Question: Comprehensive Problem #3 The Stanley Works operates as a merchandiser of fastening devices. The company uses the FIFO method of assigning costs to inventory

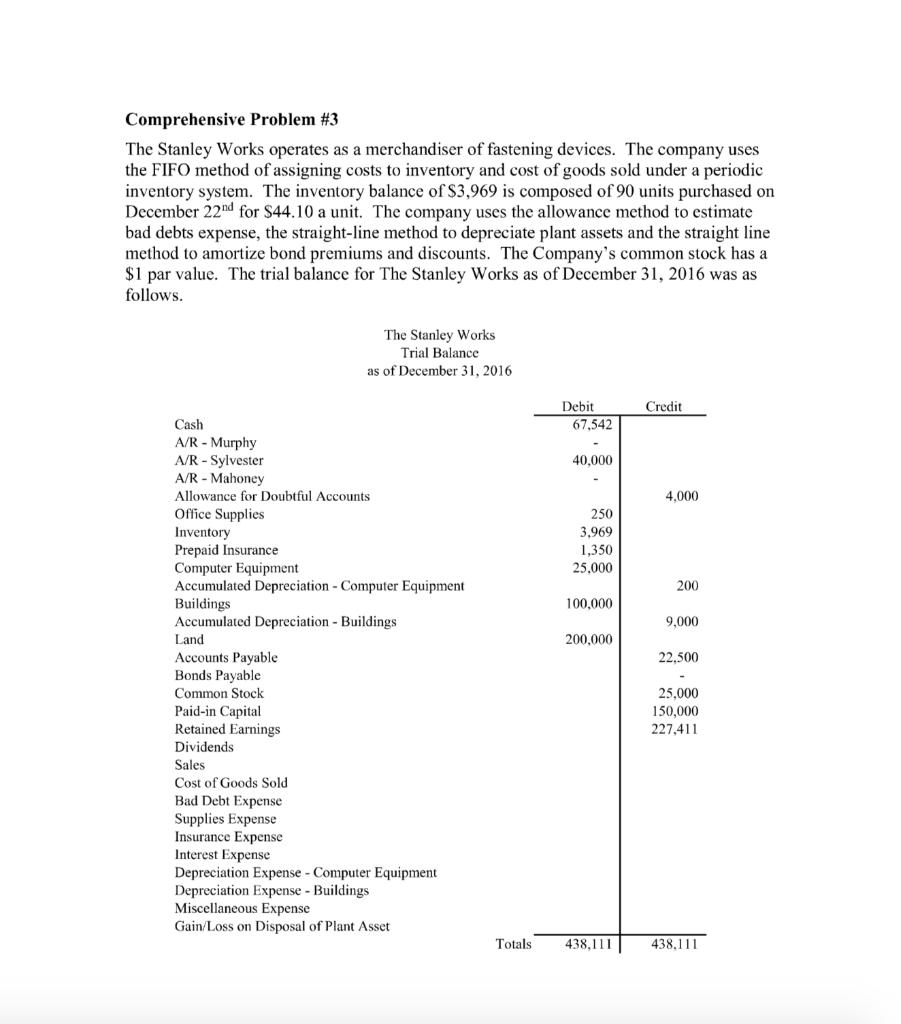

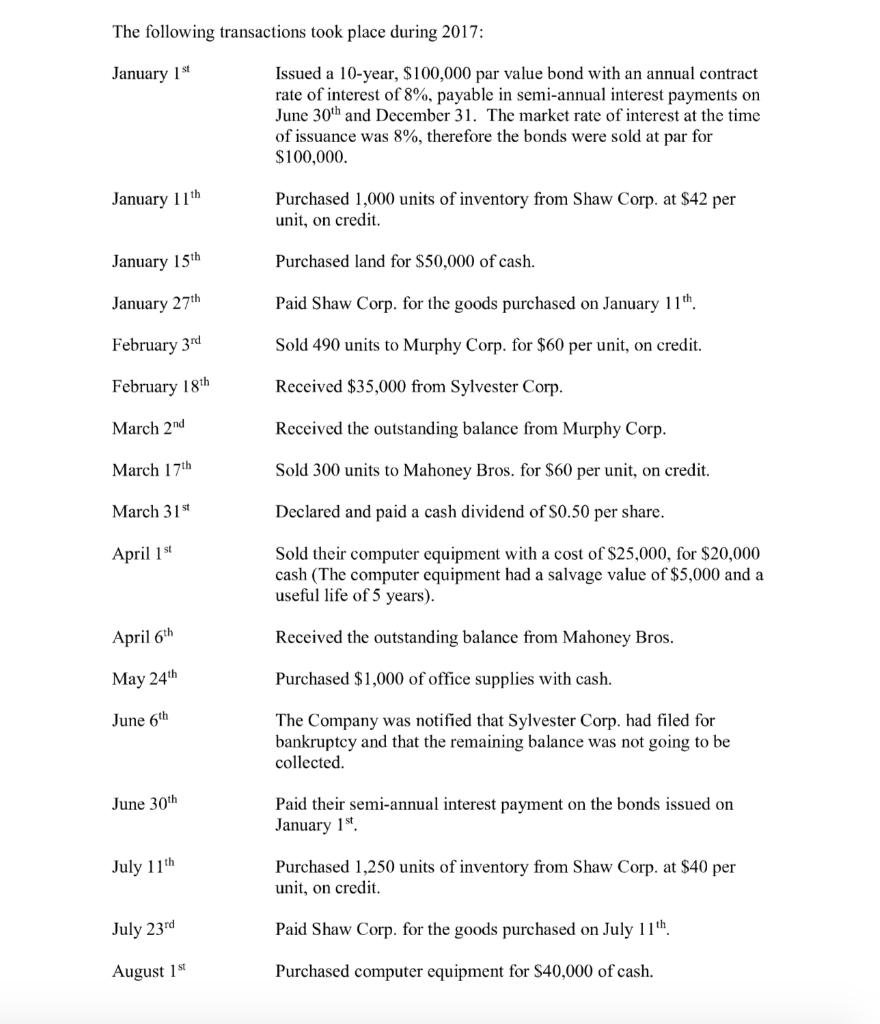

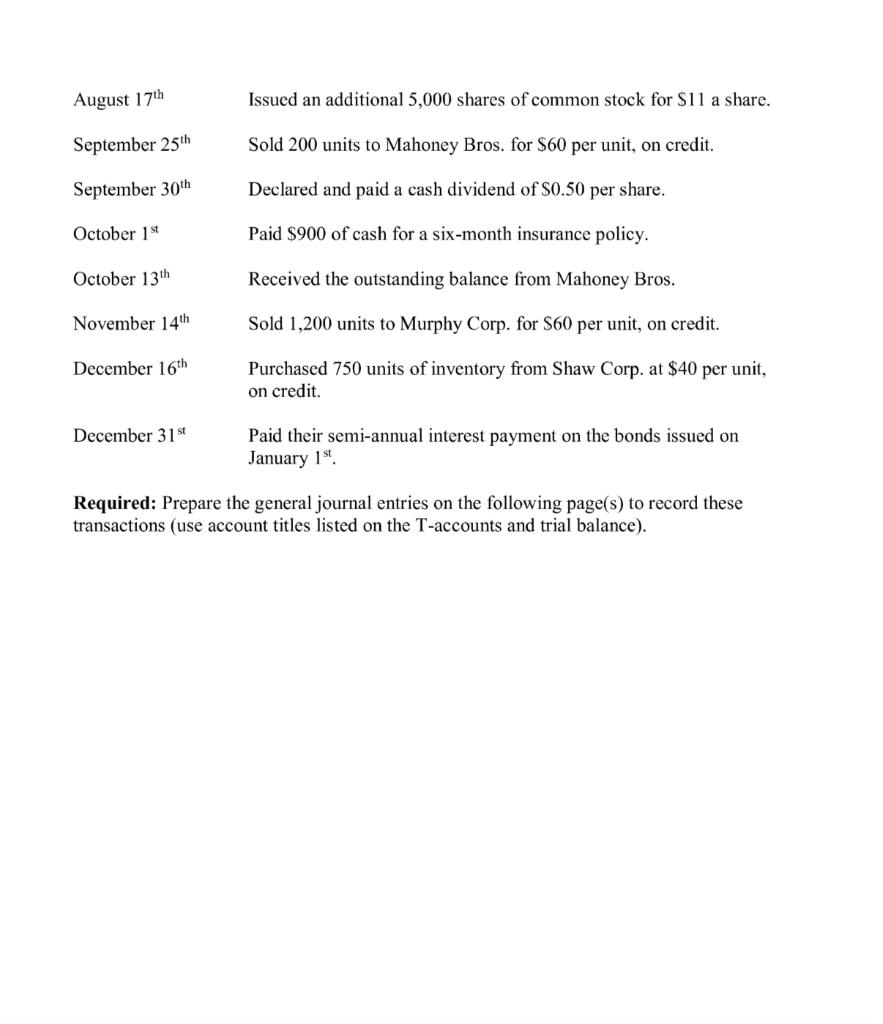

Comprehensive Problem #3 The Stanley Works operates as a merchandiser of fastening devices. The company uses the FIFO method of assigning costs to inventory and cost of goods sold under a periodic inventory system. The inventory balance of $3,969 is composed of 90 units purchased on December 22nd for $44.10 a unit. The company uses the allowance method to estimate bad debts expense, the straight-line method to depreciate plant assets and the straight line method to amortize bond premiums and discounts. The Company's common stock has a $1 par value. The trial balance for The Stanley Works as of December 31, 2016 was as follows. Cash A/R - Murphy A/R - Sylvester A/R - Mahoney Allowance for Doubtful Accounts Office Supplies Inventory. Prepaid Insurance Computer Equipment Accumulated Depreciation - Computer Equipment Buildings Accumulated Depreciation - Buildings Land Accounts Payable Bonds Payable Common Stock Paid-in Capital Retained Earnings Dividends The Stanley Works Trial Balance as of December 31, 2016 Sales Cost of Goods Sold Bad Debt Expense Supplies Expense Insurance Expense Interest Expense Depreciation Expense - Computer Equipment Depreciation Expense - Buildings Miscellaneous Expense Gain/Loss on Disposal of Plant Asset Debit 67,542 40,000 250 3,969 1,350 25,000 100,000 200,000 Totals 438,111 Credit 4,000 200 9,000 22,500 25,000 150,000 227,411 438,111 The following transactions took place during 2017: January 1st January 11th January 15th January 27th February 3rd February 18th March 2nd March 17th March 31st. April 1st April 6th May 24th June 6th June 30th July 11th July 23rd August 1st Issued a 10-year, $100,000 par value bond with an annual contract rate of interest of 8%, payable in semi-annual interest payments on June 30th and December 31. The market rate of interest at the time of issuance was 8%, therefore the bonds were sold at par for $100,000. Purchased 1,000 units of inventory from Shaw Corp. at $42 per unit, on credit. Purchased land for $50,000 of cash. Paid Shaw Corp. for the goods purchased on January 11th. Sold 490 units to Murphy Corp. for $60 per unit, on credit. Received $35,000 from Sylvester Corp. Received the outstanding balance from Murphy Corp. Sold 300 units to Mahoney Bros. for $60 per unit, on credit. Declared and paid a cash dividend of $0.50 per share. Sold their computer equipment with a cost of $25,000, for $20,000 cash (The computer equipment had a salvage value of $5,000 and a useful life of 5 years). Received the outstanding balance from Mahoney Bros. Purchased $1,000 of office supplies with cash. The Company was notified that Sylvester Corp. had filed for bankruptcy and that the remaining balance was not going to be collected. Paid their semi-annual interest payment on the bonds issued on January 1st. Purchased 1,250 units of inventory from Shaw Corp. at $40 per unit, on credit. Paid Shaw Corp. for the goods purchased on July 11th Purchased computer equipment for $40,000 of cash. August 17th September 25th September 30th October 1st October 13th November 14th December 16th December 31st Issued an additional 5,000 shares of common stock for $11 a share. Sold 200 units to Mahoney Bros. for $60 per unit, on credit. Declared and paid a cash dividend of $0.50 per share. Paid $900 of cash for a six-month insurance policy. Received the outstanding balance from Mahoney Bros. Sold 1,200 units to Murphy Corp. for $60 per unit, on credit. Purchased 750 units of inventory from Shaw Corp. at $40 per unit, on credit. Paid their semi-annual interest payment on the bonds issued on January 1st. Required: Prepare the general journal entries on the following page(s) to record these transactions (use account titles listed on the T-accounts and trial balance).

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

se freze repare the general journal entries to record the... View full answer

Get step-by-step solutions from verified subject matter experts