Question: Comprehensive problem part 2 need help filling out unajusted trial balance!!! thank you Comprehensive Problem 2 Part 3: NOTE: You must complete parts 1 and

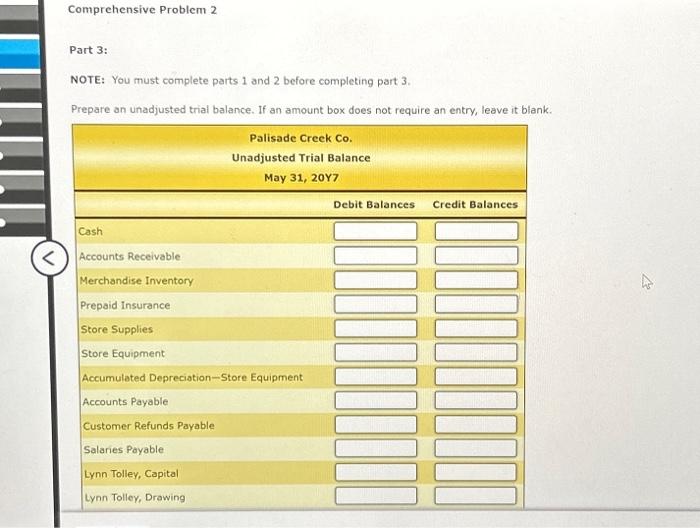

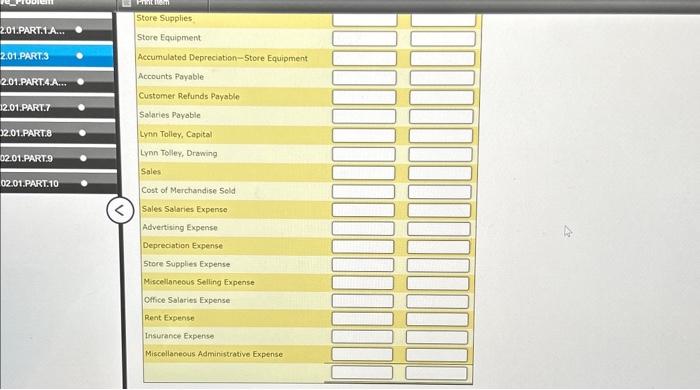

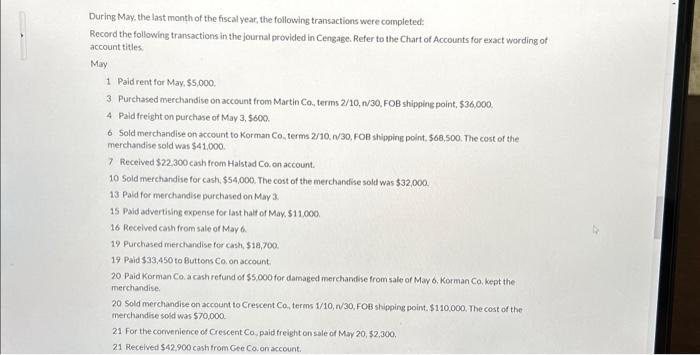

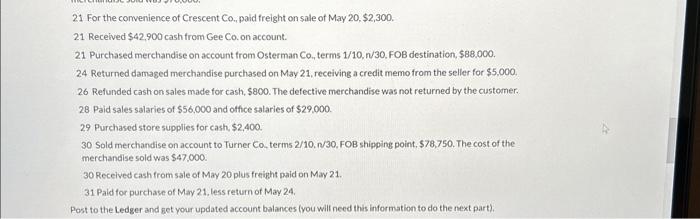

Comprehensive Problem 2 Part 3: NOTE: You must complete parts 1 and 2 before completing part 3 . Prepare an unadjusted trial balance. If an amount box does not require an entry, leave it blank. During May, the last month of the fiscal year, the following transactions were completed: Record the following transactions in the journal provided in Cengage. Refer to the Chart of Accounts for exact wording of account titles. May 1 Paid rent for May, $5,000. 3 Purchased merchandise on account from Martin Co, terms 2/10,n/30, FOB shipping point, $36,000. 4 Paid freight on purchase of May 3, $600. 6 Sold merchandise on account to Korman Co, terms 2/10,n/30, FOB shipping point, $68,500, The cost of the merchandise sold was $41,000. 7 Received $22,300 cash from Haistad Co, on account. 10 Sold merchandise for cash, $54,000. The cost of the merchandise sold was $32,000. 13 Paid for merchandise purchased on May 3 15 Paid advertising expense for last hait of May, $11.000. 16 Recelved cash from sale of May 6. 19 Purchased merchundise for cash, $18,700. 19 Paid $33,450 to Buttons Co. on account. 20 Paid Korman Co. a cash refund of $5.000 for damaged merchantise from sale of May 6. Korman Co, kept the merchandise. 20 Sold merchandise on account to Crescent CO0, terms 1/10,n/30, FOB shipping point, $110,000. The cost of the merchandise sold was $70,000 21 For the corivenience of Crescent Co, paid frelght on sale of May20,52,300. 21 Recelved $42,900 cash from Gee Co, on account. 21 For the convenience of Crescent Co0, paid freight on sale of May20,$2,300. 21 Received $42,900 cash from Gee Co. on account. 21 Purchased merchandise on account from Osterman Co, terms 1/10,n/30, FOB destination, $88,000. 24 Returned damaged merchandise purchased on May 21, receiving a credit memo from the seller for $5,000. 26 Refunded cash on sales made for cash, $800. The defective merchandise was not returned by the customer. 28 Paid sales salaries of $56,000 and offce salaries of $29,000. 29 Purchased store supplies for cash, $2,400. 30 Sold merchandise on account to Turner Ca, terms 2/10,1/30, FOB shipping point, 578,750 . The cost of the merchandise sold was $47,000. 30 Received cash from sale of May 20 plus freight paid on May 21. 31 Pald for purchase of May 21, less return of May 24. Post to the Ledger and get your updated account balances (vou will need this information to do the next part)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts