Question: Compute Bond Proceeds, Amortizing Premium by Interest Method, and Interest Expense Ware Co. produces and sells motorcycle parts. On the first day of its fiscal

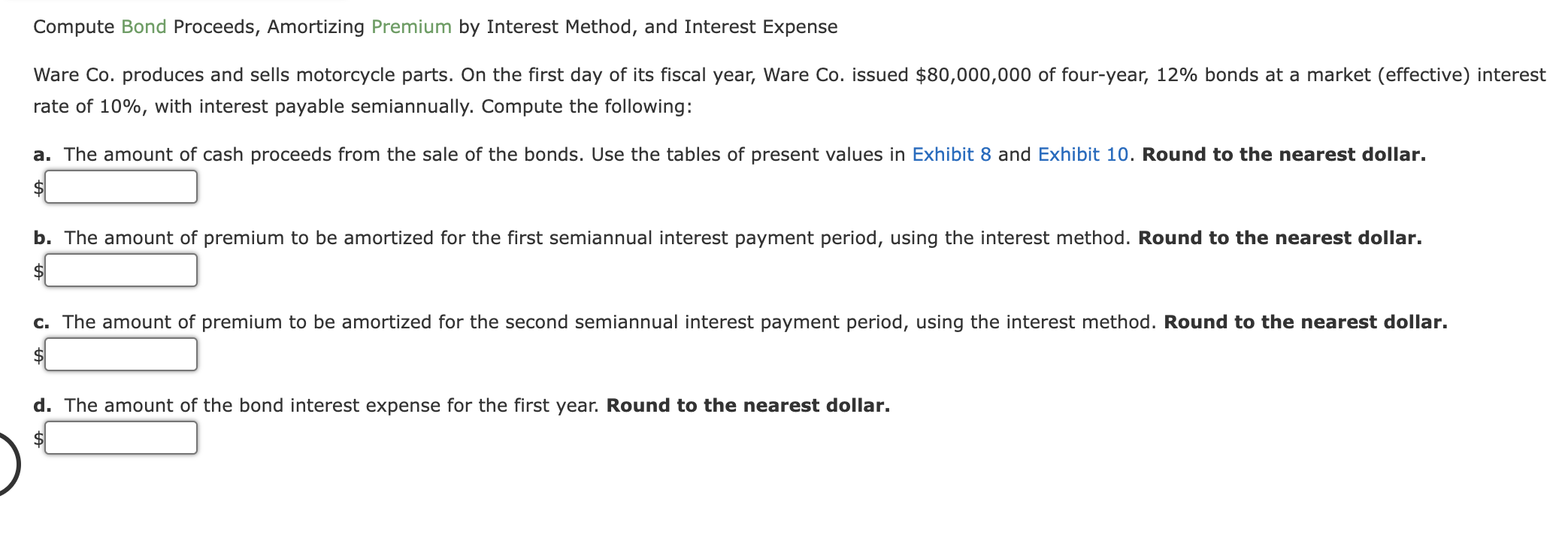

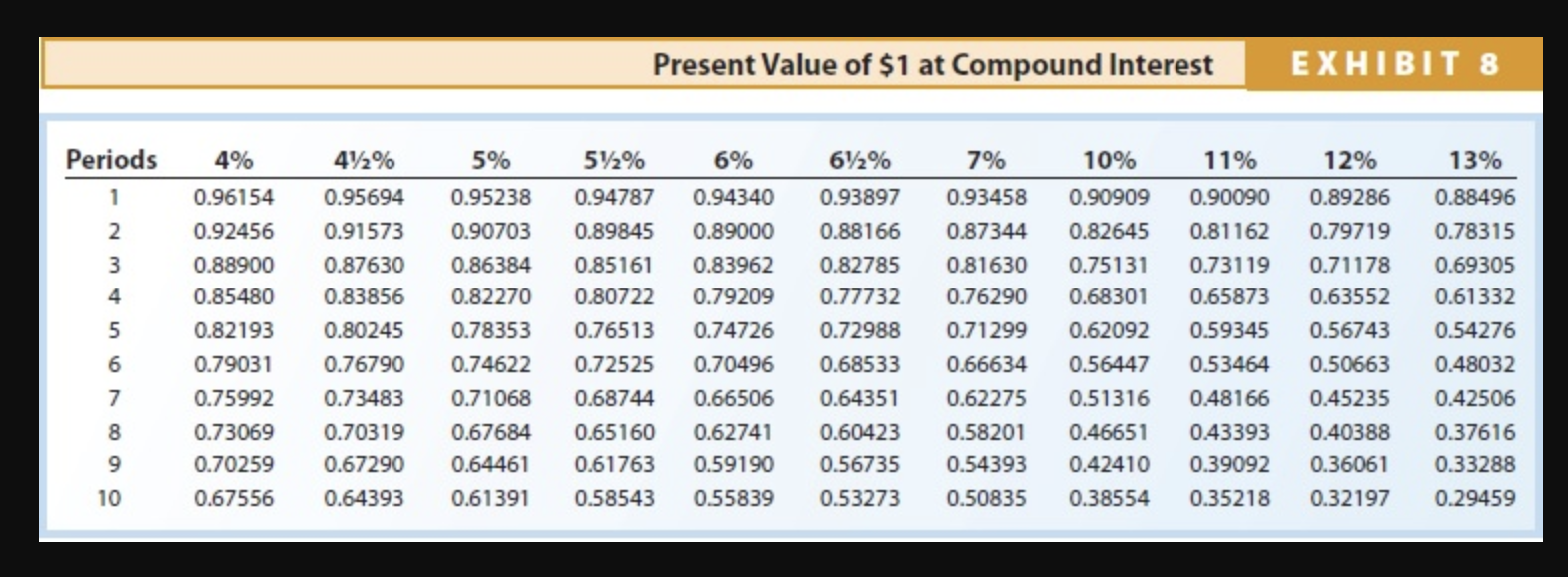

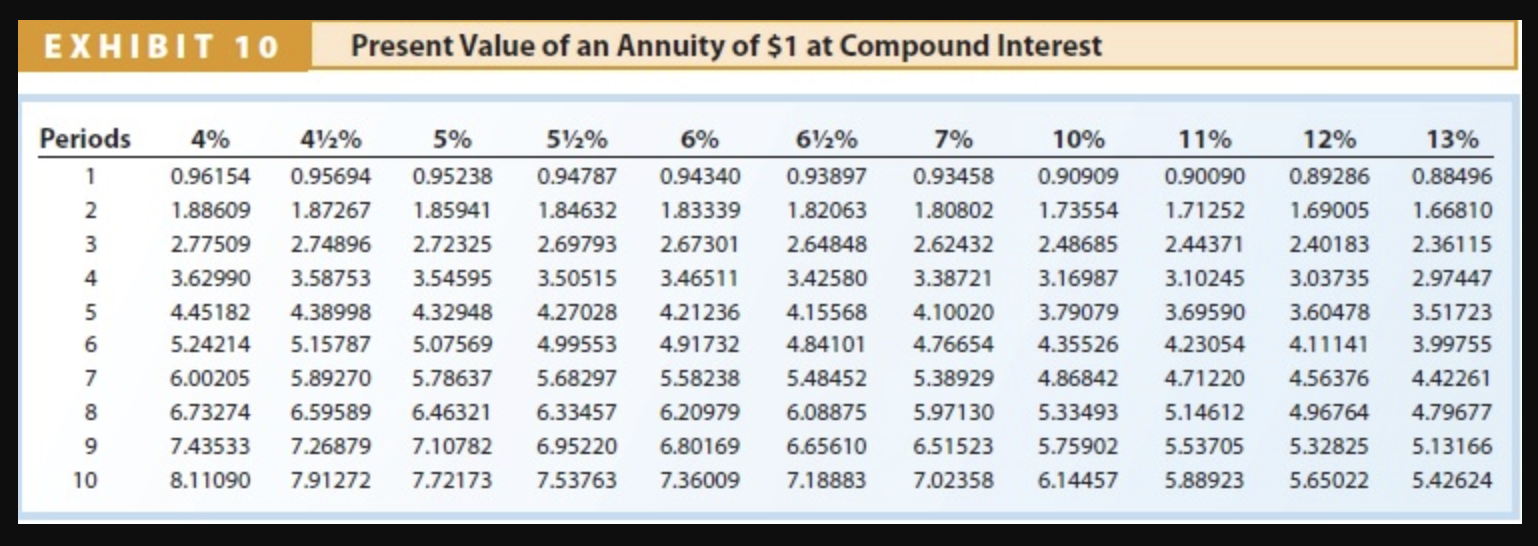

Compute Bond Proceeds, Amortizing Premium by Interest Method, and Interest Expense Ware Co. produces and sells motorcycle parts. On the first day of its fiscal year, Ware Co. issued $80,000,000 of four-year, 12% bonds at a market (effective) interest rate of 10%, with interest payable semiannually. Compute the following: a. The amount of cash proceeds from the sale of the bonds. Use the tables of present values in Exhibit 8 and Exhibit 10 . Round to the nearest dollar. $ b. The amount of premium to be amortized for the first semiannual interest payment period, using the interest method. Round to the nearest dollar. \$ c. The amount of premium to be amortized for the second semiannual interest payment period, using the interest method. Round to the nearest dollar. $ d. The amount of the bond interest expense for the first year. Round to the nearest dollar. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Periods & 4% & 4121% & 5% & 51/2% & 6% & 621% & 7% & 10% & 11% & 12% & 13% \\ \hline 1 & 0.96154 & 0.95694 & 0.95238 & 0.94787 & 0.94340 & 0.93897 & 0.93458 & 0.90909 & 0.90090 & 0.89286 & 0.88496 \\ \hline 2 & 1.88609 & 1.87267 & 1.85941 & 1.84632 & 1.83339 & 1.82063 & 1.80802 & 1.73554 & 1.71252 & 1.69005 & 1.66810 \\ \hline 3 & 2.77509 & 2.74896 & 2.72325 & 2.69793 & 2.67301 & 2.64848 & 2.62432 & 2.48685 & 2.44371 & 2.40183 & 2.36115 \\ \hline 4 & 3.62990 & 3.58753 & 3.54595 & 3.50515 & 3.46511 & 3.42580 & 3.38721 & 3.16987 & 3.10245 & 3.03735 & 2.97447 \\ \hline 5 & 4.45182 & 4.38998 & 4.32948 & 4.27028 & 4.21236 & 4.15568 & 4.10020 & 3.79079 & 3.69590 & 3.60478 & 3.51723 \\ \hline 6 & 5.24214 & 5.15787 & 5.07569 & 4.99553 & 4.91732 & 4.84101 & 4.76654 & 4.35526 & 4.23054 & 4.11141 & 3.99755 \\ \hline 7 & 6.00205 & 5.89270 & 5.78637 & 5.68297 & 5.58238 & 5.48452 & 5.38929 & 4.86842 & 4.71220 & 4.56376 & 4.42261 \\ \hline 8 & 6.73274 & 6.59589 & 6.46321 & 6.33457 & 6.20979 & 6.08875 & 5.97130 & 5.33493 & 5.14612 & 4.96764 & 4.79677 \\ \hline 9 & 7.43533 & 7.26879 & 7.10782 & 6.95220 & 6.80169 & 6.65610 & 6.51523 & 5.75902 & 5.53705 & 5.32825 & 5.13166 \\ \hline 10 & 8.11090 & 7.91272 & 7.72173 & 7.53763 & 7.36009 & 7.18883 & 7.02358 & 6.14457 & 5.88923 & 5.65022 & 5.42624 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{10}{|c|}{ Present Value of $1 at Compound Interest } & \multicolumn{2}{|c|}{ EXHIBIT 8} \\ \hline Periods & 4% & 421% & 5% & 5121% & 6% & 61/2% & 7% & 10% & 11% & 12% & 13% \\ \hline 1 & 0.96154 & 0.95694 & 0.95238 & 0.94787 & 0.94340 & 0.93897 & 0.93458 & 0.90909 & 0.90090 & 0.89286 & 0.88496 \\ \hline 2 & 0.92456 & 0.91573 & 0.90703 & 0.89845 & 0.89000 & 0.88166 & 0.87344 & 0.82645 & 0.81162 & 0.79719 & 0.78315 \\ \hline 3 & 0.88900 & 0.87630 & 0.86384 & 0.85161 & 0.83962 & 0.82785 & 0.81630 & 0.75131 & 0.73119 & 0.71178 & 0.69305 \\ \hline 4 & 0.85480 & 0.83856 & 0.82270 & 0.80722 & 0.79209 & 0.77732 & 0.76290 & 0.68301 & 0.65873 & 0.63552 & 0.61332 \\ \hline 5 & 0.82193 & 0.80245 & 0.78353 & 0.76513 & 0.74726 & 0.72988 & 0.71299 & 0.62092 & 0.59345 & 0.56743 & 0.54276 \\ \hline 6 & 0.79031 & 0.76790 & 0.74622 & 0.72525 & 0.70496 & 0.68533 & 0.66634 & 0.56447 & 0.53464 & 0.50663 & 0.48032 \\ \hline 7 & 0.75992 & 0.73483 & 0.71068 & 0.68744 & 0.66506 & 0.64351 & 0.62275 & 0.51316 & 0.48166 & 0.45235 & 0.42506 \\ \hline 8 & 0.73069 & 0.70319 & 0.67684 & 0.65160 & 0.62741 & 0.60423 & 0.58201 & 0.46651 & 0.43393 & 0.40388 & 0.37616 \\ \hline 9 & 0.70259 & 0.67290 & 0.64461 & 0.61763 & 0.59190 & 0.56735 & 0.54393 & 0.42410 & 0.39092 & 0.36061 & 0.33288 \\ \hline 10 & 0.67556 & 0.64393 & 0.61391 & 0.58543 & 0.55839 & 0.53273 & 0.50835 & 0.38554 & 0.35218 & 0.32197 & 0.29459 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts