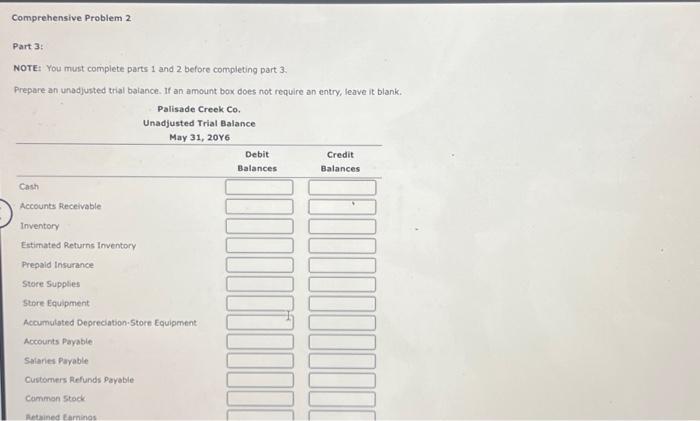

Question: NOTE: You must complete parts 1 and 2 before completing part 3 . Prepare an unadjusted trial balance. If an amount box does not require

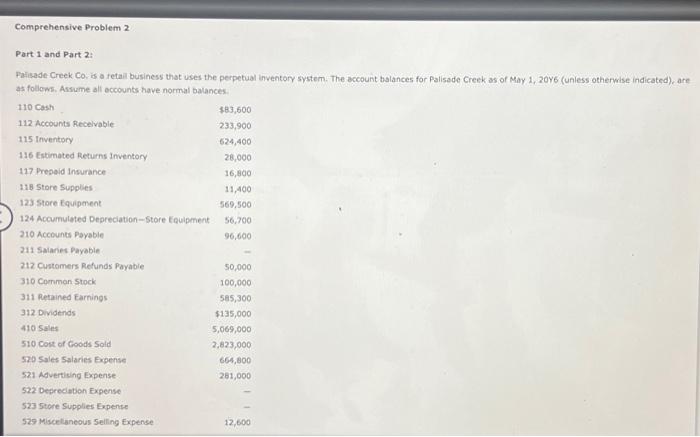

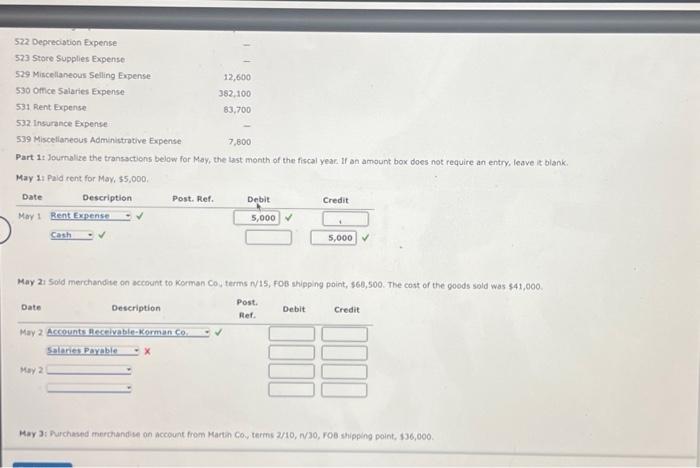

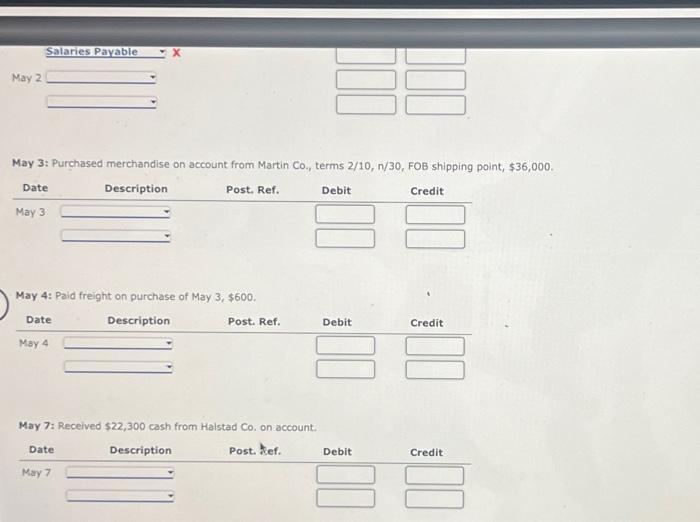

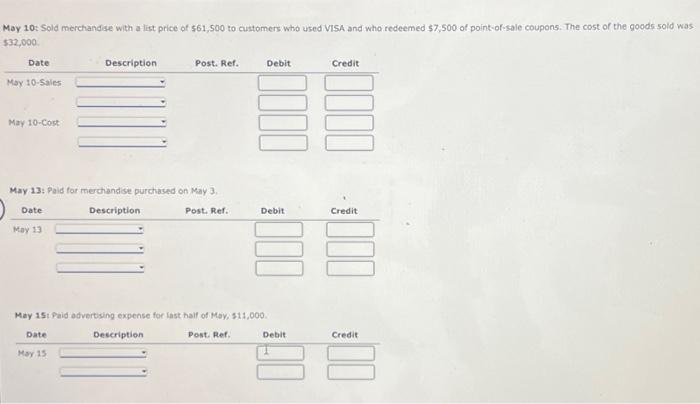

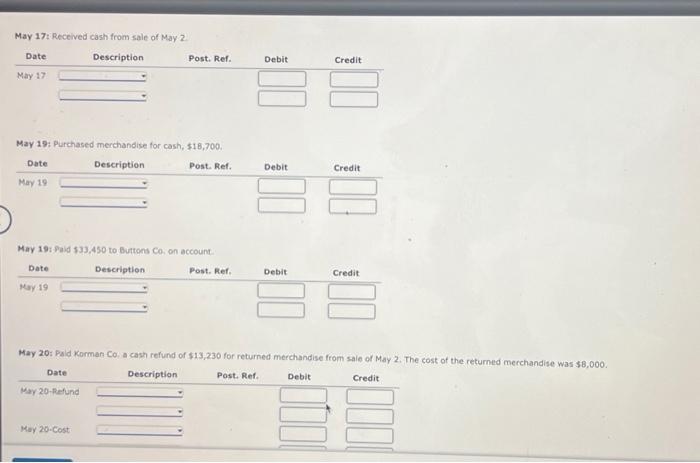

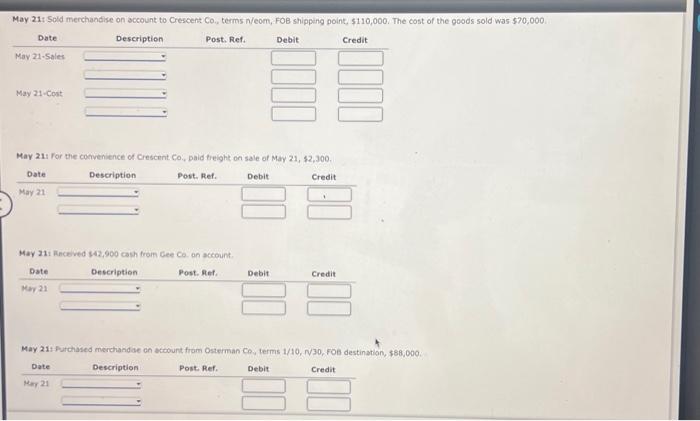

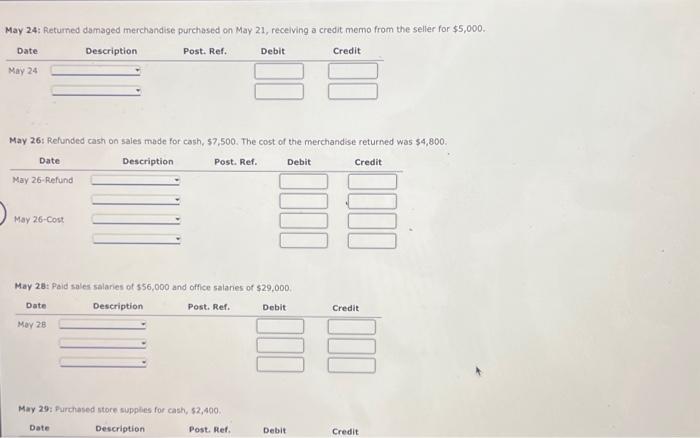

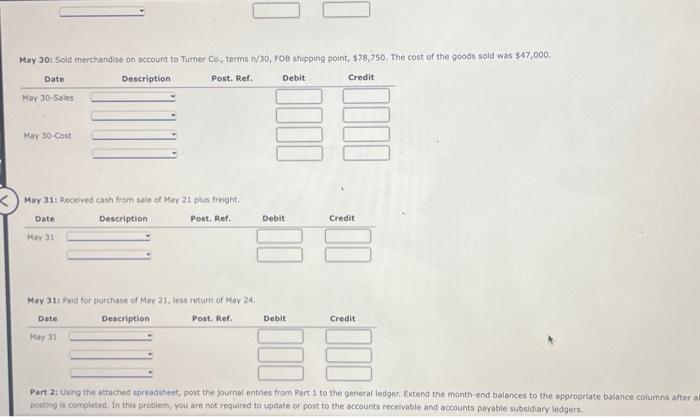

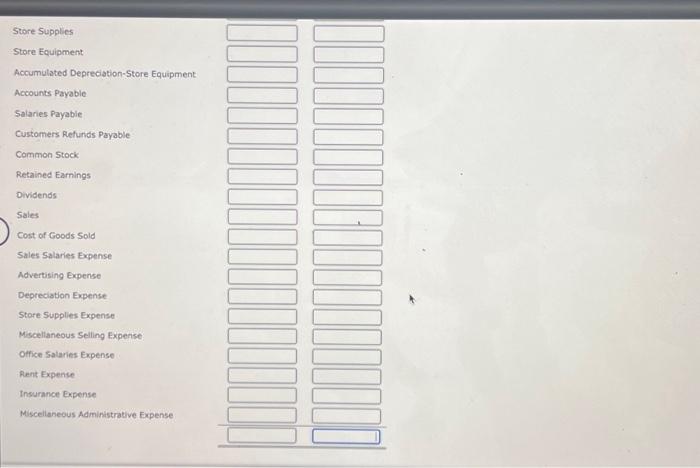

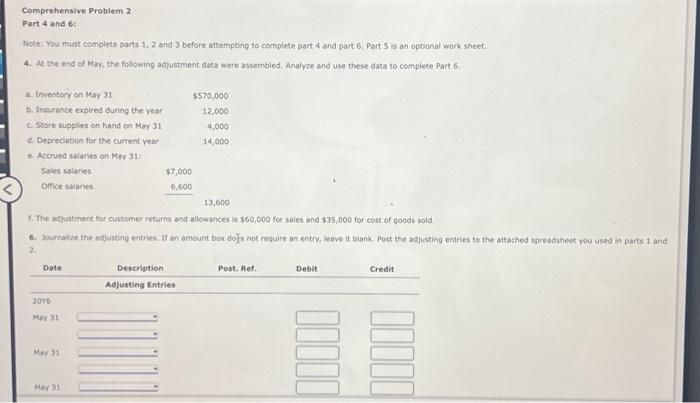

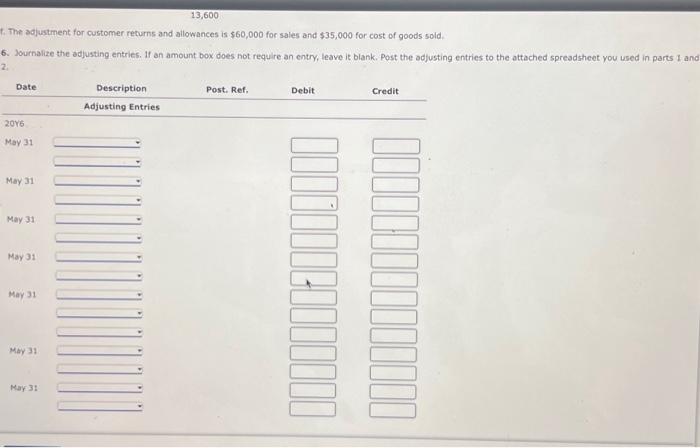

NOTE: You must complete parts 1 and 2 before completing part 3 . Prepare an unadjusted trial balance. If an amount box does not require an entry, leave it blank. Part 1t Journalze the transactions below for May, the last month of the fiscai year. If an amount box does not require an entry, leave it blank. May is Patd rent for May, 55,000 . May 2. Soid merchandive on account to Korman Co, terms N/15, FOB shipping point, $60,500. The cost of the goods sold was $41,000. May 3i Rurchaspd merchandise an account from Martin Co, terms 2/10, N/30, ros shipping point, 336,000. Comprehensive Problem 2 Part 4 and 6: Note: You must complete parts 1,2 and 3 before attempting to complete part 4 and part 6 , Part 5 is an optional work sheet. 4. At the end of May, the following adjustment data were assembied. Analyze and use these data to complete Part 6. 6. The adjustment for cuvtomer recurns and allowances is $60,000 foc sales and $35,000 for cost of goods sold. 6. Joumalize the adjustiog entries. If an amount bax dols not require an entry, leave it blank, Post the adjusting entries to the attached soreadaheet you used in parts t and 2 Comprehensive Problem 2 Part 1 and Part 2: Paliteade Creek Co, is a retail business that uses the perpetual inventory system. The account balances for Palisade Creek as of May 1,20y6 (unless otherwise indicated), are as follows. Assume alt eccounts have normal balances. May 24: Returned damaged merchandise purchased on May 21, receiving a credit memo from the seller for $5,000. May 26: Relunded cash on sales made for cash, $7,500. The cost of the merchandise returned was $4,800. May 28: Paid sales salaries of $56,000 and office salanes of $29,000. May 3: Purchased merchandise on account from Martin Co., terms 2/10, n/30, FOB shipping point, $36,000. May 4: Paid freight on purchase of May 3,$600. May 7: Received $22,300 cash from Halstad Co0. on account. Store Supplies Store Equipment Accumulated Depreciation-Store Equipment Accounts Payable Salaries Payable Customers Refunds Payable Common Stock Retained Eamings Oividends Sales Cost of Coods Sold Sales Salaries Expense Advertising Expense Depreciation Expence Store Supplies Expense Miscellaneous Selling Expense Office Salaries Expense Rent Expense Insurance Expense Miccelianeous Administrative Expense May 31: Received cash from sale of Mar 21 plis freight. May 311 Deid for purchase of May 21, less return of May 24. Part 2: Using the attached spreadsheet, post the journal entries from Part 1 to the general ledger. Extend the month-end balances to the appropriate balance columns after posting is completed. In this problem, you are nat required to update or post to the sccounts receivable and accounts payable subsidiary ledgers. May 21: For the cotvenience of Crescent Co., paid treight on sale of Mary 21, 52,300 . May 211 Recoved 442,900 cash from Gee Ca. on account. May 21 : Futchased merchandae on account from Osterman C0, terms 1/10, rv30, FOB destination, $88,000. May 10: Sold merchandise with a list price of $61,500 to customers who used VISA and who redeemed $7,500 of point-of-sale coupons. The cost of the goods 50 ld was $32,000. May 13: Paid for merchandise purchased on May 3. May ist Paid advertsing expense for last half of May, 511,000 May 17: Received cash from sale of May 2. May 19: Purchased merchandise for cash, $18,700. May 19: Paid $33,450 to Buttons Co, on account The adjustment for customer returns and allowances is $60,000 for sales and $35,000 for cost of goods sold. 5. Journalize the adjusting entries. If an amount box does not require an entry, leave it blank. Post the adjusting entries to the attached spreadsheet you used in parts 1 and 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts