Question: Compute fir machine b and c too The table below itemizes several assets. Assume in all cases that the asset's first and last years are

Compute fir machine b and c too

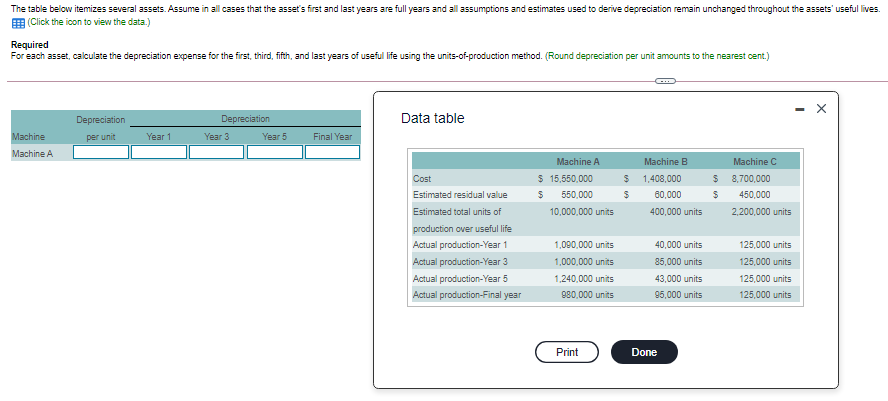

The table below itemizes several assets. Assume in all cases that the asset's first and last years are full years and all assumptions and estimates used to derive depreciation remain unchanged throughout the assets' useful lives. B (Click the icon to view the data.) Required For each asset, calculate the depreciation expense for the first, third, fifth, and last years of useful life using the units-of-production method. (Round depreciation per unit amounts to the nearest cent.) X Depreciation Data table Depreciation Year 3 Year 5 per unit Year 1 Final Year Machine Machine A Machine A $ 15,550,000 $ 550.000 10,000,000 units Machine B $ 1,408,000 $ 60,000 $ $ Machine C 8,700,000 450,000 2,200,000 units 400,000 units Cost Estimated residual value Estimated total units of production over useful life Actual production-Year 1 Actual production-Year 3 Actual production-Year 5 Actual production-Final year 40,000 units 1,000,000 units 1,000,000 units 1,240,000 units 980,000 units 85,000 units 43,000 units 95,000 units 125,000 units 125,000 units 125,000 units 125,000 units Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts