Question: Compute Bond Proceeds, Amortizing Premium by Interest Method, and Interest Expense Ware Co. produces and sells motorcycle parts. On the first day of its fiscal

Compute Bond Proceeds, Amortizing Premium by Interest Method, and Interest Expense

Ware Co. produces and sells motorcycle parts. On the first day of its fiscal year, Ware Co. issued $10,000,000 of five-year, 12% bonds at a market (effective) interest rate of 10%, with interest payable semiannually. Compute the following:

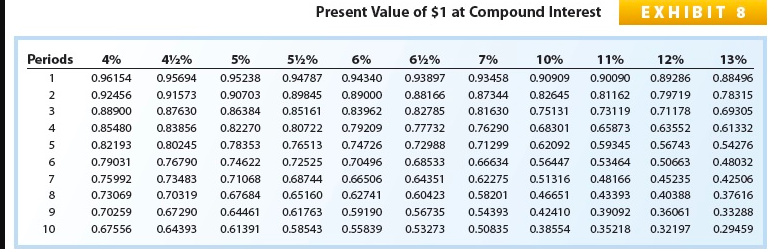

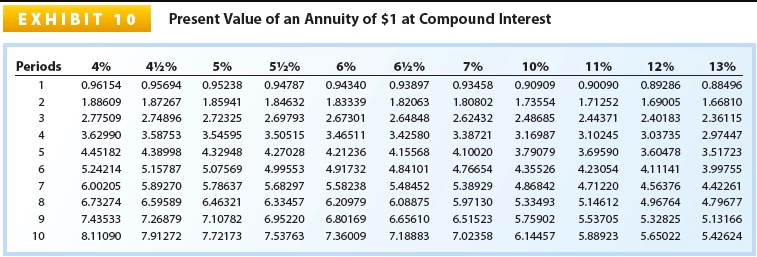

a. The amount of cash proceeds from the sale of the bonds. Use the tables of present values in Exhibit 8 and Exhibit 10. Round to the nearest dollar. $

b. The amount of premium to be amortized for the first semiannual interest payment period, using the interest method. Round to the nearest dollar. $

c. The amount of premium to be amortized for the second semiannual interest payment period, using the interest method. Round to the nearest dollar. $

d. The amount of the bond interest expense for the first year. Round to the nearest dollar. $

Present Value of $1 at Compound Interest EXHIBIT 8 Periods 4% 4496 5% 5,496 6% 6 % 7% 10% 11% 12% 13% 1 0.96154 0.95694 0.95238 0.94787 0.94340 0.93897 0.93458 0.90909 0.90090 0.89286 0.88496 0.92456 a91573 0.90703 0.89845 O89000 088166 87344 08264 081162 073719 or835 0.88900 0.87630 0.86384 0.85161 0.83962 0.82785 0.81630 0.75131 0.73119 0.71178 0.69305 4 0.85480 0.83856 0.82270 0.80722 0.79209 0.77732 0.76290 0.68301 0.65873 0.63552 0.61332 5 0.82193 0.80245 0.78353 0.76513 0.74726 0.72988 0.71299 0.62092 059345 0.56743 0.54276 6 0.79031 0.76790 0.74622 0.72525 0.70496 0.68533 0.66634 0.56447 053464 0.50663 0.48032 7 O.75992 .73483 0.7 1068 0.68744 0.66506 0.64351 0.62275 0.5 1316 048166 045235 042506 8 0.73069 0.70319 0.67684 0.65160 0.62741 0.60423 0.58201 046651 0.43393 040388 0.37616 9 0.70259 0.67290 0.64461 061 763 0.59190 056735 0.54393 o42410 0.39092 0.36061 0.33288 10 0.67556 0.64393 0.61391 058543 0.55839 053273 0.5D835 O33554 03521 832197 0.23459 EXHIBIT 10 Present Value of an Annuity of $1 at Compound Interest Periods 4% 4% 5% 5,496 6% 6% 7% 10% 11% 12% 13% 0.96154 0.95694 0.95238 0.94787 094340 0.938970.93458 0.90909 0.90090 0.89286 0.88496 21.88609 1.87267 1.85941 184632 183339 182063 1.80802 1.73554 1.71252 1.69005 1.66810 3 2.77509 2.74896 2.72325 2.69793 2.67301 2.64848 2.62432 2.48685 2.44371 2.40183 2.36115 3.62990 3.58753 3.54595 3.50515 346511 3.42580 3.38721 3.16987 3.10245 3.03735 2.97447 5 445182 438998 432948 4.27028 421236 4.15 568 4.0020 3.79079 3.69590 3.60478 3.51723 6 5.24214 5.15787 5.07569 4.99553 4.91732 4.8410 476654 435526 4.23054 41114 3.99755 7 6.00205 5.89270 5.78637 5.68297 5.58238 5.48452 5.38929 486842 4.71220 4.56376 4.42261 8 6.73274 6.59589 6.46321 6.33457 6.20979 6.08875 5.97130 5.33493 5.14612 4.96764 4.79677 9 743533 7.26879 7.10782 6.95220 6.80169 6.65610 651523 5.75902 553705 5.32825 5.13166 10 8.11090 7.91272 7.72173 7.53763 736009 7.18883 7.02358 6.14457 5.88923 5.65022 542624 Present Value of $1 at Compound Interest EXHIBIT 8 Periods 4% 4496 5% 5,496 6% 6 % 7% 10% 11% 12% 13% 1 0.96154 0.95694 0.95238 0.94787 0.94340 0.93897 0.93458 0.90909 0.90090 0.89286 0.88496 0.92456 a91573 0.90703 0.89845 O89000 088166 87344 08264 081162 073719 or835 0.88900 0.87630 0.86384 0.85161 0.83962 0.82785 0.81630 0.75131 0.73119 0.71178 0.69305 4 0.85480 0.83856 0.82270 0.80722 0.79209 0.77732 0.76290 0.68301 0.65873 0.63552 0.61332 5 0.82193 0.80245 0.78353 0.76513 0.74726 0.72988 0.71299 0.62092 059345 0.56743 0.54276 6 0.79031 0.76790 0.74622 0.72525 0.70496 0.68533 0.66634 0.56447 053464 0.50663 0.48032 7 O.75992 .73483 0.7 1068 0.68744 0.66506 0.64351 0.62275 0.5 1316 048166 045235 042506 8 0.73069 0.70319 0.67684 0.65160 0.62741 0.60423 0.58201 046651 0.43393 040388 0.37616 9 0.70259 0.67290 0.64461 061 763 0.59190 056735 0.54393 o42410 0.39092 0.36061 0.33288 10 0.67556 0.64393 0.61391 058543 0.55839 053273 0.5D835 O33554 03521 832197 0.23459 EXHIBIT 10 Present Value of an Annuity of $1 at Compound Interest Periods 4% 4% 5% 5,496 6% 6% 7% 10% 11% 12% 13% 0.96154 0.95694 0.95238 0.94787 094340 0.938970.93458 0.90909 0.90090 0.89286 0.88496 21.88609 1.87267 1.85941 184632 183339 182063 1.80802 1.73554 1.71252 1.69005 1.66810 3 2.77509 2.74896 2.72325 2.69793 2.67301 2.64848 2.62432 2.48685 2.44371 2.40183 2.36115 3.62990 3.58753 3.54595 3.50515 346511 3.42580 3.38721 3.16987 3.10245 3.03735 2.97447 5 445182 438998 432948 4.27028 421236 4.15 568 4.0020 3.79079 3.69590 3.60478 3.51723 6 5.24214 5.15787 5.07569 4.99553 4.91732 4.8410 476654 435526 4.23054 41114 3.99755 7 6.00205 5.89270 5.78637 5.68297 5.58238 5.48452 5.38929 486842 4.71220 4.56376 4.42261 8 6.73274 6.59589 6.46321 6.33457 6.20979 6.08875 5.97130 5.33493 5.14612 4.96764 4.79677 9 743533 7.26879 7.10782 6.95220 6.80169 6.65610 651523 5.75902 553705 5.32825 5.13166 10 8.11090 7.91272 7.72173 7.53763 736009 7.18883 7.02358 6.14457 5.88923 5.65022 542624

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts