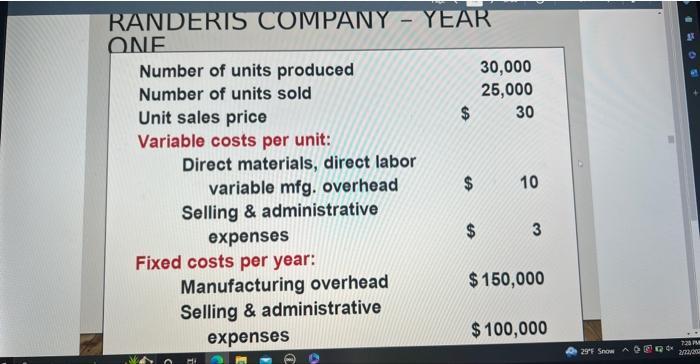

Question: RANDERIS COMPANY YEAR ONE Number of units produced Number of units sold Unit sales price Variable costs per unit: Direct materials, direct labor variable

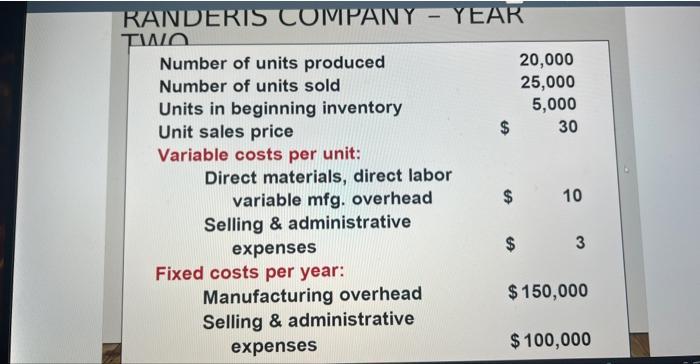

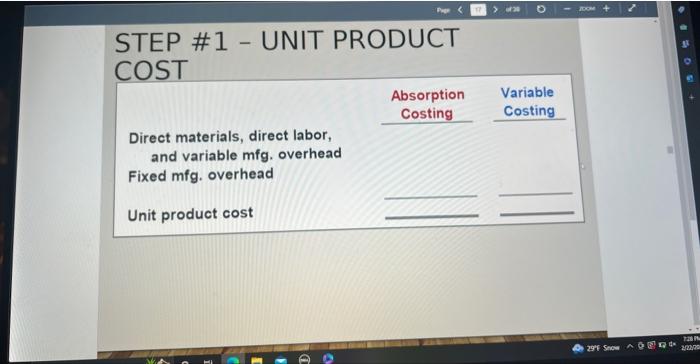

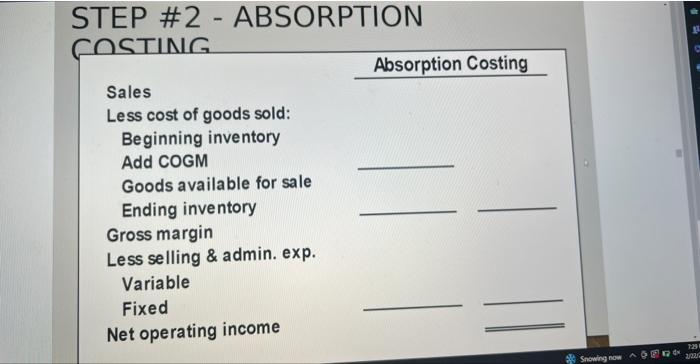

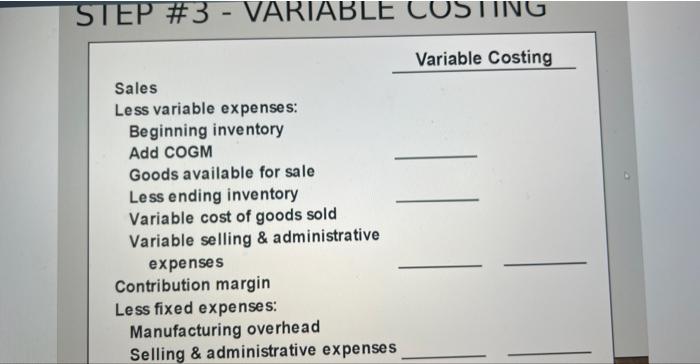

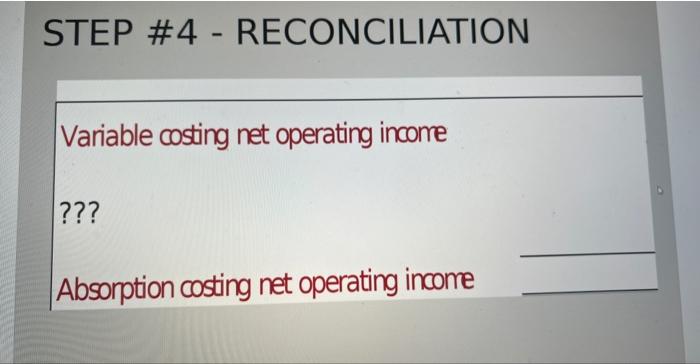

RANDERIS COMPANY YEAR ONE Number of units produced Number of units sold Unit sales price Variable costs per unit: Direct materials, direct labor variable mfg. overhead Selling & administrative expenses Fixed costs per year: Manufacturing overhead Selling & administrative expenses HI - $ 30,000 25,000 30 10 $ 3 $150,000 $100,000 29 Snowo 725 PM 2/22/201 RANDERIS COMPANY - YEAR TWO Number of units produced Number of units sold Units in beginning inventory Unit sales price Variable costs per unit: Direct materials, direct labor variable mfg. overhead Selling & administrative expenses Fixed costs per year: Manufacturing overhead Selling & administrative expenses 20,000 25,000 5,000 30 10 3 $150,000 $100,000 STEP #1 - UNIT PRODUCT COST Direct materials, direct labor, and variable mfg. overhead Fixed mfg. overhead Unit product cost Absorption Variable Costing Costing ZOOM 29F Snow 8849 D 7:28 2/22/20 STEP #2 - ABSORPTION COSTING Sales Less cost of goods sold: Beginning inventory Add COGM Goods available for sale Ending inventory Gross margin Less selling & admin. exp. Variable Fixed Net operating income Absorption Costing Snowing now 12 dx 7291 2/22/ STEP #3 - VARIABLE COSTING Sales Less variable expenses: Beginning inventory Add COGM Goods available for sale. Less ending inventory Variable cost of goods sold Variable selling & administrative expenses Contribution margin Less fixed expenses: Manufacturing overhead Selling & administrative expenses Variable Costing STEP #4 - RECONCILIATION Variable costing net operating income ??? Absorption costing net operating income RANDERIS COMPANY YEAR ONE Number of units produced Number of units sold Unit sales price Variable costs per unit: Direct materials, direct labor variable mfg. overhead Selling & administrative expenses Fixed costs per year: Manufacturing overhead Selling & administrative expenses HI - $ 30,000 25,000 30 10 $ 3 $150,000 $100,000 29 Snowo 725 PM 2/22/201 RANDERIS COMPANY - YEAR TWO Number of units produced Number of units sold Units in beginning inventory Unit sales price Variable costs per unit: Direct materials, direct labor variable mfg. overhead Selling & administrative expenses Fixed costs per year: Manufacturing overhead Selling & administrative expenses 20,000 25,000 5,000 30 10 3 $150,000 $100,000 STEP #1 - UNIT PRODUCT COST Direct materials, direct labor, and variable mfg. overhead Fixed mfg. overhead Unit product cost Absorption Variable Costing Costing ZOOM 29F Snow 8849 D 7:28 2/22/20 STEP #2 - ABSORPTION COSTING Sales Less cost of goods sold: Beginning inventory Add COGM Goods available for sale Ending inventory Gross margin Less selling & admin. exp. Variable Fixed Net operating income Absorption Costing Snowing now 12 dx 7291 2/22/ STEP #3 - VARIABLE COSTING Sales Less variable expenses: Beginning inventory Add COGM Goods available for sale. Less ending inventory Variable cost of goods sold Variable selling & administrative expenses Contribution margin Less fixed expenses: Manufacturing overhead Selling & administrative expenses Variable Costing STEP #4 - RECONCILIATION Variable costing net operating income ??? Absorption costing net operating income RANDERIS COMPANY YEAR ONE Number of units produced Number of units sold Unit sales price Variable costs per unit: Direct materials, direct labor variable mfg. overhead Selling & administrative expenses Fixed costs per year: Manufacturing overhead Selling & administrative expenses HI - $ 30,000 25,000 30 10 $ 3 $150,000 $100,000 29 Snowo 725 PM 2/22/201 RANDERIS COMPANY - YEAR TWO Number of units produced Number of units sold Units in beginning inventory Unit sales price Variable costs per unit: Direct materials, direct labor variable mfg. overhead Selling & administrative expenses Fixed costs per year: Manufacturing overhead Selling & administrative expenses 20,000 25,000 5,000 30 10 3 $150,000 $100,000 STEP #1 - UNIT PRODUCT COST Direct materials, direct labor, and variable mfg. overhead Fixed mfg. overhead Unit product cost Absorption Variable Costing Costing ZOOM 29F Snow 8849 D 7:28 2/22/20 STEP #2 - ABSORPTION COSTING Sales Less cost of goods sold: Beginning inventory Add COGM Goods available for sale Ending inventory Gross margin Less selling & admin. exp. Variable Fixed Net operating income Absorption Costing Snowing now 12 dx 7291 2/22/ STEP #3 - VARIABLE COSTING Sales Less variable expenses: Beginning inventory Add COGM Goods available for sale. Less ending inventory Variable cost of goods sold Variable selling & administrative expenses Contribution margin Less fixed expenses: Manufacturing overhead Selling & administrative expenses Variable Costing STEP #4 - RECONCILIATION Variable costing net operating income ??? Absorption costing net operating income RANDERIS COMPANY YEAR ONE Number of units produced Number of units sold Unit sales price Variable costs per unit: Direct materials, direct labor variable mfg. overhead Selling & administrative expenses Fixed costs per year: Manufacturing overhead Selling & administrative expenses HI - $ 30,000 25,000 30 10 $ 3 $150,000 $100,000 29 Snowo 725 PM 2/22/201 RANDERIS COMPANY - YEAR TWO Number of units produced Number of units sold Units in beginning inventory Unit sales price Variable costs per unit: Direct materials, direct labor variable mfg. overhead Selling & administrative expenses Fixed costs per year: Manufacturing overhead Selling & administrative expenses 20,000 25,000 5,000 30 10 3 $150,000 $100,000 STEP #1 - UNIT PRODUCT COST Direct materials, direct labor, and variable mfg. overhead Fixed mfg. overhead Unit product cost Absorption Variable Costing Costing ZOOM 29F Snow 8849 D 7:28 2/22/20 STEP #2 - ABSORPTION COSTING Sales Less cost of goods sold: Beginning inventory Add COGM Goods available for sale Ending inventory Gross margin Less selling & admin. exp. Variable Fixed Net operating income Absorption Costing Snowing now 12 dx 7291 2/22/ STEP #3 - VARIABLE COSTING Sales Less variable expenses: Beginning inventory Add COGM Goods available for sale. Less ending inventory Variable cost of goods sold Variable selling & administrative expenses Contribution margin Less fixed expenses: Manufacturing overhead Selling & administrative expenses Variable Costing STEP #4 - RECONCILIATION Variable costing net operating income ??? Absorption costing net operating income RANDERIS COMPANY YEAR ONE Number of units produced Number of units sold Unit sales price Variable costs per unit: Direct materials, direct labor variable mfg. overhead Selling & administrative expenses Fixed costs per year: Manufacturing overhead Selling & administrative expenses HI - $ 30,000 25,000 30 10 $ 3 $150,000 $100,000 29 Snowo 725 PM 2/22/201 RANDERIS COMPANY - YEAR TWO Number of units produced Number of units sold Units in beginning inventory Unit sales price Variable costs per unit: Direct materials, direct labor variable mfg. overhead Selling & administrative expenses Fixed costs per year: Manufacturing overhead Selling & administrative expenses 20,000 25,000 5,000 30 10 3 $150,000 $100,000 STEP #1 - UNIT PRODUCT COST Direct materials, direct labor, and variable mfg. overhead Fixed mfg. overhead Unit product cost Absorption Variable Costing Costing ZOOM 29F Snow 8849 D 7:28 2/22/20 STEP #2 - ABSORPTION COSTING Sales Less cost of goods sold: Beginning inventory Add COGM Goods available for sale Ending inventory Gross margin Less selling & admin. exp. Variable Fixed Net operating income Absorption Costing Snowing now 12 dx 7291 2/22/ STEP #3 - VARIABLE COSTING Sales Less variable expenses: Beginning inventory Add COGM Goods available for sale. Less ending inventory Variable cost of goods sold Variable selling & administrative expenses Contribution margin Less fixed expenses: Manufacturing overhead Selling & administrative expenses Variable Costing STEP #4 - RECONCILIATION Variable costing net operating income ??? Absorption costing net operating income

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts