Comprehensive Problem One

Noah and Joan Arc's Tax Return

Noah and Joan Arc live with their family in Dayton, OH Noah's Social Security number is

Noah was born on February and Joan was born on July Both enjoy

good health and eyesight. Noah owns and operates a pet store, and Joan is a firefighter for the

city of Dayton.

The Arcs have two children, a son named Shem Social Security number

born on March and a daughter named Nora Social Security number

born on December

Joan and Noah brought a folder of tax documents located on Pages D to D

Noah's pet store is located at S Patterson Blvd Dayton, OH The name of the

store is "The Arc" and its taxpayer identification number is Since you handle

Noah's bookkeeping, you have printed the income statement from your Quickbooks

software, shown on Page D

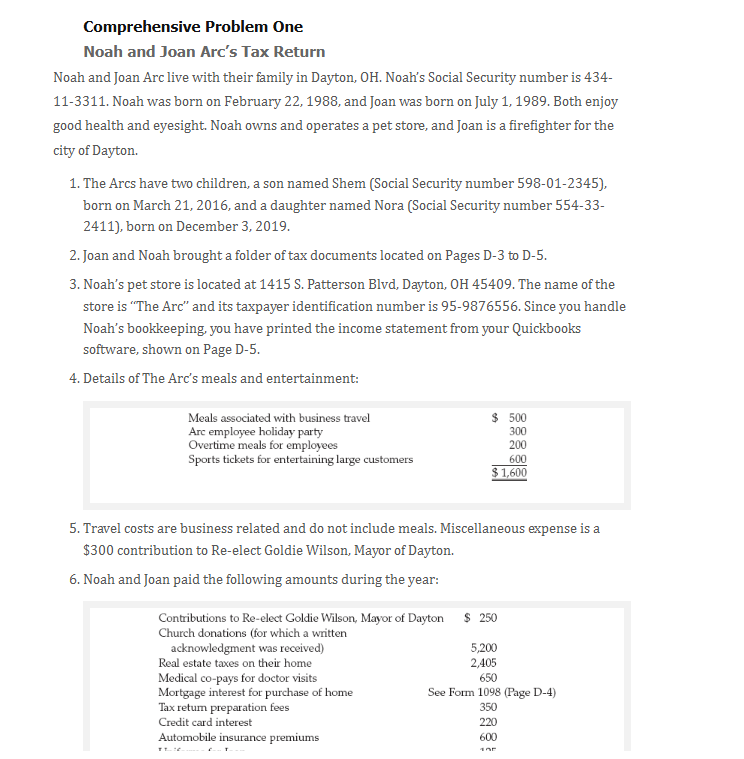

Details of The Arc's meals and entertainment:

Travel costs are business related and do not include meals. Miscellaneous expense is a

$ contribution to Reelect Goldie Wilson, Mayor of Dayton.

Noah and Joan paid the following amounts during the year:

find schedule c line b Deductible meals