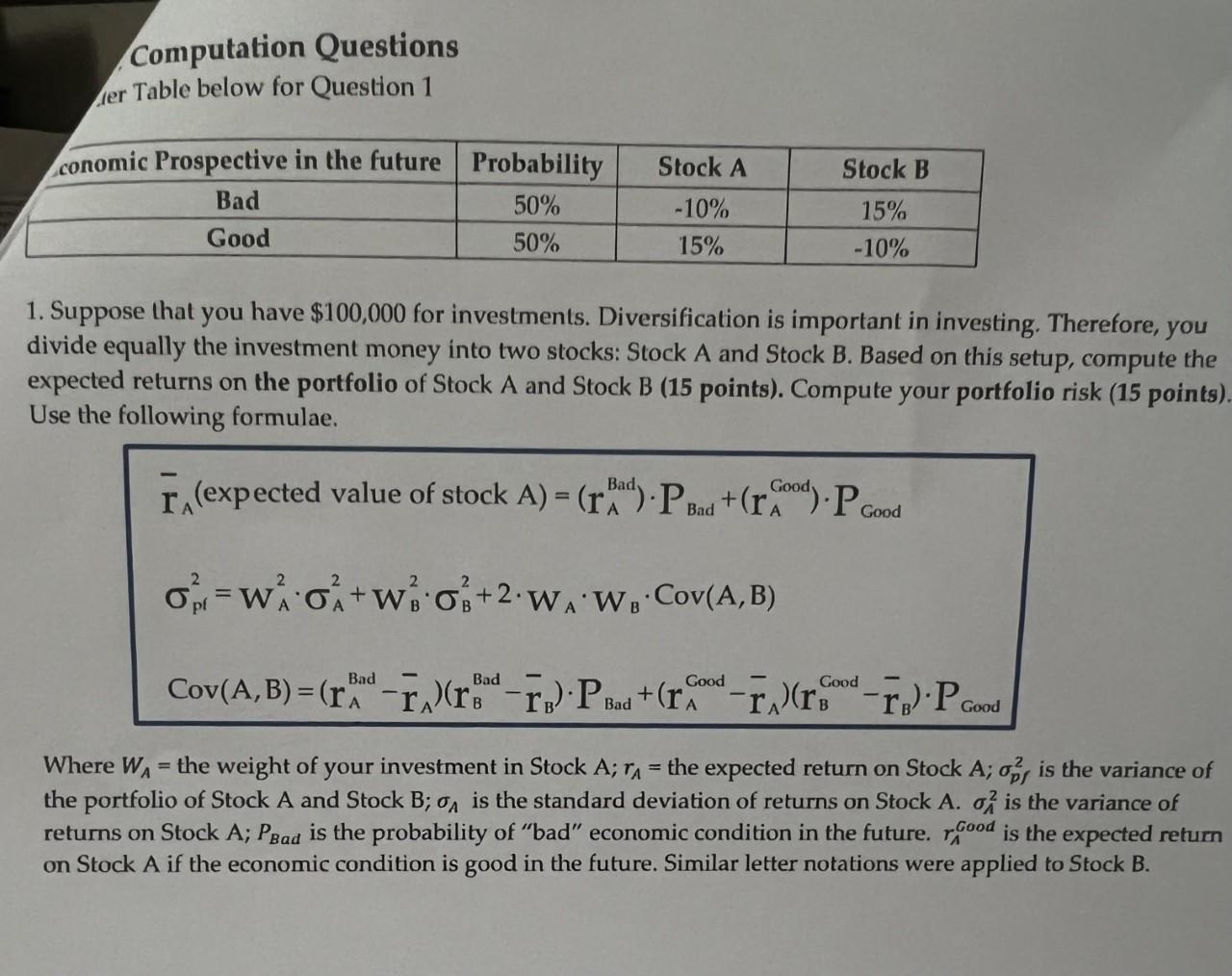

Question: Computation Questions .fer Table below for Question 1 1. Suppose that you have $100,000 for investments. Diversification is important in investing. Therefore, you divide equally

Computation Questions .fer Table below for Question 1 1. Suppose that you have $100,000 for investments. Diversification is important in investing. Therefore, you divide equally the investment money into two stocks: Stock A and Stock B. Based on this setup, compute the expected returns on the portfolio of Stock A and Stock B (15 points). Compute your portfolio risk (15 points) Use the following formulae. rA( expected value of stock A)=(rABad)PBad+(rAGood)PGood pt2=WA2A2+WB2B2+2WAWBCov(A,B) Cov(A,B)=(rABadrA)(rBBadrB)PBad+(rACoodrA)(rBCoodrB)PGood Where WA= the weight of your investment in Stock A;rA= the expected return on Stock A;pp2 is the variance of the portfolio of Stock A and Stock B; A is the standard deviation of returns on Stock A. A2 is the variance of returns on Stock A;PBad is the probability of "bad" economic condition in the future. rAGood is the expected return on Stock A if the economic condition is good in the future. Similar letter notations were applied to Stock B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts