Question: COMPREHENSIVE PROBLEM: JV Manufacturing Inc. is a mid - sized company specializing in the production of high - tech components for the automotive industry. The

COMPREHENSIVE PROBLEM:

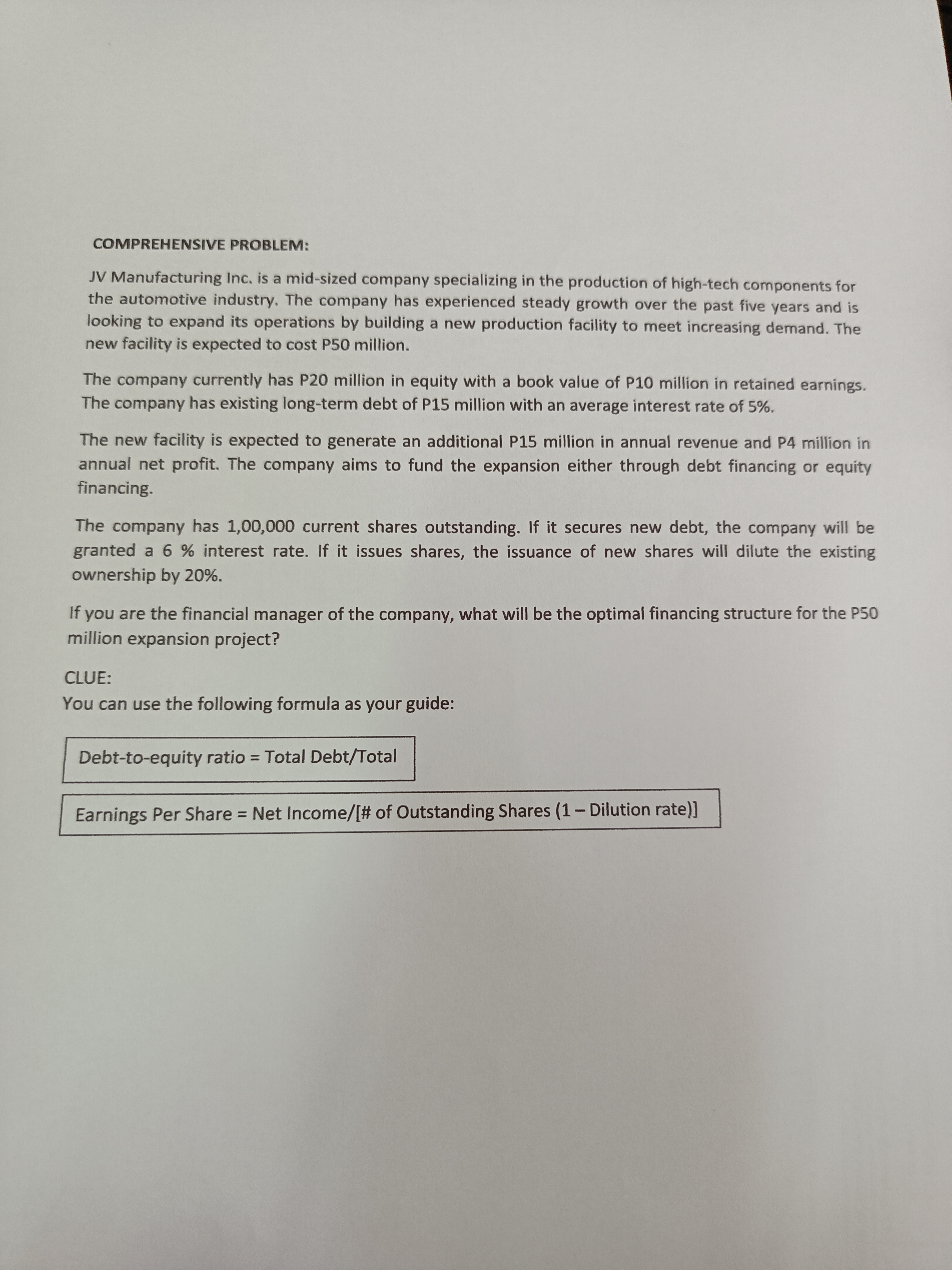

JV Manufacturing Inc. is a midsized company specializing in the production of hightech components for

the automotive industry. The company has experienced steady growth over the past five years and is

looking to expand its operations by building a new production facility to meet increasing demand. The

new facility is expected to cost P million.

The company currently has P million in equity with a book value of P million in retained earnings.

The company has existing longterm debt of P million with an average interest rate of

The new facility is expected to generate an additional P million in annual revenue and P million in

annual net profit. The company aims to fund the expansion either through debt financing or equity

financing.

The company has current shares outstanding. If it secures new debt, the company will be

granted a interest rate. If it issues shares, the issuance of new shares will dilute the existing

ownership by

If you are the financial manager of the company, what will be the optimal financing structure for the P

million expansion project?

CLUE:

You can use the following formula as your guide:

Earnings Per Share Net Income# of Outstanding Shares Dilution rate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock