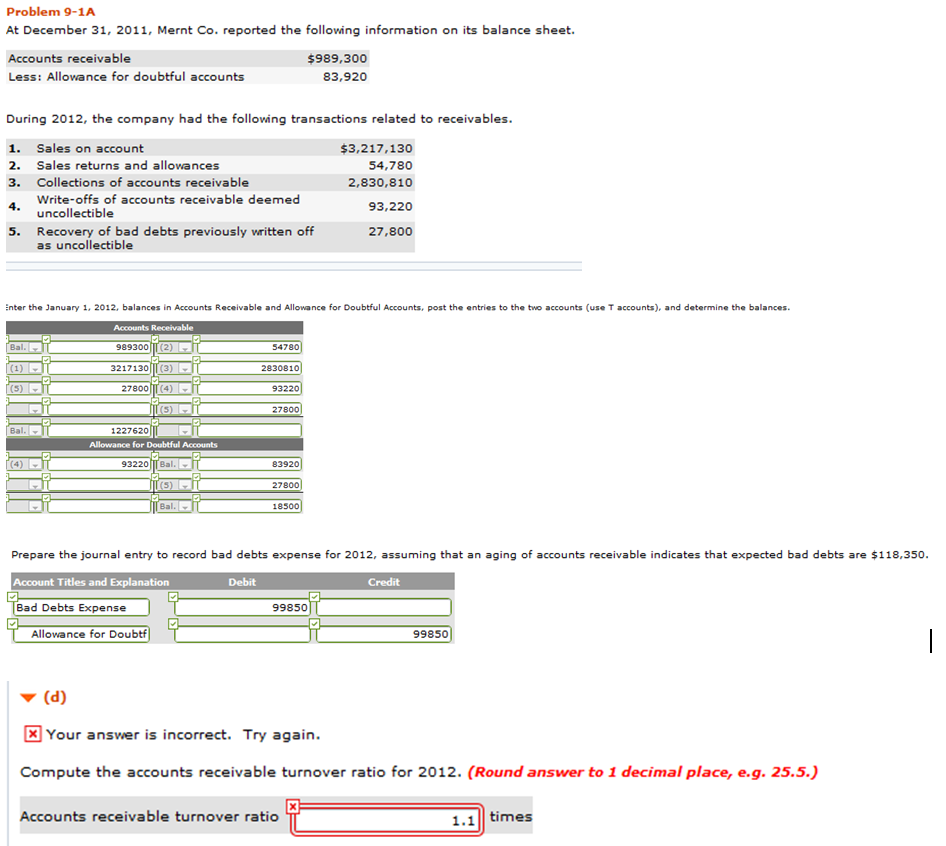

Question: Problem 9-1A At December 31, 2011, Mernt Co. reported the following information on its balance sheet. Accounts receivable $989,300 Less: Allowance for doubtful accounts 83,920

Problem 9-1A At December 31, 2011, Mernt Co. reported the following information on its balance sheet. Accounts receivable $989,300 Less: Allowance for doubtful accounts 83,920 During 2012, the company had the following transactions related to receivables. 1. Sales on account $3,217,130 2. Sales returns and allowances 54,780 3. Collections of accounts receivable 2,830,810 Write-offs of accounts receivable deemed 4. 93,220 uncollectible 5. Recovery of bad debts previously written off as uncollectible 27,800 Enter the January 1, 2012, balances in Accounts Receivable and Allowance for Doubtful Accounts, post the entries to the two accounts (use T accounts), and determine the balances. Accounts Receivable Bal. 989300 54780 (1) 3217130 2830810 27800 (5) (4 93220 27800 Bal. 1227620 Allowance for Doubtful Accounts Bal. 93220 83920 27800 18500 Bal. Prepare the journal entry to record bad debts expense for 2012, assuming that an aging of accounts receivable indicates that expected bad debts are $118,350. Account Titles and Explanation Credit Debit Bad Debts Expense 99850 Allowance for Doubtf| 99850 (d) Your answer is incorrect. Try again. Compute the accounts receivable turnover ratio for 2012. (Round answer to 1 decimal place, e.g. 25.5.) Accounts receivable turnover ratio 1.1| times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts