Question: Comprehensive Problem 9 - 8 2 ( LO 9 - 1 , LO 9 - 2 , LO 9 - 3 , LO 9 -

Comprehensive Problem LO LO LO LO Algo

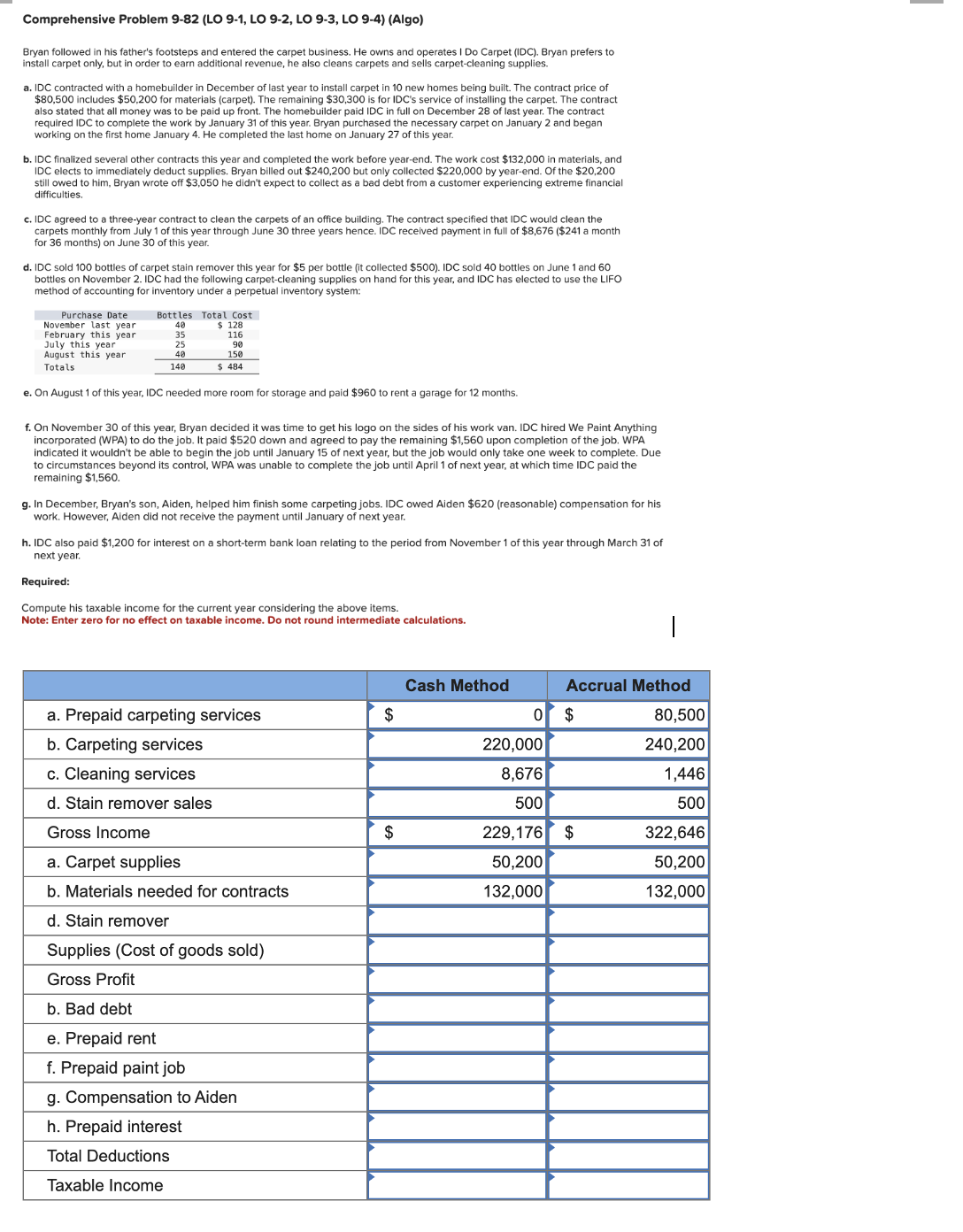

Bryan followed in his father's footsteps and entered the carpet business. He owns and operates I Do Carpet IDC Bryan prefers to install carpet only, but in order to earn additional revenue, he also cleans carpets and sells carpetcleaning supplies.

a IDC contracted with a homebuilder in December of last year to install carpet in new homes being built. The contract price of $ includes $ for materials carpet The remaining $ is for IDC's service of installing the carpet. The contract also stated that all money was to be paid up front. The homebuilder paid IDC in full on December of last year. The contract required IDC to complete the work by January of this year. Bryan purchased the necessary carpet on January and began working on the first home January He completed the last home on January of this year.

b IDC finalized several other contracts this year and completed the work before yearend. The work cost $ in materials, and IDC elects to immediately deduct supplies. Bryan billed out $ but only collected $ by yearend. Of the $ still owed to him, Bryan wrote off $ he didn't expect to collect as a bad debt from a customer experiencing extreme financial difficulties.

c IDC agreed to a threeyear contract to clean the carpets of an office building. The contract specified that IDC would clean the carpets monthly from July of this year through June three years hence. IDC received payment in full of $ $ a month for months on June of this year.

d IDC sold bottles of carpet stain remover this year for $ per bottle it collected $ IDC sold bottles on June and bottles on November IDC had the following carpetcleaning supplies on hand for this year, and IDC has elected to use the LIFO method of accounting for inventory under a perpetual inventory system:

tablePurchase Date,Bottles,Total CostNovember last year,$February this year,July this year,August this year,Totals$

e On August of this year, IDC needed more room for storage and paid $ to rent a garage for months.

f On November of this year, Bryan decided it was time to get his logo on the sides of his work van. IDC hired We Paint Anything incorporated WPA to do the job. It paid $ down and agreed to pay the remaining $ upon completion of the job. WPA indicated it wouldn't be able to begin the job until January of next year, but the job would only take one week to complete. Due to circumstances beyond its control, WPA was unable to complete the job until April of next year, at which time IDC paid the remaining $

g In December, Bryan's son, Aiden, helped him finish some carpeting jobs. IDC owed Aiden $reasonable compensation for his work. However, Aiden did not receive the payment until January of next year.

h IDC also paid $ for interest on a shortterm bank loan relating to the period from November of this year through March of next year.

Required:

Compute his taxable income for the current year considering the above items.

Note: Enter zero for no effect on taxable income. Do not round intermediate calculations.

tableCash Method,Accrual Methoda Prepaid carpeting services,$b Carpeting services,c Cleaning services,d Stain remover sales,Gross Income,a Carpet supplies,b Materials needed for contracts,d Stain removerSupplies Cost of goods soldGross Profitb Bad debte Prepaid rentf Prepaid paint jobg Compensation to Aidenh Prepaid interestTotal DeductionsTaxable Income,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock