Question: Compute all necessary figures for FP,IP,SP & CP. Please show all work of the caculations for each position. Compute the X and Y coordinates, Show

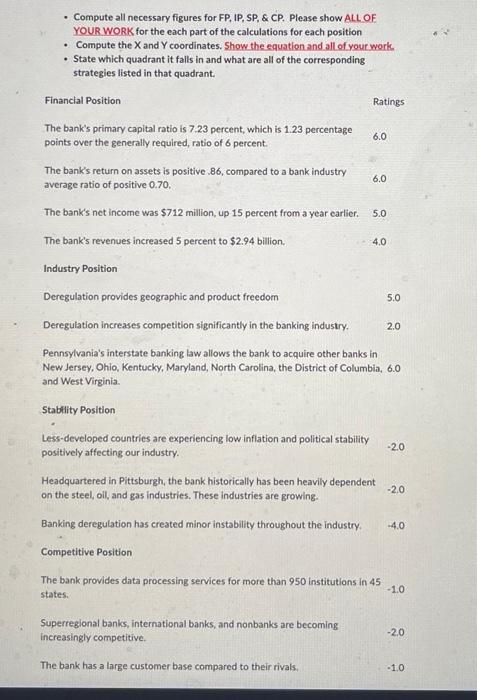

- Compute all necessary figures for FP, IP, SP, \& CP. Please show ALLOE YOUR WORK for the each part of the calculations for each position - Compute the X and Y coordinates. Show the equation and all of your work. - State which quadrant it falls in and what are all of the corresponding strategies listed in that quadrant. Financial Position Ratings The bank's primary capital ratio is 7.23 percent, which is 1.23 percentage points over the generally required, ratio of 6 percent. 6.0 The bank's return on assets is positive .86, compared to a bank industry average ratio of positive 0.70 . 6.0 The bank's net incorne was $712 million, up 15 percent from a year earlier. 5.0 The bank's revenues increased 5 percent to $2.94 billion. 4.0 Industry Position Deregulation provides geographic and product freedom 5.0 Deregulation increases competition significantly in the banking industry. 2.0 Pennsylvania's interstate banking law allows the bank to acquire other banks in New Jersey, Ohio, Kentucky, Maryland, North Carolina, the District of Columbia, 6.0 and West Virginia. Stablity Position Less-developed countries are experiencing low inflation and political stability positively affecting our industry. 2.0 Headquartered in Pittsburgh, the bank historically has been heavily dependent on the steel, oil, and gas industries. These industries are growing. 2.0 Banking deregulation has created minor instability throughout the industry. 4.0 Competitive Position The bank provides data processing services for more than 950 institutions in 45 states. 1.0 Superregional banks, international banks, and nonbanks are becoming increasingly competitive. 2.0 The bank has a large customer base compared to their rivals: .10 - Compute all necessary figures for FP, IP, SP, \& CP. Please show ALLOE YOUR WORK for the each part of the calculations for each position - Compute the X and Y coordinates. Show the equation and all of your work. - State which quadrant it falls in and what are all of the corresponding strategies listed in that quadrant. Financial Position Ratings The bank's primary capital ratio is 7.23 percent, which is 1.23 percentage points over the generally required, ratio of 6 percent. 6.0 The bank's return on assets is positive .86, compared to a bank industry average ratio of positive 0.70 . 6.0 The bank's net incorne was $712 million, up 15 percent from a year earlier. 5.0 The bank's revenues increased 5 percent to $2.94 billion. 4.0 Industry Position Deregulation provides geographic and product freedom 5.0 Deregulation increases competition significantly in the banking industry. 2.0 Pennsylvania's interstate banking law allows the bank to acquire other banks in New Jersey, Ohio, Kentucky, Maryland, North Carolina, the District of Columbia, 6.0 and West Virginia. Stablity Position Less-developed countries are experiencing low inflation and political stability positively affecting our industry. 2.0 Headquartered in Pittsburgh, the bank historically has been heavily dependent on the steel, oil, and gas industries. These industries are growing. 2.0 Banking deregulation has created minor instability throughout the industry. 4.0 Competitive Position The bank provides data processing services for more than 950 institutions in 45 states. 1.0 Superregional banks, international banks, and nonbanks are becoming increasingly competitive. 2.0 The bank has a large customer base compared to their rivals: .10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts