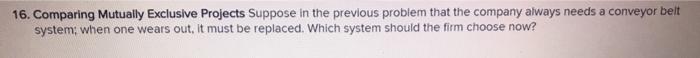

Question: compute for system A: EAC and system B EAC 16. Comparing Mutually Exclusive Projects Suppose in the previous problem that the company always needs a

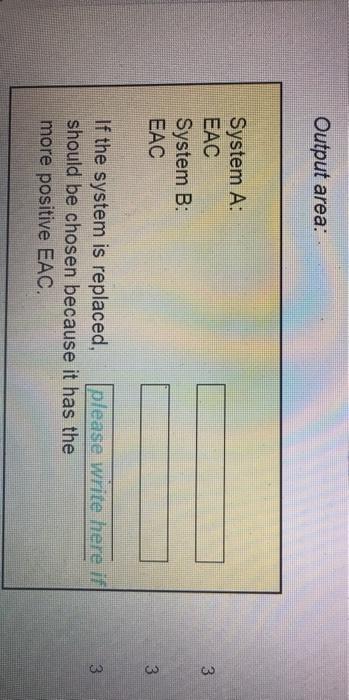

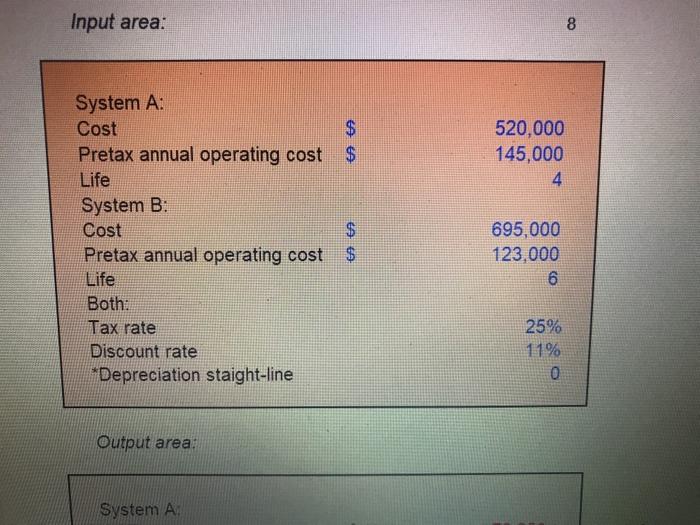

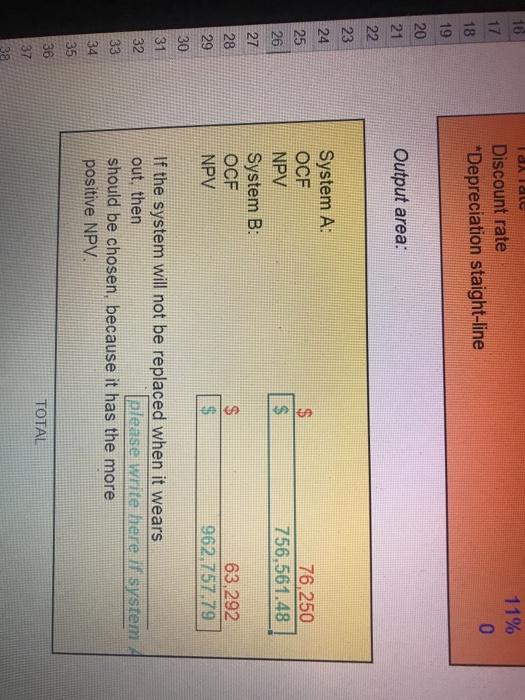

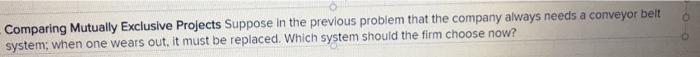

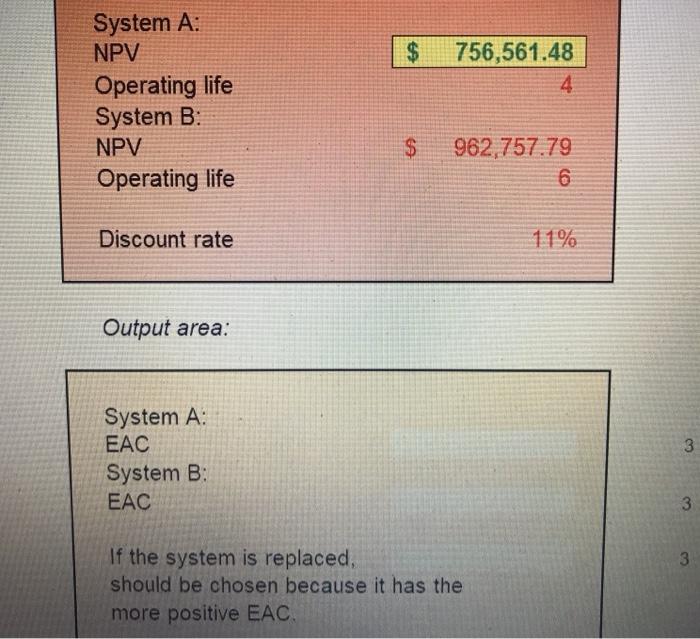

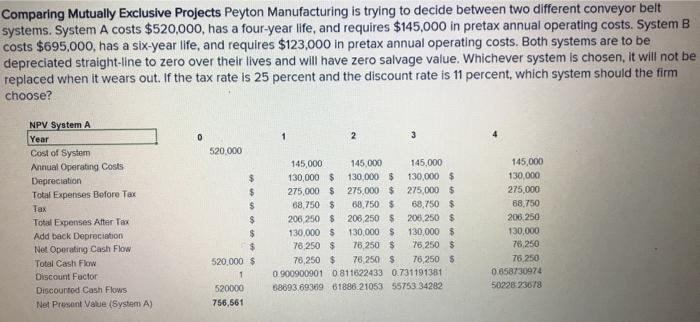

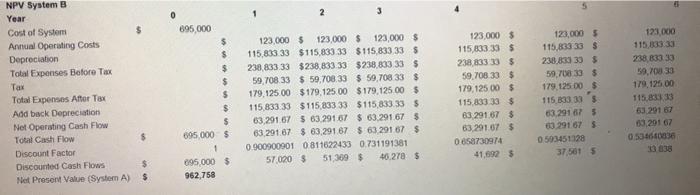

16. Comparing Mutually Exclusive Projects Suppose in the previous problem that the company always needs a conveyor belt system, when one wears out, it must be replaced. Which system should the firm choose now? Output area: 3 System A: EAC System B: EAC 3 3 If the system is replaced, please write here if should be chosen because it has the more positive EAC. Input area: 8 A 4 520,000 145,000 4 $ System A: Cost Pretax annual operating cost Life System B: Cost Pretax annual operating cost Life Both: Tax rate Discount rate *Depreciation staight-line 6 695,000 123,000 6 25% 11% 0 Output area: System A Tala 16 17 Discount rate *Depreciation staight-line 11% 0 18 19 20 21 Output area: 22 23 24 25 26 $ $ 76.250 756.561.48 System A OCF NPV System B: OCF NPV 27 28 $ $ 63,292 962.757.79 29 30 31 32 If the system will not be replaced when it wears out, then please write here if system should be chosen, because it has the more positive NPV. 33 34 35 TOTAL 36 37 38 Comparing Mutually Exclusive Projects Suppose in the previous problem that the company always needs a conveyor belt system, when one wears out, it must be replaced. Which system should the firm choose now? $ 756,561.48 4 System A: NPV Operating life System B: NPV Operating life $ 962 757.79 6 Discount rate 11% Output area: 3 System A EAC System B: EAC 3 3 3 If the system is replaced, should be chosen because it has the more positive EAC. Comparing Mutually Exclusive Projects Peyton Manufacturing is trying to decide between two different conveyor belt systems. System A costs $520,000, has a four-year life, and requires $145,000 in pretax annual operating costs. System B costs $695,000, has a six-year life, and requires $123,000 in pretax annual operating costs. Both systems are to be depreciated straight-line to zero over their lives and will have zero salvage value. Whichever system is chosen, it will not be replaced when it wears out. If the tax rate is 25 percent and the discount rate is 11 percent, which system should the firm choose? 2 3 520.000 NPV System A Year Cost of System Annual Operating costs Depreciation Total Expenses Before Tax Tax Total Expenses After Tax Add back Depreciation Net Operating Cash Flow Total Cash Flow Discount Factor Discounted Cash Flows Nel Present Value (System A) $ $ $ $ $ $ 520,000 $ 1 520000 756,561 145,000 145.000 145,000 130,000 $ 130,000 $ 130,000 $ 275,000 $ 275,000 $275,000 $ 68.750 $ 68,750 $ 68,750 $ 206,250 $ 206,250 $ 206,250 $ 130,000 $ 130,000 $ 130,000 $ 76 250 $ 78,250 $ 76,250 $ 76,250 $ 76,250 $ 76,250 $ 0900900001 0811622433 0.731191381 68693.69369 61886.21053 55753 34282 145,000 130,000 275,000 68.750 206 250 130,000 76,250 76.250 0.658730974 50228 23678 2 3 0 895,000 $ $ $ NPV System B Year Cost of System Annual Operating Costs Depreciation Total Expenses Before Tax Tax Total Expenses After Tax Add back Depreciation Net Operating Cash Flow Total Cash Flow Discount Factor Discounted Cash Flows Net Present Value (System A) $ $ 5 $ $ 695 000 $ 123,000 $ 123 000 $ 123,000 $ 115,833 33 $115,833 33 $115,833 33 5 238,833 33 $238,833 33 $238.833335 59,708 33 $ 59,708,33 $ 59,708 33 $ 179,125.00 $179,125.00 $ 179,125.00 $ 115,833.33 $115,833 33 $115,833.33 $ 63 291.67 $ 63.291.67 $ 63.291.67$ 63.291.67 $ 63.291.67 $ 63 291 67 $ 0900900901 0811622433 0.731191381 570205 51 309 46.278 $ 123,000 $ 115,833 33 $ 238,833 33 $ 59.708 33$ 179,125 00 $ 115,833 33 $ 83 291.67 $ 63.291.675 0.650730974 41.622 5 123,000 5 115,833 33 $ 238.833 30 $ 59,708 33 $ 179, 125.00 $ 115 333 333 63.291 675 83 291 675 0593451128 375015 123 000 115,83333 238 333 33 59,700 33 179,125 00 115.83333 63 291 87 13.201 67 0536606 $ $ $ 095.000 $ 962,758

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts