Question: Comprehenslve Problem 1 4 - 7 5 ( LO 1 4 - 1 , LO 1 4 - 2 , LO 1 4 - 3

Comprehenslve Problem LO LO LO LO LO Algo

Rex and Fellx are the sole shareholders of Dogs and Cats Corporation DCC After several years of operations using the accrual

method, they decided to liquidate the corporation and operate the business as a partnership. Rex and Fellx hired a lawyer to draw up

the legal papers to dissolve the corporation, but they need some tax advice from you, thelr trusted accountant. They are hoping you

will find a way for them to liquidate the corporation while minimizing their total income tax liability.

Rex has a tax basis in his shares of $ and Fellx has a tax basis in his shares of $ DCCs tax accounting balance sheet at

the date of liquidation is as follows:

Required:

a Compute the gain or loss recognized by Rex, Fellx, and DCC on a complete liquidation of the corporation assuming each

shareholder recelves a pro rata distributlon of the corporation's assets and assumes a pro rata amount of the liabilitles.

b Compute the gain or loss recognized by Rex, Fellix, and DCC on a complete liquidation of the corporation assuming that Fellix

recelved cash in lieu of his pro rata share of assets and liabilitles.

For parts c and d: Assume Fellix recelved the accounts recelvable and equipment and assumed the accounts payable for the

following two questions.

c Will Fellx recognize any Income when he collects the accounts recelvable?

d Will Fellx be able to take a deduction when he pays the accounts payable?

For parts e and f Assume Rex is a corporate shareholder of DCC for the following two questions.

e Compute the gain or loss recognized by Rex, Fellx, and DCC on a complete liquidation of the corporation assuming each

shareholder recelves a pro rata distributlon of the corporation's assets and assumes a pro rata amount of the liabilities.

f Compute the gain or loss recognized by Rex, Fellx, and DCC on a complete liquidation of the corporation assuming Fellix recelves

$ In cash and Rex recelves the remainder of the assets and assumes all the liabilities.

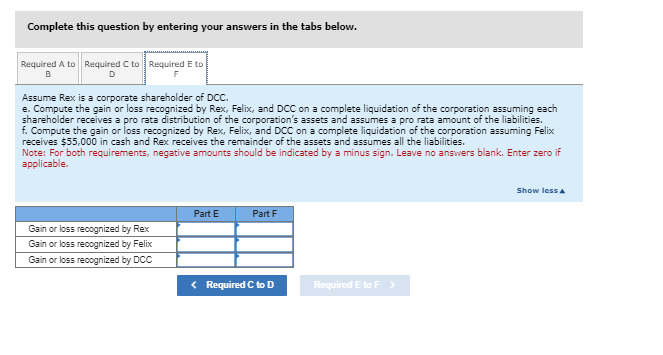

Complete this question by entering your answers in the tabs below.Complete this question by entering your answers in the tabs below.

Required C to

Required E to

B

D

F

Assume Rex is a corporate shareholder of DCC

e Compute the gain or loss recognized by Rex, Felix, and DCC on a complete liquidation of the corporation assuming each

shareholder receives a pro rata distribution of the corporation's assets and assumes a pro rata amount of the liabilities,

f Compute the gain or loss recognized by Rex, Felix, and DCC on a complete liquidation of the corporation assuming Felix

receives $ in cash and Rex receives the remainder of the assets and assumes all the liabilities.

Note: For both requirements, negative amounts should be indicated by a minus sign. Leave no answers blank. Enter zero if

applicable.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock