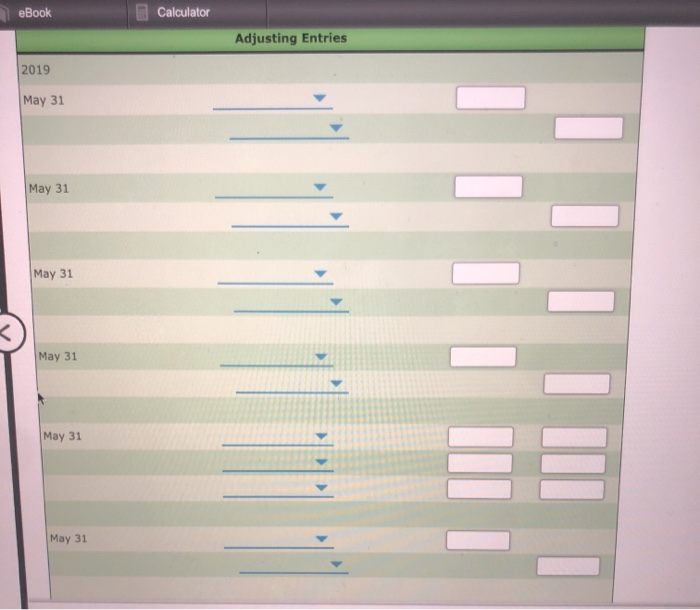

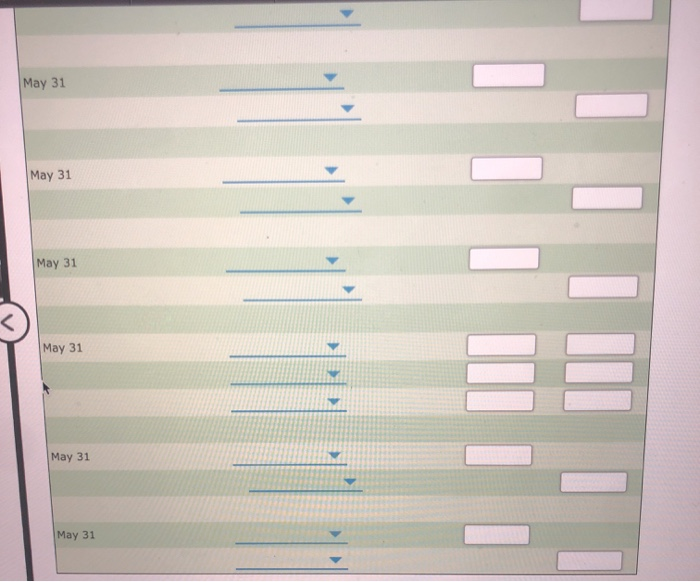

Comprehensive Problem 2 Part 4 and 6: Note: You must complete parts 1, 2 and 3 before attempting to complete part 4 and part 6. Part 5 is an optional work sheet. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete Part 6 a. Merchandise inventory on May 31 $570,000 b. Insurance expired during the year 12,000 C. Store supplies on hand on May 31 4,000 d. Depreciation for the current year 14,000 e. Accrued salaries on May 31: Sales salaries $7,000 Office salaries 6,600 13,600 f. The adjustment for customer returns and allowances is $60,000 for sales and $35,000 for cost of merchandise sold. 6. Journalize the adjusting entries. For a compound transaction, if an amount box does not require an entry, leave it blank. Post the adjusting entries to the attached spreadsheet you used in parts 1 and 2. Page 22 Credit Date Post. Ref. Debit Description Adjusting Entries 2019 May 31 eBook Calculator Adjusting Entries 2019 May 31 May 31 May 31 May 31 May 31 May 31 May 31 May 31 |May 31 May 31 May 31 |May 31 Comprehensive Problem 2 Part 4 and 6: Note: You must complete parts 1, 2 and 3 before attempting to complete part 4 and part 6. Part 5 is an optional work sheet. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete Part 6 a. Merchandise inventory on May 31 $570,000 b. Insurance expired during the year 12,000 C. Store supplies on hand on May 31 4,000 d. Depreciation for the current year 14,000 e. Accrued salaries on May 31: Sales salaries $7,000 Office salaries 6,600 13,600 f. The adjustment for customer returns and allowances is $60,000 for sales and $35,000 for cost of merchandise sold. 6. Journalize the adjusting entries. For a compound transaction, if an amount box does not require an entry, leave it blank. Post the adjusting entries to the attached spreadsheet you used in parts 1 and 2. Page 22 Credit Date Post. Ref. Debit Description Adjusting Entries 2019 May 31 eBook Calculator Adjusting Entries 2019 May 31 May 31 May 31 May 31 May 31 May 31 May 31 May 31 |May 31 May 31 May 31 |May 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts