Question: Comprehensive Problem 5 - 7 7 Part 1 and 3 ( Algo ) Required: 1 . Assuming the Workmans file a joint tax return, determine

Comprehensive Problem Part and Algo

Required:

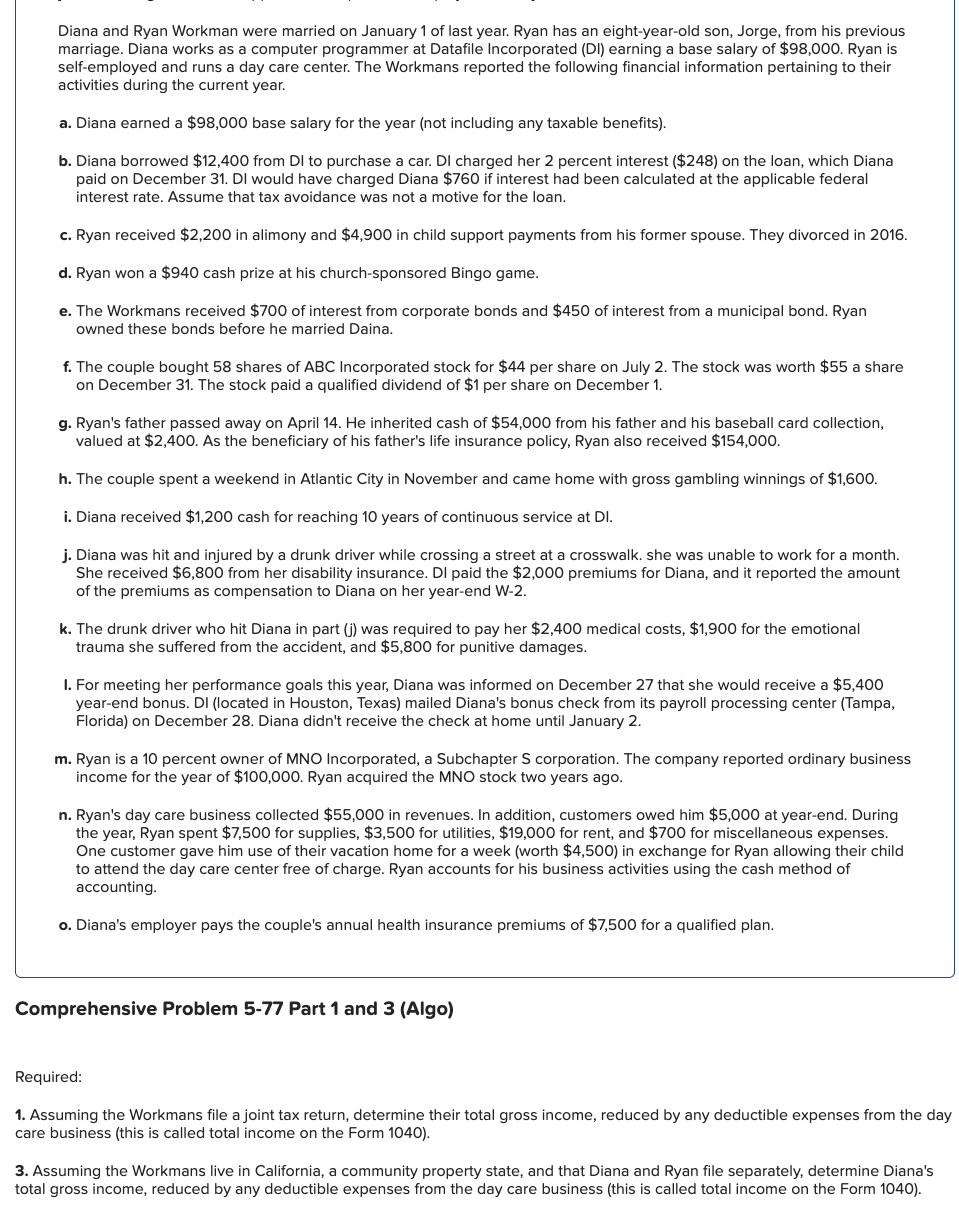

Assuming the Workmans file a joint tax return, determine their total gross income, reduced by any deductible expenses from the day care business this is called total income on the Form

Assuming the Workmans live in California, a community property state, and that Diana and Ryan file separately, determine Diana's total gross income, reduced by any deductible expenses from the day care business this is called total income on the Form

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock