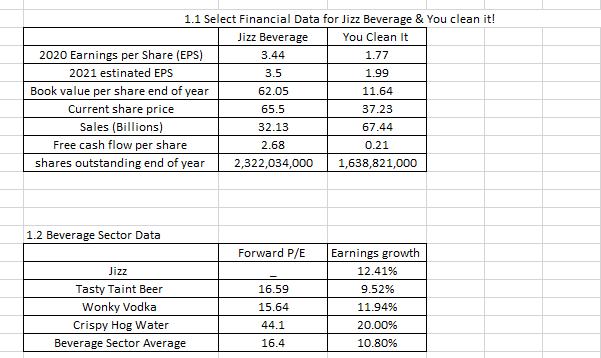

Question: Compute Jizz's P/E growth ratio (PEG ratio). Round answer to two digits. 2. Compare Jizz's PEG ratio to other companies' ratios and to the industry

Compute Jizz's P/E growth ratio (PEG ratio). Round answer to two digits.

2. Compare Jizz's PEG ratio to other companies' ratios and to the industry average. Is Jizz... (Pick the right one and explain)

- fairly valued?

- overvalued?

- undervalued?

2020 Earnings per Share (EPS) 2021 estinated EPS 1.1 Select Financial Data for Jizz Beverage & You clean it! Jizz Beverage You Clean It 3.44 1.77 3.5 1.99 62.05 11.64 65.5 37.23 32.13 67.44 2.68 0.21 2,322,034,000 1,638,821,000 Book value per share end of year Current share price Sales (Billions) Free cash flow per share. shares outstanding end of year 1.2 Beverage Sector Data Jizz Tasty Taint Beer Wonky Vodka Crispy Hog Water Beverage Sector Average Forward P/E 16.59 15.64 44.1 16.4 Earnings growth 12.41% 9.52% 11.94% 20.00% 10.80%

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

To compute Jizzs PEG ratio we need to divide its forward PE ratio by its earnings growth rate Jiz... View full answer

Get step-by-step solutions from verified subject matter experts