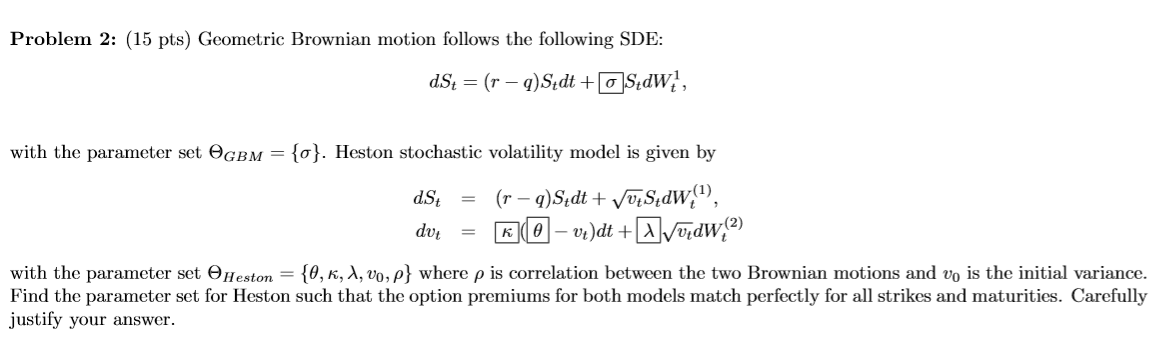

Question: Computational method in Finance, Ali Hirsa Problem 2: (15 pts) Geometric Brownian motion follows the following SDE: dSt = (r - q)Sidt + . Sidwl,

Computational method in Finance, Ali Hirsa

Problem 2: (15 pts) Geometric Brownian motion follows the following SDE: dSt = (r - q)Sidt + . Sidwl, with the parameter set OGBM = {}. Heston stochastic volatility model is given by dSt = (r - q)Sidt + VuiSidw(1), dut = K 0 - vi)dt + Xvidw (2) with the parameter set OHeston = {0, k, A, vo, p} where p is correlation between the two Brownian motions and vo is the initial variance. Find the parameter set for Heston such that the option premiums for both models match perfectly for all strikes and maturities. Carefully justify your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts