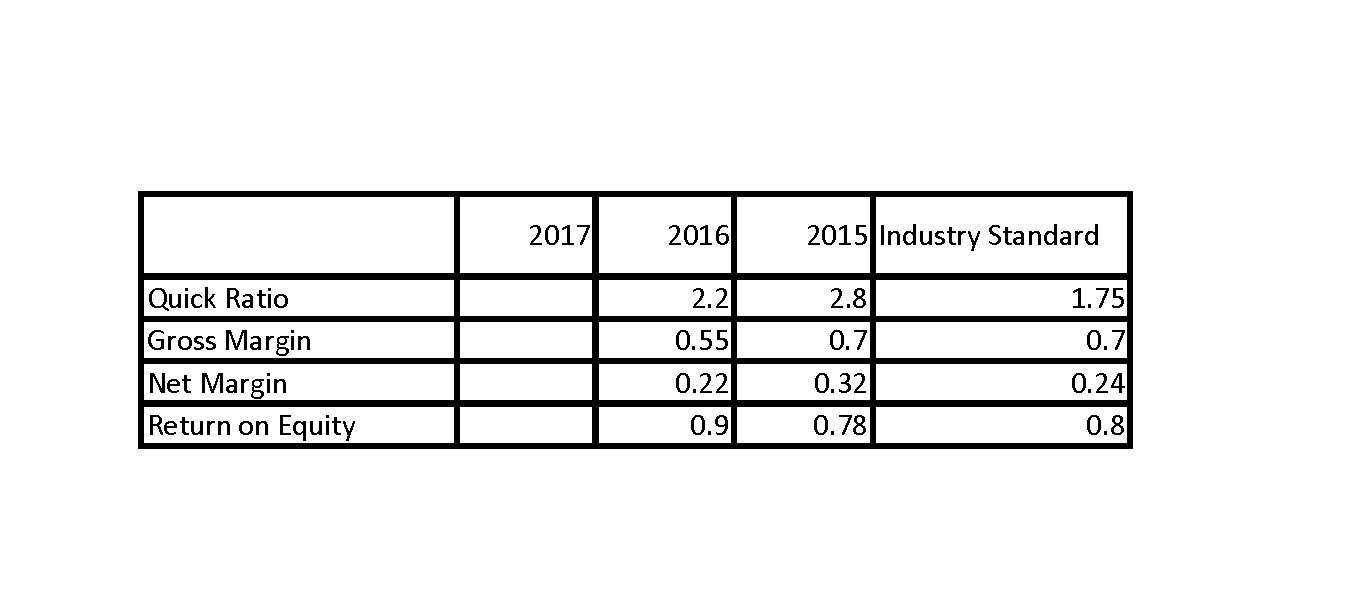

Question: compute quick ratio, gross margin, net margin and return on equity on below grid Abstract: Summarize the story of profitability and liquidity for your company.

-

compute quick ratio, gross margin, net margin and return on equity on below grid

-

Abstract: Summarize the story of profitability and liquidity for your company. In other words, highlight the most important aspects of your report, including your major conclusions.

-

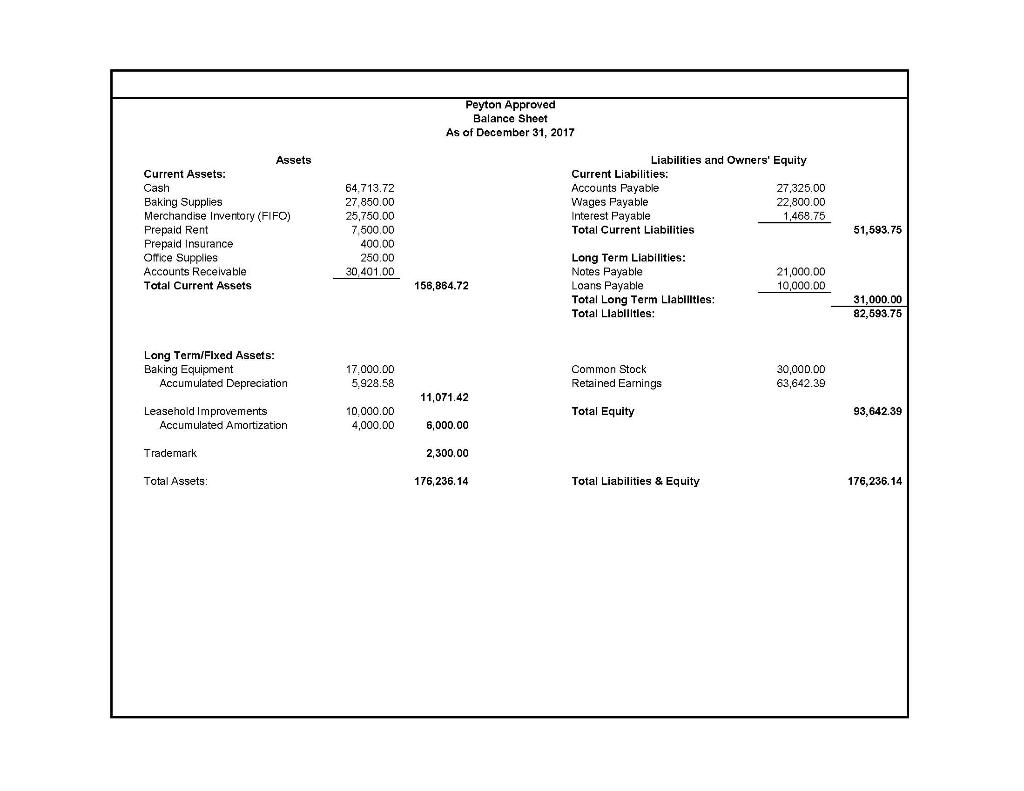

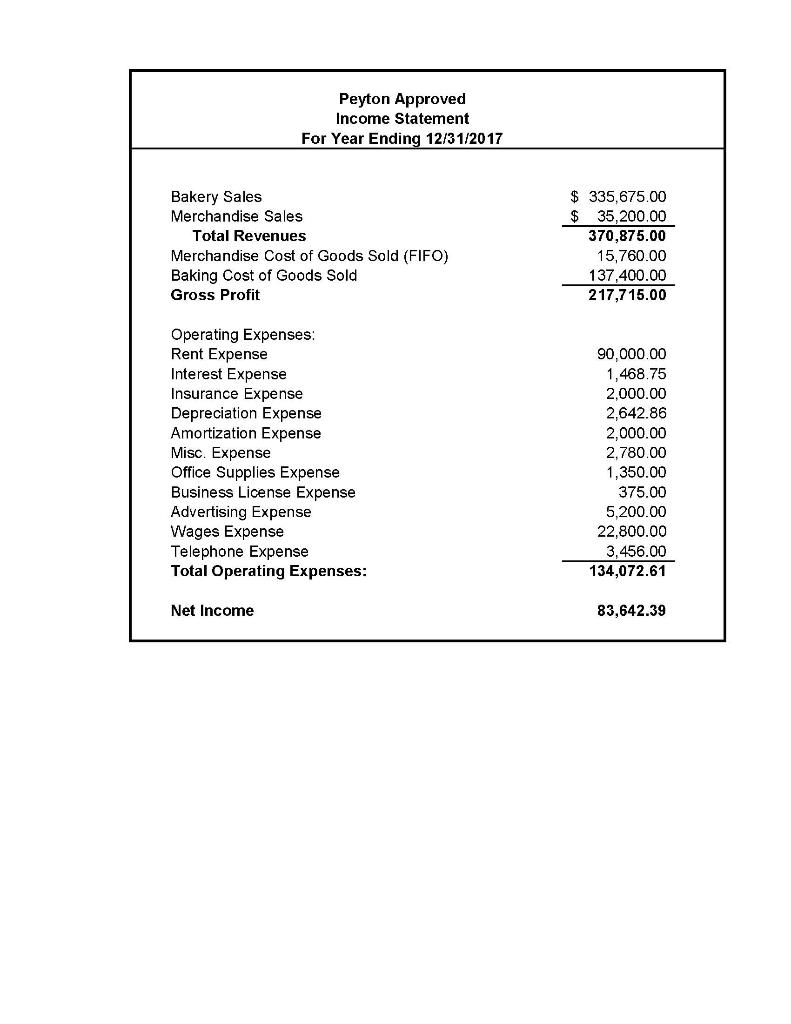

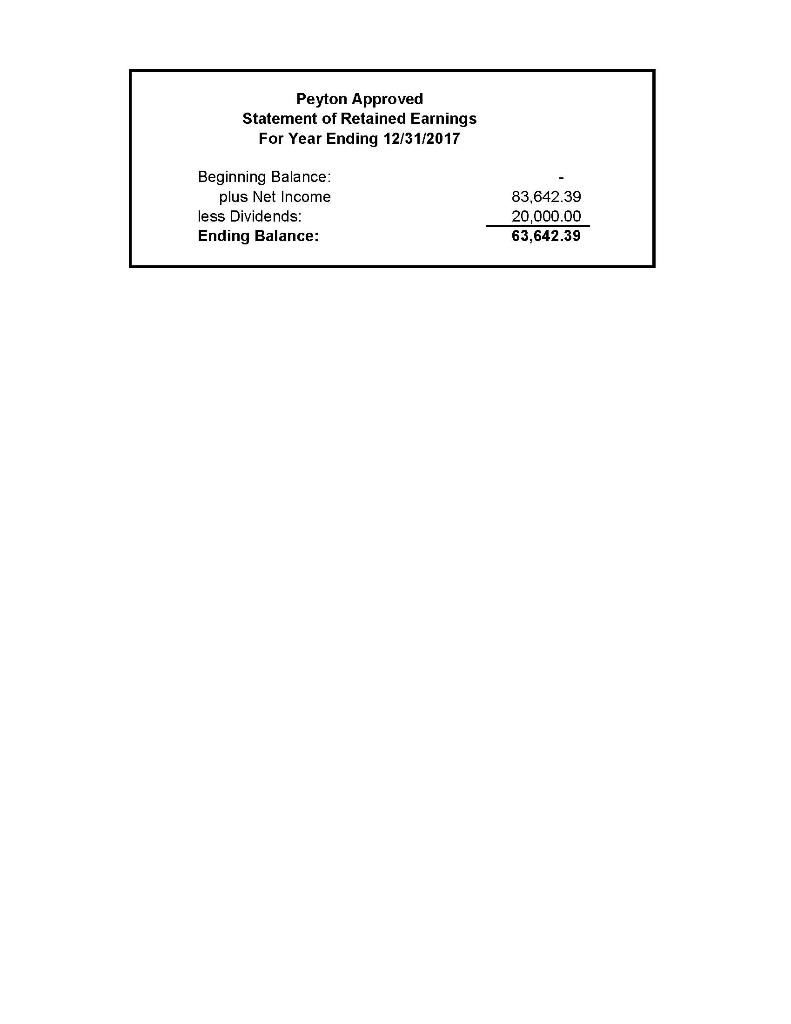

Computations: Identify and describe your computations from the Financial Analysis tab of your workbook. Be sure to format your key results in a table or graphical format, as appropriate. Explain why each cited figure was included in your report in terms of its importance for the organization.

-

Comparison: Evaluate the financials of the company by comparing current ratios to both historical and industry-average ratios. Clearly identify all unexpected or aberrant figures.

-

Conclusion: Draw informed conclusions based on your computations and comparisons in the previous paragraphs. Be sure to justify your claims with specific evidence and examples

-

-

-

-

Peyton Approved Balance Sheet As of December 31, 2017 Assets Current Assets: : Cash Baking Supplies Merchandise Inventory (FIFO) Prepaid Rent Prepaid Insurance Office Supplies Accounts Receivable Total Current Assets 64.713.72 27.850.00 25,750.00 7 500.00 400.00 250.00 30 401.00 Liabilities and Owners' Equity Current Liabilities: Accounts Payable 27,325.00 Wages Payable 22,800.00 Interest Payable 1,468.75 Total Current Liabilities 51,593.75 156,864.72 Long Term Liabilities: Notes Payable Loans Payable Total Long Term Llabilities: Total Liabilities: 21,000.00 10,000.00 31,000.00 82,693.75 Long Term/Fixed Assets: Baking Equipment Accumulated Depreciation 17.000.00 5.928.58 Common Stock Retained Earnings 30,000.00 63,642.39 11,071.42 Total Equity 93,642.39 Leasehold Improvements Accumulated Amortization 10.000.00 4,000.00 6,000.00 Trademark 2,300.00 Total Assets: 176.236.14 Total Liabilities & Equity 176,236.14 Peyton Approved Income Statement For Year Ending 12/31/2017 Bakery Sales Merchandise Sales Total Revenues Merchandise Cost of Goods Sold (FIFO) Baking Cost of Goods Sold Gross Profit $ 335,675.00 $ 35,200.00 370,875.00 15,760.00 137,400.00 217,715.00 Operating Expenses: Rent Expense Interest Expense Insurance Expense Depreciation Expense Amortization Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense Total Operating Expenses: 90,000.00 1,468.75 2,000.00 2,642.86 2,000.00 2,780.00 1,350.00 375.00 5,200.00 22,800.00 3,456.00 134,072.61 Net Income 83,642.39 Peyton Approved Statement of Retained Earnings For Year Ending 12/31/2017 Beginning Balance: plus Net Income less Dividends: Ending Balance: 83,642.39 20,000.00 63,642.39 2017 2016 2015 Industry Standard 2.2 2.8 0.7 0.55 Quick Ratio Gross Margin Net Margin Return on Equity 1.75 0.7 0.24 0.8 0.22 0.32 0.9 0.78

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts