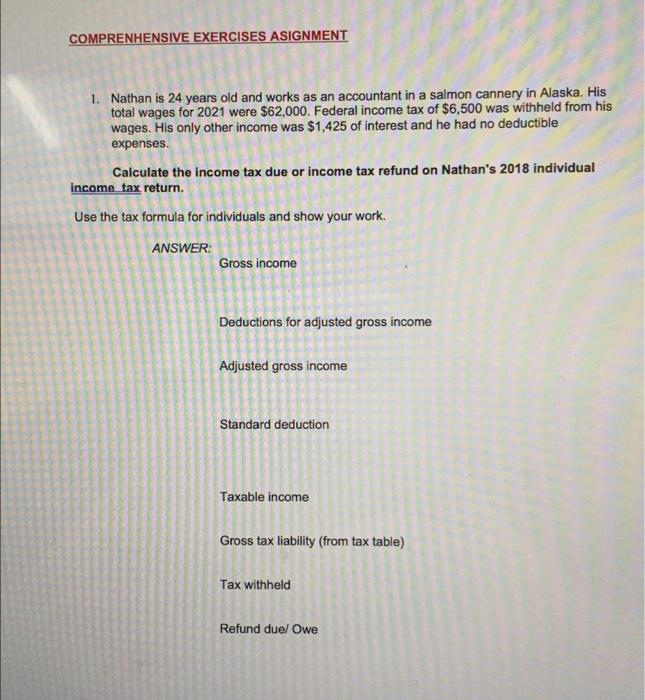

Question: COMPRENHENSIVE EXERCISES ASIGNMENT 1. Nathan is 24 years old and works as an accountant in a salmon cannery in Alaska. His total wages for 2021

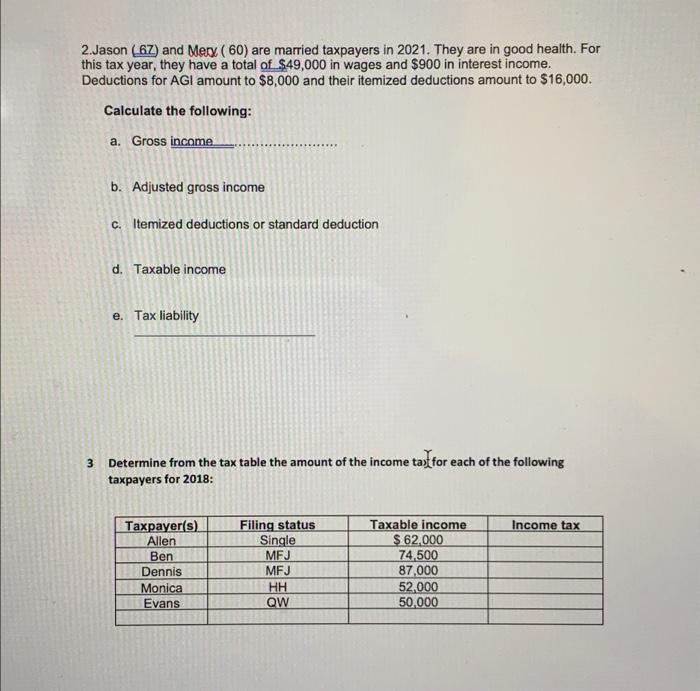

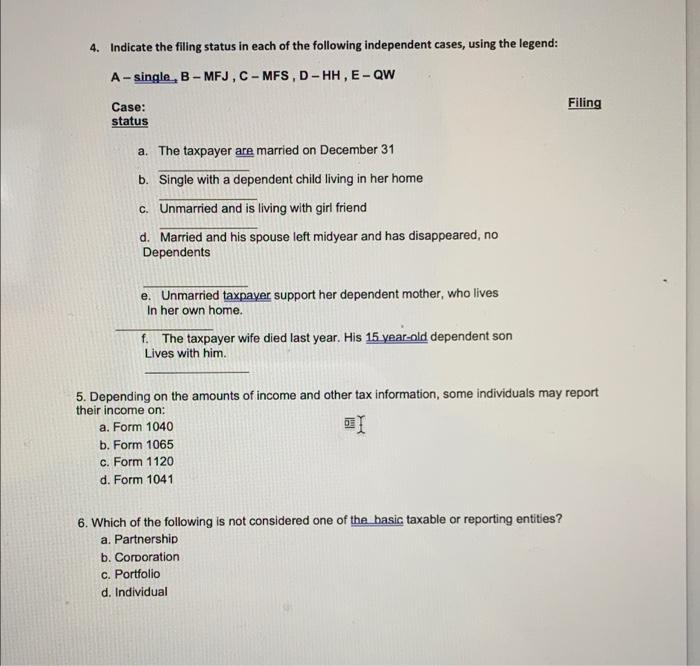

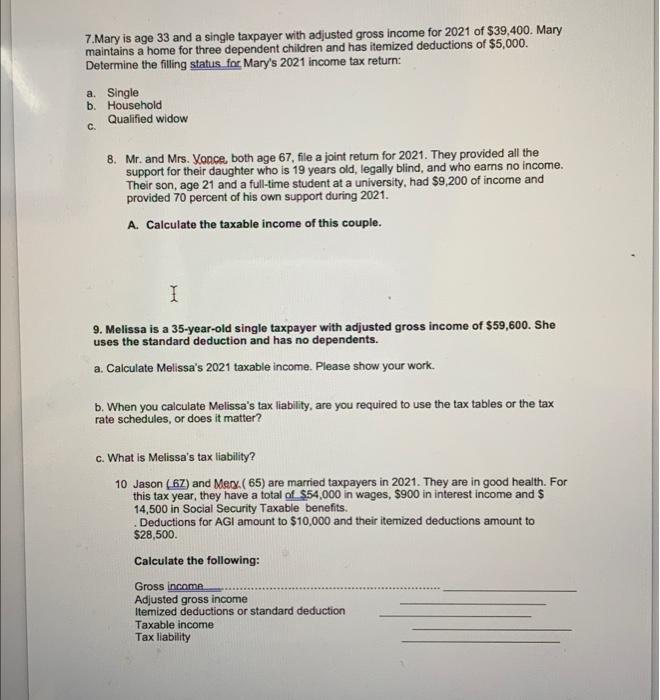

COMPRENHENSIVE EXERCISES ASIGNMENT 1. Nathan is 24 years old and works as an accountant in a salmon cannery in Alaska. His total wages for 2021 were $62,000. Federal income tax of $6,500 was withheld from his wages. His only other income was $1,425 of interest and he had no deductible expenses. Calculate the income tax due or income tax refund on Nathan's 2018 individual income tax return. Use the tax formula for individuals and show your work. ANSWER: Gross income Deductions for adjusted gross income Adjusted gross income Standard deduction Taxable income Gross tax liability (from tax table) Tax withheld Refund duel Owe 2.Jason (62) and Mery (60) are married taxpayers in 2021. They are in good health. For this tax year, they have a total of $49,000 in wages and $900 in interest income. Deductions for AGI amount to $8,000 and their itemized deductions amount to $16,000. Calculate the following: a. Gross income b. Adjusted gross income C.Itemized deductions or standard deduction d. Taxable income e. Tax liability 3 Determine from the tax table the amount of the income tast for each of the following taxpayers for 2018: Income tax Taxpayer(s) Allen Ben Dennis Monica Evans Filing status Single MFJ MFJ HH QW Taxable income $ 62,000 74,500 87,000 52.000 50.000 4. Indicate the filling status in each of the following independent cases, using the legend: A-single, B-MFJ, C-MFS, D-HH, E-QW Filing Case: status a. The taxpayer are married on December 31 b. Single with a dependent child living in her home c. Unmarried and is living with girl friend d. Married and his spouse left midyear and has disappeared, no Dependents e. Unmarried taxpayer support her dependent mother, who lives In her own home. f. The taxpayer wife died last year. His 15 year-old dependent son Lives with him. 5. Depending on the amounts of income and other tax information, some individuals may report their income on: a. Form 1040 b. Form 1065 c. Form 1120 d. Form 1041 6. Which of the following is not considered one of the basic taxable or reporting entities? a. Partnership b. Corporation C. Portfolio d. Individual 7.Mary is age 33 and a single taxpayer with adjusted gross income for 2021 of $39,400. Mary maintains a home for three dependent children and has itemized deductions of $5,000. Determine the filling status for. Mary's 2021 income tax return: a. Single b. Household Qualified widow C. c 8. Mr. and Mrs. Konce, both age 67, file a joint retum for 2021. They provided all the support for their daughter who is 19 years old, legally blind, and who earns no income. Their son, age 21 and a full-time student at a university, had $9,200 of income and provided 70 percent of his own support during 2021. A. Calculate the taxable income of this couple. I 9. Melissa is a 35-year-old single taxpayer with adjusted gross income of $59,600. She uses the standard deduction and has no dependents. a. Calculate Melissa's 2021 taxable income. Please show your work. b. When you calculate Melissa's tax liability, are you required to use the tax tables or the tax rate schedules, or does it matter? c. What is Melissa's tax liability? 10 Jason (6Z) and Merx: (65) are married taxpayers in 2021. They are in good health. For this tax year, they have a total of $54,000 in wages, $900 in interest income and $ 14,500 in Social Security Taxable benefits. Deductions for AGI amount to $10,000 and their itemized deductions amount to $28,500 Calculate the following: Gross income Adjusted gross income Itemized deductions or standard deduction Taxable income Tax liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts