Question: Compute and interpret Z - score - refer to the financial statements for Nike. The company's stock closed at $ 7 7 . 1 4

Compute and interpret Zscore refer to the financial statements for Nike. The company's stock closed at $ on May and $ pn May

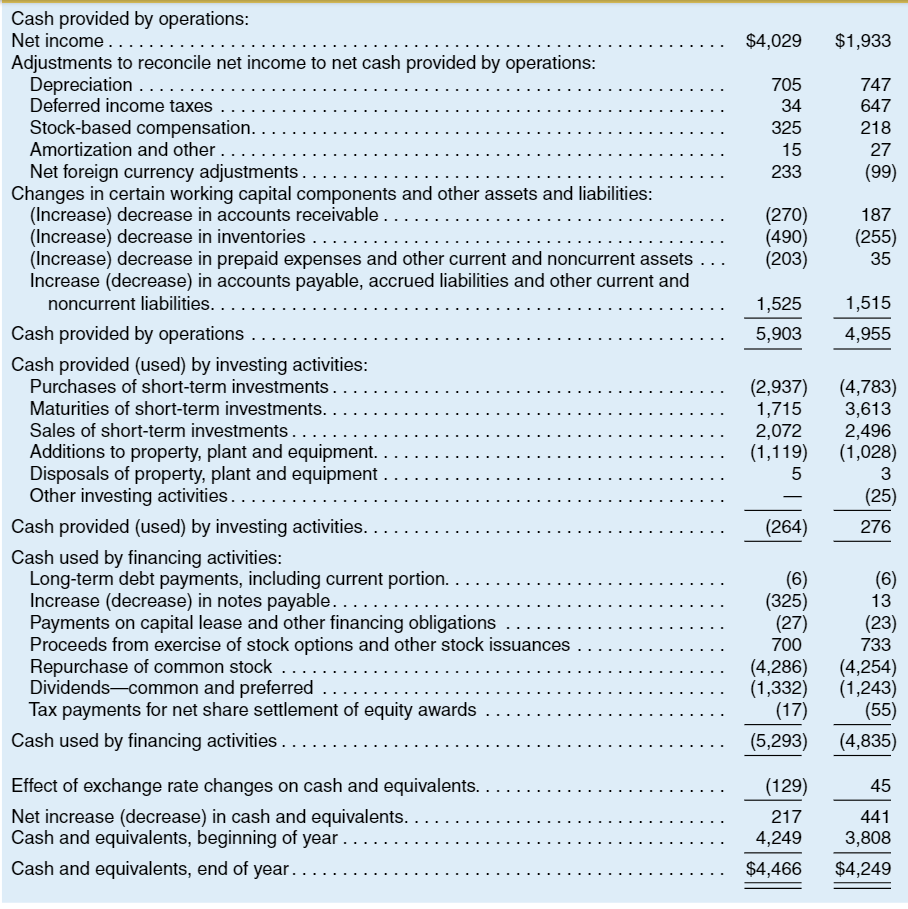

Cash provided by operations:

Net income

Adjustments to reconcile net income to net cash provided by operations:

Depreciation

Deferred income taxes

Stockbased compensation.

Amortization and other

Net foreign currency adjustments

Changes in certain working capital components and other assets and liabilities:

Increase decrease in accounts receivable

Increase decrease in inventories

Increase decrease in prepaid expenses and other current and noncurrent assets

Increase decrease in accounts payable, accrued liabilities and other current and

noncurrent liabilities.

Cash provided by operations

Cash provided used by investing activities:

Purchases of shortterm investments

Maturities of shortterm investments.

Sales of shortterm investments

Additions to property, plant and equipment.

Disposals of property, plant and equipment

Other investing activities.

Cash provided used by investing activities

Cash used by financing activities:

Longterm debt payments, including current portion.

Increase decrease in notes payable.

Payments on capital lease and other financing obligations

Proceeds from exercise of stock options and other stock issuances

Repurchase of common stock

Dividendscommon and preferred

Tax payments for net share settlement of equity awards

Cash used by financing activities

Effect of exchange rate changes on cash and equivalents.

Net increase decrease in cash and equivalents.

Cash and equivalents, beginning of year

Cash and equivalents, end of year.

a Compute and compare the Altman Zscores

for both years. What explains the yearoveryear change?

bIs the company more likely to go bankrupt given the Zscore in compared to Explain.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock